Introduction:

in today’s digital age, the convenience of online shopping comes with a hidden threat: ecommerce fraud. As more consumers turn to their screens for everything from groceries to gadgets, fraudsters are getting bolder and more sophisticated in their tactics. That’s why understanding how to protect your business—and your customers—is more crucial than ever. But don’t worry! You don’t need to be a tech wizard to safeguard your ecommerce store. In this article,we’re diving into 19 practical and effective practices that can help you prevent all types of fraud. Whether you’re a seasoned online retailer or just starting out,these strategies will empower you to fortify your defenses,build customer trust,and ultimately,boost your bottom line. So, let’s roll up our sleeves and get ready to make your ecommerce business a fortress against fraud!

Understanding Ecommerce Fraud and Its Impact on Your Business

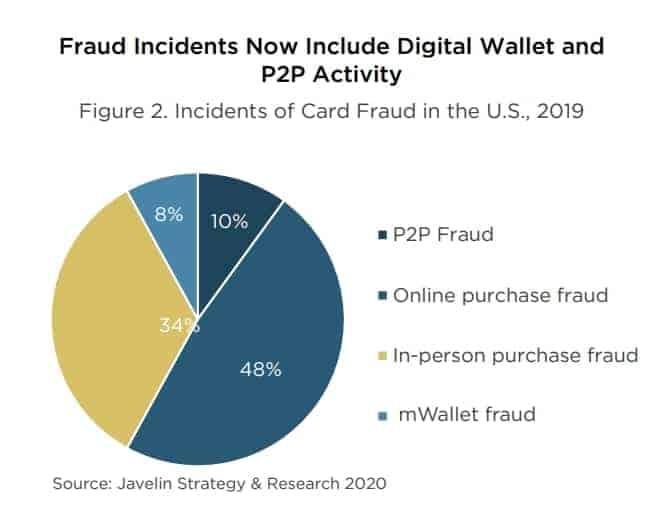

Ecommerce fraud is a growing concern that can significantly impact your business, regardless of its size or industry.Understanding the various types of fraud that can occur in online transactions is crucial to safeguarding your revenue and reputation. The consequences of fraud can be far-reaching, affecting not only your bottom line but also customer trust and loyalty. Businesses that fail to address these threats may find themselves facing significant financial losses, legal issues, and damage to their brand image.

There are several common types of ecommerce fraud, each with its own unique characteristics and risks. Here are a few to be aware of:

- Credit Card Fraud: This involves unauthorized use of stolen credit card information to make purchases.

- Account Takeover: Fraudsters gain access to customer accounts and make unauthorized transactions.

- Return Fraud: Customers return stolen or counterfeit goods for refunds.

- Friendly Fraud: Legitimate customers dispute transactions after receiving their products, claiming they never made the purchase.

The impact of ecommerce fraud extends beyond immediate financial losses. The ripple effects can include:

- Increased Operational Costs: Dealing with fraud cases requires additional resources, including time and manpower.

- Higher Chargeback Ratios: Excessive chargebacks can lead to penalties from payment processors or even account termination.

- Reputational Damage: Customers may lose trust in a business that does not adequately protect their information.

- Legal Consequences: Non-compliance with data protection regulations can result in legal action and fines.

To illustrate the impact of ecommerce fraud, consider the following table that highlights potential costs associated with different fraud types:

| Fraud Type | Potential Cost | Impact on Business |

|---|---|---|

| Credit Card Fraud | Up to $3,000 per incident | Profit loss, chargeback fees |

| Account Takeover | Varies widely | Customer trust erosion |

| Return Fraud | Up to $200 per instance | Inventory loss, financial strain |

| Friendly Fraud | Average $500 | Increased chargebacks |

As ecommerce continues to grow, so does the sophistication of fraud tactics. Staying informed and proactive is essential.Investing in robust fraud prevention measures not only protects your profits but also ensures a secure shopping environment for your customers. By implementing effective strategies, you can mitigate risks and build long-term success in the digital marketplace.

Identifying Common Types of Fraud in the Ecommerce Landscape

Common Types of Fraud in the Ecommerce Landscape

in the fast-paced world of ecommerce, fraud can take many forms, and identifying these types is crucial for any online business aiming to protect itself and its customers. Understanding the common fraud tactics allows merchants to implement preventive measures effectively.

Credit Card Fraud

One of the most prevalent forms of fraud is credit card fraud, where stolen card information is used for unauthorized purchases.This type of fraud can lead to significant financial losses for both businesses and consumers. To combat this, robust verification processes such as CVV checks and address verification systems (AVS) are essential.

Account Takeover

Account takeover occurs when a fraudster gains access to a legitimate user’s account,ofen through phishing attacks or data breaches. Once they have control, they can make unauthorized purchases or change account details. Implementing multi-factor authentication (MFA) can significantly reduce the risk of account takeovers.

Friendly Fraud

Friendly fraud happens when customers make a legitimate purchase but later dispute the charge with their bank, claiming they never received the product or that it was unauthorized. This is often not a result of malicious intent, but it can still be damaging. To mitigate this, maintain clear communication with customers and provide transparent return policies.

Fake Returns and Return Fraud

Return fraud includes various tactics, such as returning used products or items not purchased from the retailer. It can strain a business’s resources and affect inventory. Employing a thorough returns process and analyzing return patterns can help identify suspicious activities.

Phishing and Social Engineering

Phishing remains a critical threat, where scammers impersonate trustworthy entities to steal sensitive information. Educating employees about recognizing phishing attempts and employing email verification can thwart many social engineering attacks.

Shipping Fraud

Shipping fraud emerges when fraudsters manipulate shipping information to redirect packages to unauthorized addresses, often leading to significant losses. Utilizing advanced tracking systems and requiring confirmation for shipping address changes can definitely help in minimizing this risk.

Table: Summary of Common Fraud Types

| Fraud Type | description | Prevention Strategy |

|---|---|---|

| Credit Card Fraud | Unauthorized use of stolen credit card information. | Implement CVV and AVS checks. |

| Account Takeover | Accessing a user’s account without consent. | Utilize multi-factor authentication. |

| Friendly Fraud | Disputing legitimate purchases. | Enhance customer communication. |

| return Fraud | Returning non-purchased or used products. | Establish strict return policies. |

| Phishing | Fraudulent attempts to steal personal information. | Train employees on phishing detection. |

| Shipping fraud | Manipulating shipping to unauthorized addresses. | Use advanced tracking systems. |

By identifying these common types of fraud and implementing effective strategies,ecommerce businesses can safeguard their operations and foster a secure shopping environment for their customers. The key lies in vigilance and proactive measures.

Building a Solid Foundation: Essential Security Measures to Implement

When it comes to safeguarding your ecommerce business, laying down a solid foundation of security measures is non-negotiable. The digital landscape is rife with potential threats, and taking proactive steps can mean the difference between thriving and suffering significant losses. Here are some essential security measures to consider:

- SSL Certificates: Secure your website with an SSL certificate to encrypt data transmitted between your site and users. This not only protects sensitive information but also enhances your credibility.

- Two-Factor Authentication: Implement two-factor authentication (2FA) for both customer accounts and administrative access. This adds an additional layer of security, making it harder for unauthorized users to gain access.

- regular Software Updates: Keep your ecommerce platform, plugins, and systems up-to-date. Regular updates patch vulnerabilities and protect against emerging threats.

Along with these measures, adopting a robust fraud detection system is crucial. Such systems analyze transaction patterns, flagging suspicious activities in real-time. This not only helps you detect fraud early but also reassures customers that their transactions are safe.

Another critical aspect is employee training. Ensure your team is well-informed about security protocols and the latest scams. Regular training sessions can empower employees to recognize potential threats and respond appropriately.

| Security Measure | Benefit |

|---|---|

| SSL Certificates | Data Encryption |

| Two-Factor Authentication | Enhanced Account Security |

| Regular Software Updates | Protection Against Vulnerabilities |

| Fraud Detection Systems | Real-time Threat analysis |

| Employee Training | Increased Awareness |

consider using transaction monitoring tools. These tools help you examine various metrics such as IP addresses, user behavior, and device fingerprints, allowing you to make informed decisions about potentially suspicious transactions. by integrating these tools into your payment processing system, you can significantly reduce the chances of fraud slipping through the cracks.

Leveraging Advanced Technology for Enhanced Fraud Detection

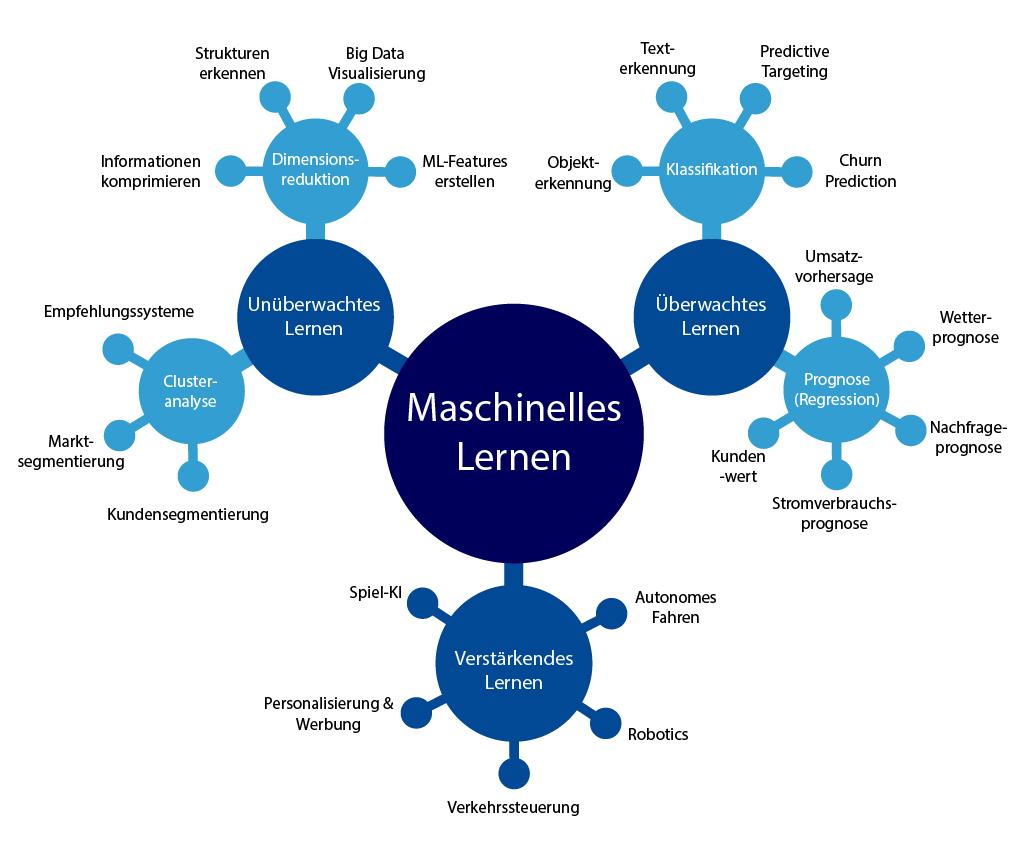

In today’s fast-paced digital landscape, ecommerce businesses face the relentless threat of fraud, making it imperative to adopt innovative technologies that enhance detection capabilities. By leveraging advanced technological solutions, organizations can stay one step ahead of fraudsters and protect their bottom line.

One of the most effective methods is utilizing machine learning algorithms. These systems analyze vast amounts of data to identify patterns and anomalies that may indicate fraudulent activity. With continuous learning capabilities, they improve over time, ensuring that your defenses evolve alongside emerging threats.

Another powerful tool is real-time data analytics. By processing transactions as they occur, businesses can quickly flag suspicious behavior before any damage is done. This proactive approach allows companies to respond swiftly, reducing the likelihood of successful fraudulent transactions.

Incorporating biometric authentication methods, such as fingerprint scanning or facial recognition, adds an additional layer of security. These technologies not only enhance user experience but also provide fraudsters with a challenging hurdle,as they require unique biological traits that are challenging to replicate.

Moreover, cloud-based fraud management systems offer scalability and versatility, enabling businesses to adjust their fraud detection strategies as their needs evolve. These systems can integrate with existing tools, providing a seamless transition to a more secure operating environment.

| Technology | Benefits |

|---|---|

| Machine Learning | Adapts to new fraud patterns, reducing false positives. |

| Real-Time Analytics | Immediate transaction monitoring, enhancing response times. |

| Biometric Authentication | Increases security by utilizing unique biological traits. |

| Cloud-Based Solutions | offers scalability and integration with existing systems. |

By adopting these advanced technologies, ecommerce businesses can build a robust framework for fraud detection. Investing in these solutions not only protects your assets but also fosters customer trust—an invaluable component in today’s competitive market.The right technology can transform your approach to fraud prevention, turning potential vulnerabilities into strengths.

Creating a Comprehensive Risk Assessment strategy

In the fast-paced world of ecommerce, a robust risk assessment strategy is crucial for safeguarding your business against fraud.This strategy should encompass an array of practices designed to identify, evaluate, and mitigate risks associated with fraudulent activities. By implementing a comprehensive approach, you can fortify your defenses and instill confidence in your customers.

To begin crafting your strategy, consider the following core components:

- Data Analysis: Regularly analyze transaction data, customer behavior, and patterns to identify anomalies that may indicate fraudulent activity.

- Risk Scoring: Develop a risk scoring system that assigns values to various transaction attributes, helping prioritize cases for closer examination.

- Customer Verification: Implement robust verification methods during the onboarding process and at the point of sale, such as two-factor authentication or address verification systems.

- Monitoring Tools: Invest in sophisticated monitoring tools that provide real-time alerts for suspicious activities. This proactive approach aids in speedy responses to potential threats.

Another vital aspect is fostering a culture of fraud awareness within your organization. Training employees across all levels— from customer service to finance—about the signs of fraud can significantly enhance your defense mechanisms. when everyone is informed and vigilant, the chances of catching fraudulent activities early increase dramatically.

Moreover, don’t underestimate the importance of customer feedback. Encourage customers to report any suspicious activities or concerns they may have. Creating an atmosphere where customers feel safe and valued can lead to improved trust and loyalty, making them more likely to report potential fraud.

it’s essential to regularly review and refine your risk assessment strategy. the landscape of ecommerce fraud is continually evolving, with fraudsters constantly adapting their tactics. Schedule periodic audits of your strategy to ensure it remains effective and aligned with current threats. This iterative process will not only keep your defenses up to date but also demonstrate to your customers that you are committed to protecting their interests.

The Role of Machine Learning in Fighting Ecommerce Fraud

In the ever-evolving landscape of ecommerce, fraud is becoming increasingly sophisticated, requiring equally advanced solutions. Machine learning emerges as a powerful ally in the fight against ecommerce fraud, leveraging vast amounts of data to identify patterns and anomalies that traditional methods may overlook. By analyzing user behavior and transaction history, machine learning algorithms can detect potential fraudulent activity in real time.

One of the key advantages of machine learning is its ability to adapt and improve over time. As more transaction data is collected, algorithms can learn from previous fraud attempts and adjust their parameters accordingly. This means that the system becomes more accurate at identifying genuine transactions while reducing false positives, which can frustrate legitimate customers. The result is a smoother shopping experience coupled with enhanced security.

To illustrate the impact of machine learning on fraud detection, consider the following aspects:

- Behavioral Analysis: Machine learning can analyze user behavior, such as browsing patterns and purchase history, to create a unique profile for each customer. Any deviation from this profile can trigger alerts for potential fraud.

- Predictive Analytics: By employing predictive models, ecommerce businesses can forecast future fraud risks based on historical data, allowing them to proactively address vulnerabilities.

- Real-Time Monitoring: machine learning enables continuous monitoring of transactions,providing immediate feedback and action to prevent unauthorized activities.

Moreover, the integration of machine learning with other technologies, such as biometric verification and multi-factor authentication, can further bolster fraud prevention efforts. For instance, by combining transaction data with biometric inputs like fingerprint recognition, ecommerce platforms can create a multi-layered defense system that makes it exceedingly difficult for fraudsters to succeed.

| Machine Learning Benefits | Impact on Ecommerce Fraud |

|---|---|

| Enhanced Detection Rates | Fewer fraudulent transactions slipping through |

| Reduced False Positives | Improved customer satisfaction |

| Scalability | Adapts to increasing data volumes easily |

Ultimately,embracing machine learning in ecommerce fraud prevention is not just about technology; it’s about building trust with customers. By demonstrating a commitment to security and proactively addressing fraud risks, businesses can foster a safer shopping environment. This not only protects the bottom line but also enhances brand loyalty and customer retention.

Establishing Strong Payment Verification Processes

In the fast-paced world of ecommerce, ensuring that payments are verified thoroughly and securely is paramount. Fraudsters are becoming increasingly sophisticated, leveraging advanced techniques to exploit weaknesses in the payment process. To combat this, establishing robust verification measures can dramatically reduce the risk of fraudulent transactions.

One key aspect of these verification processes is the implementation of multi-factor authentication (MFA).By requiring customers to provide additional verification—such as a one-time code sent to their mobile device—you add an extra layer of security that is difficult for fraudsters to bypass.This simple step can significantly decrease the likelihood of unauthorized transactions.

Another effective strategy is to utilize address verification systems (AVS). This tool checks the billing address entered by the customer against the address on file with their card issuer. If there’s a mismatch, it raises a red flag, prompting further verification before proceeding with the transaction.This proactive measure can help identify potentially fraudulent activity early on.

Incorporating machine learning algorithms for fraud detection can also enhance your payment verification processes. These algorithms analyze transaction patterns and user behavior, learning over time to identify anomalies that may indicate fraud. By automating this detection, you can quickly flag suspicious transactions for review, ensuring that legitimate customers are not inconvenienced.

| Verification Method | Benefits |

|---|---|

| Multi-Factor Authentication (MFA) | Enhances security through additional verification steps. |

| Address Verification Systems (AVS) | Identifies discrepancies in billing information. |

| Machine Learning Algorithms | Automates fraud detection by analyzing transaction patterns. |

Lastly, educating your customers about the importance of maintaining updated personal information plays a crucial role in verifying payments. Encourage them to keep their payment details current and to be vigilant for any suspicious activity on their accounts. When customers are informed, they are more likely to report anything unusual, allowing you to take immediate action.

By integrating these verification practices into your ecommerce platform, you not only protect your business from fraud but also build trust with your customers. A secure payment process is not just a defensive measure; it is indeed a vital component of a positive shopping experience that can lead to increased loyalty and repeat business.

Educating Your Team on Fraud Awareness and prevention

One of the most effective ways to safeguard your eCommerce business from fraud is through education. By empowering your team with knowledge about various fraud types, detection methods, and preventive measures, you create a strong line of defense against fraudulent activities. Start by organizing regular training sessions that cover the nuances of eCommerce fraud.

Consider incorporating these key topics into your training:

- Types of Fraud: familiarize your team with different kinds of eCommerce fraud, such as credit card fraud, return fraud, and account takeover.

- Red Flags: Teach your team how to identify suspicious behaviors or signs that a transaction might potentially be fraudulent.

- Security Protocols: Ensure that they understand the importance of security measures like two-factor authentication and secure payment gateways.

- Data Protection: Highlight the importance of customer data security and the implications of data breaches.

Utilize real-life examples and case studies during training to illustrate the impact of fraud on businesses. This makes the information more relatable and emphasizes the importance of vigilance. You can also create a fraud awareness handbook that your team can refer to at any time. Including a section on common scams and their characteristics can help them quickly spot potential threats.

Another effective method is to foster a culture of open communication. Encourage your team to report any suspicious activities or concerns without fear of repercussion. Establishing a fraud response team can streamline this process, allowing for quick action and thorough inquiry of potential fraud incidents.

| Fraud Type | Common Indicators | Preventive Measures |

|---|---|---|

| Credit Card Fraud | multiple transactions from the same IP | Use address verification service |

| Account takeover | Unusual login attempts | Implement two-factor authentication |

| return Fraud | Frequent returns from the same customer | Strict return policy enforcement |

Lastly, keep your team updated on emerging fraud trends and technologies. The digital landscape is constantly evolving, and so are the tactics used by fraudsters. By staying informed about the latest threats and tools available for fraud detection,your team will be better equipped to tackle potential risks. Regularly scheduled workshops or webinars can be an invaluable resource for ongoing education.

Fostering Customer Trust with Transparent Practices

Building customer trust is essential in the ever-evolving world of eCommerce, especially when it comes to fraud prevention. When customers feel secure in their transactions, they are more likely to return and recommend the site to others. Achieving this requires a commitment to transparency in every aspect of the business.

One vital practice is clearly communicating your security measures. When customers know that their data is protected by advanced encryption and that you employ regular security audits,it instills confidence in your brand. Consider implementing a dedicated security page that outlines these measures in layman’s terms, making it accessible and understandable.

Another effective strategy is to provide comprehensive information on your return and refund policies. A straightforward and hassle-free policy can significantly enhance customer trust. Customers are more inclined to make a purchase when they know they have options if the product does not meet their expectations. Highlight the key aspects of your policy directly on product pages for easy access.

Utilizing customer reviews and testimonials can also play a crucial role in fostering trust. When potential buyers see authentic feedback from previous customers, it reassures them of your credibility. Encourage satisfied customers to leave reviews and display them prominently on your site. This not only helps to build trust but also enhances your site’s visibility in search engine results.

Lastly, consider instituting a clear and accessible privacy policy. customers should be able to see how their data is collected, used, and stored. A transparent approach regarding data handling not only complies with regulations but also reassures customers that their personal information is safe with you.

| Practice | Description |

|---|---|

| Security Communication | Detail your security measures on a dedicated page. |

| Clear Policies | Provide easy-to-understand return and refund policies. |

| customer Reviews | Showcase authentic customer feedback prominently. |

| Privacy Assurance | Maintain a transparent privacy policy about data usage. |

Through these transparent practices, you can create a trustworthy environment for your customers, making them feel valued and secure. In turn, this approach not only protects your business from fraud but also fosters long-term loyalty and positive relationships with your clientele.

Implementing Multi-Factor Authentication for Extra Security

In today’s digital landscape, securing your ecommerce platform goes beyond just implementing standard security measures. Multi-Factor Authentication (MFA) plays a pivotal role in safeguarding customer accounts and sensitive information. By requiring users to provide two or more verification factors to gain access, MFA adds an essential layer of protection against unauthorized access.

When setting up MFA,consider the following methods to enhance security:

- SMS or Email Verification: Send a one-time code to the user’s registered phone number or email. This simple yet effective method ensures that even if a password is compromised,the account remains protected.

- Authenticator Apps: Encourage users to utilize apps like Google Authenticator or Authy. These apps generate time-sensitive codes, making it difficult for attackers to gain access.

- Biometric Verification: Leverage fingerprint or facial recognition technologies. These methods provide a seamless experience while significantly boosting security.

Integration of MFA should not only focus on customer accounts but also on admin access. This ensures that even those with elevated privileges face an additional hurdle when accessing sensitive information or making critical changes.You can implement MFA for:

- Admin Panels: Require MFA for all administrative logins.

- Payment Processing: Protect payment gateways with additional verification steps.

- Account Recovery Options: Reinforce recovery processes with MFA to prevent unauthorized account takeovers.

To visualize the impact of MFA on your ecommerce site, consider this comparison:

| Without MFA | With MFA |

|---|---|

| Higher risk of account takeover | Drastically reduced risk |

| Single point of failure (password) | Multiple layers of security |

| Increased fraud incidents | Lower fraud rates |

| Customer distrust | Enhanced consumer confidence |

While the implementation of MFA may pose slight inconveniences for users, the long-term benefits far outweigh these concerns. By prioritizing security, you not only protect your business but also foster trust with your customers, encouraging repeat purchases and brand loyalty.

Ultimately, the goal is to create a secure online shopping environment where customers feel confident sharing their information. By implementing multi-factor authentication, you are taking a proactive step toward minimizing risks and ensuring that your ecommerce platform remains resilient against fraud.

Regularly reviewing and Updating Your Fraud Prevention Strategies

in the ever-evolving landscape of ecommerce, fraud prevention strategies must be as dynamic as the threats they aim to combat. Regularly reviewing and updating these strategies is not just advisable; it’s essential. As new technologies and methodologies emerge, so too do the tactics employed by fraudsters, making it imperative for businesses to stay ahead of the curve.

Start by establishing a routine for evaluating your current fraud prevention measures. This could be on a quarterly or bi-annual basis, depending on the volume of transactions your business processes. During these reviews, ask critical questions:

- Are our existing tools effective?

- Have there been any recent breaches that could inform our strategy?

- are we leveraging the latest technology and data analytics?

- have we trained our staff on the latest fraud trends?

Integrating insights from recent fraud incidents into your strategy is crucial. Consider creating a table to document these insights, highlighting the type of fraud, the method used, and how your business can adapt.Here’s a simple example:

| Type of Fraud | Method Used | Suggested Adaptation |

|---|---|---|

| Account Takeover | Phishing Emails | enhance email verification processes |

| Card Not Present Fraud | Stolen Card Information | Implement Address verification System (AVS) |

| Return Fraud | Fake Receipts | Utilize detailed purchase history analysis |

Moreover, engaging with industry peers can provide valuable perspectives on effective practices. Attend webinars, join forums, and participate in networking events focused on ecommerce security. Sharing experiences and strategies can lead to a more robust fraud prevention framework.

Remember, fraud prevention is not a one-time effort but a continuous journey.The more proactive you are in reviewing and updating your strategies, the stronger your defenses will be against increasingly sophisticated fraud attempts. Embrace the challenge, and make it a priority to safeguard your business and your customers with a vigilant and adaptable approach.

Responding Effectively to Fraud Incidents: A Step-by-Step Guide

When your business faces a fraud incident, the way you respond can make all the difference. Here’s a step-by-step guide to tackling these challenges effectively.

Assess the Situation

the first step in responding to a fraud incident is to assess the situation thoroughly.Gather all pertinent information regarding the fraud attempt, including:

- Details of the transaction

- Customer information

- Patterns or anomalies in data

Analyze the impact of the incident on your operations, finances, and reputation. This step is crucial for developing an appropriate response strategy.

Implement Immediate Controls

Once you have a clear picture, it’s time to implement immediate controls to prevent further fraud. Consider actions like:

- Temporarily suspending suspicious accounts

- Enhancing verification processes for transactions

- Adjusting fraud detection algorithms

Taking swift action not only limits further exposure but also reassures your customers that you are taking their security seriously.

Engage internal Teams

Communication is key. Make sure to involve the relevant internal stakeholders, such as:

- Fraud prevention teams

- Customer service representatives

- Legal and compliance departments

Regular updates and collaboration will ensure that everyone is on the same page and that a unified response is executed.

Document Everything

Keep meticulous records of the incident, including communications, actions taken, and lessons learned. this documentation can be invaluable for:

- Future prevention efforts

- Compliance with legal obligations

- training staff on recognizing fraud

Communicate with Affected Parties

Once the immediate threat is managed, reach out to any affected customers or partners.Transparency builds trust, so make sure to:

- Inform them about the incident

- Detail the steps you are taking to rectify the situation

- Offer support or compensation, if applicable

Review and Enhance Prevention Strategies

After addressing the incident, take the time to review and enhance your fraud prevention strategies. Consider conducting a risk assessment, and if necessary, invest in advanced technology or training programs. A proactive approach will ensure your business remains resilient against future threats.

Continuous Advancement

Fraud tactics are ever-evolving. commit to a culture of continuous improvement by regularly updating your fraud detection mechanisms and staying informed about the latest trends in ecommerce fraud. Join forums, engage with industry experts, and participate in training programs to keep your knowledge fresh.

Frequently Asked Questions (FAQ)

Q&A: Ecommerce Fraud Prevention – 19 Practices for All Fraud Types

Q1: Why should I be concerned about ecommerce fraud?

A1: Great question! ecommerce fraud is a growing issue that can lead to significant financial losses, damage to your reputation, and a loss of customer trust. As more businesses move online, fraudsters are becoming increasingly sophisticated. By being proactive about fraud prevention, you can protect your business and your customers!

Q2: What are the different types of ecommerce fraud I should be aware of?

A2: There are several types of ecommerce fraud to keep an eye on. Some common ones include credit card fraud, friendly fraud (where customers dispute legitimate charges), account takeover, and phishing scams. Each type has its own nuances, but understanding them is key to implementing effective prevention strategies.

Q3: Can you share some specific practices for preventing ecommerce fraud?

A3: Absolutely! Here are a few practices that can make a big difference:

- Implement Strong Authentication: Use multi-factor authentication to verify customer identities during sign-ins and transactions.

- Monitor Transactions in Real Time: Utilize tools that analyze transactions for suspicious activity as they happen.

- Educate Your Team: Regularly train your staff on the latest fraud trends and prevention techniques.

- Optimize Your Checkout Process: A streamlined and secure checkout process reduces the risk of cart abandonment and fraud.

These are just a few, but the full list includes 19 practices to cover all bases!

Q4: How can I effectively educate my customers about ecommerce fraud?

A4: Educating customers is key! Share valuable content through blog posts, newsletters, and social media about how they can spot fraud and protect their information. Consider creating a “Fraud Awareness” section on your website where customers can learn about common scams and how to avoid them.Transparency builds trust!

Q5: Is it worth investing in fraud prevention tools and technologies?

A5: Definitely! Investing in fraud prevention tools can save you money in the long run. These tools can help you identify and mitigate risks before they escalate into costly problems. Plus, having the right technology in place can enhance your customer’s shopping experience, making them feel safer and more confident when they buy from you.

Q6: What are the long-term benefits of a comprehensive fraud prevention strategy?

A6: A solid fraud prevention strategy isn’t just about blocking criminals—it’s about building a better business. You’ll see improved customer trust and loyalty, reduced financial losses, and a stronger reputation in the marketplace. the effort you put into preventing fraud can lead to increased sales and growth opportunities.

Q7: Where can I learn more about these 19 practices?

A7: You’re in luck! We’ve compiled a detailed article covering all 19 practices tailored to combat various types of ecommerce fraud. check it out for in-depth insights and actionable tips to help you safeguard your business. remember,being informed is your first line of defense!

By following these practices and staying vigilant,you can significantly reduce your risk of falling victim to ecommerce fraud. Remember,prevention is always better than cure when it comes to protecting your business and your customers!

The Way forward

As we wrap up our deep dive into the world of eCommerce fraud prevention,it’s clear that safeguarding your online business is not just a good practice—it’s an absolute necessity. With the rise of digital shopping, fraudsters are getting more sophisticated, and the stakes are higher than ever. But don’t let that overwhelm you! By implementing the 19 practices we explored, you can build a robust defense system that not only protects your revenue but also strengthens customer trust and loyalty.

Remember, in the ever-evolving landscape of eCommerce, staying a step ahead of fraudsters is a continuous journey. it’s about creating a culture of vigilance within your organization and fostering a proactive approach to security. Whether you’re a seasoned eCommerce veteran or just starting out, these practices can be tailored to fit your unique business needs.So, take a moment to review your current fraud prevention strategies and see where you can make improvements. Invest in the tools and technologies that can help detect suspicious activity, train your team to recognize the signs of fraud, and always prioritize customer transparency.Your business deserves to thrive in a safe and secure environment. By taking these actionable steps, you’re not just protecting your bottom line; you’re enhancing your brand’s reputation and ensuring that your customers feel safe and valued.

Let’s make eCommerce a safer space for everyone. Together,we can outsmart the fraudsters and create a thriving online marketplace! Thanks for joining us on this journey—now,let’s put these practices into action and watch your business flourish!