Are you looking to streamline your business operations and make your life a little easier? If you’re running an online shop, a membership site, or any kind of service-based business, you know just how crucial it is to have a smooth payment system in place. But wait—what if I told you that you don’t have to break the bank to set up recurring payments on your WordPress site? That’s right! In this article, we’re diving into a free solution that can help you effortlessly manage subscriptions and recurring payments. Whether you’re a WordPress newbie or a seasoned pro, you’ll discover just how simple it can be to keep the cash flow coming with minimal fuss. So, grab a cup of coffee, and let’s unlock the potential of your WordPress site together!

Understanding Recurring Payments and Why They Matter

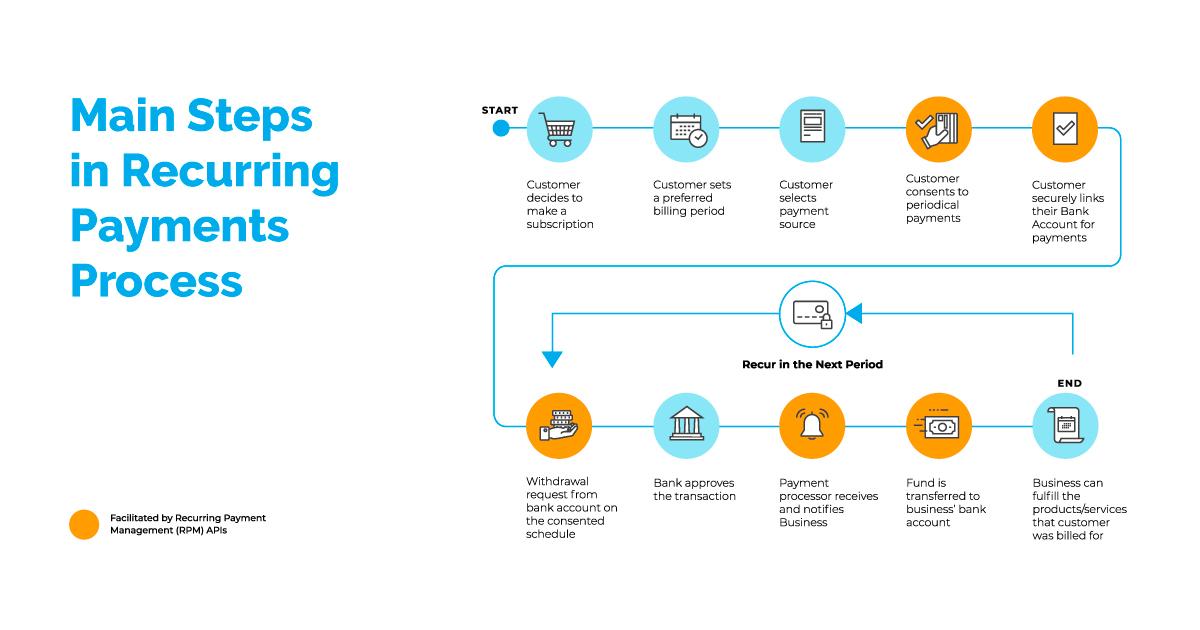

Recurring payments have transformed the way businesses manage transactions, offering a seamless experience for both merchants and customers. By allowing customers to authorize payments on a regular schedule, businesses can ensure a steady stream of income, while customers enjoy convenience and uninterrupted access to services.

one of the most significant advantages of recurring payments is the improved cash flow. With a predictable income stream, businesses can plan their finances more effectively. This model reduces the need for constant invoicing and chasing late payments, which can be a drain on resources. Rather, payments are automatically processed, leading to less administrative hassle and more time to focus on growth.

Additionally, customer loyalty is often enhanced through recurring payment models. When customers subscribe to a service, they’re more likely to stay engaged. this creates a sense of commitment, where customers feel they are part of a community. Regular interactions foster relationships,which can lead to increased customer lifetime value.

Moreover, recurring payments can definitely help businesses gather valuable insights into customer behavior. By tracking when and how frequently enough payments are made, businesses can analyze trends and adjust their offerings accordingly. This data-driven approach allows for personalized marketing strategies, which can significantly boost conversion rates.

Implementing recurring payments can also simplify budgeting for customers. With fixed amounts deducted at regular intervals, customers can better manage their finances, making it easier for them to plan their spending. This predictability frequently enough results in higher satisfaction and reduces the likelihood of payment-related disputes.

when it comes to setting up recurring payments, WordPress offers several solutions. There are free plugins available that can definitely help you integrate this feature into your website without breaking the bank.Utilizing these tools not only streamlines your process but also opens up new avenues for revenue generation.

The Best Free Plugins for Accepting Recurring Payments

If you’re looking to integrate recurring payments into your WordPress site without breaking the bank, you’re in luck! There are some fantastic free plugins available that can definitely help you manage subscriptions, memberships, and ongoing payments with ease. Here are a few options that stand out in the crowded plugin marketplace:

- WooCommerce Subscriptions – While the premium version is a paid option, WooCommerce offers a free base plugin that allows you to set up a shop and manage subscriptions effectively. with the right extensions, you can create a comprehensive payment solution.

- Paid Memberships Pro – This plugin excels in managing memberships and can handle recurring payments seamlessly.It offers a solid free version that includes basic membership functionality, ideal for those just starting out.

- WP Simple Pay - A great solution for one-time and recurring payments with a simple setup process. The free version is intuitive, allowing you to accept payments without the overhead of complex configurations.

- Stripe Payments – If you prefer Stripe for payment processing, this plugin lets you accept one-time and recurring payments.The user interface is straightforward, making it easy to integrate with your existing site.

When selecting a plugin, consider your specific requirements. Some plugins may offer advanced features in their premium versions, but the free versions frequently enough provide enough functionality to get you started. Here are some features you might want to look at:

| Plugin | Recurring Payments | Membership Capabilities | Payment gateways |

|---|---|---|---|

| WooCommerce Subscriptions | ✔️ | ✔️ | Multiple |

| Paid Memberships Pro | ✔️ | ✔️ | Multiple |

| WP Simple Pay | ✔️ | ❌ | Stripe |

| Stripe Payments | ✔️ | ❌ | Stripe |

Not only do these plugins facilitate recurring payments, but they also allow for customization and scalability as your business grows.It’s essential to read through the documentation of each plugin to understand their capabilities and limitations. User reviews can also offer insights into their reliability and performance.

With these free plugins at your disposal, you can easily set up recurring payments and focus on what truly matters—growing your business. Whether you’re launching a subscription box service, an online course, or a membership site, the right tools can make all the difference!

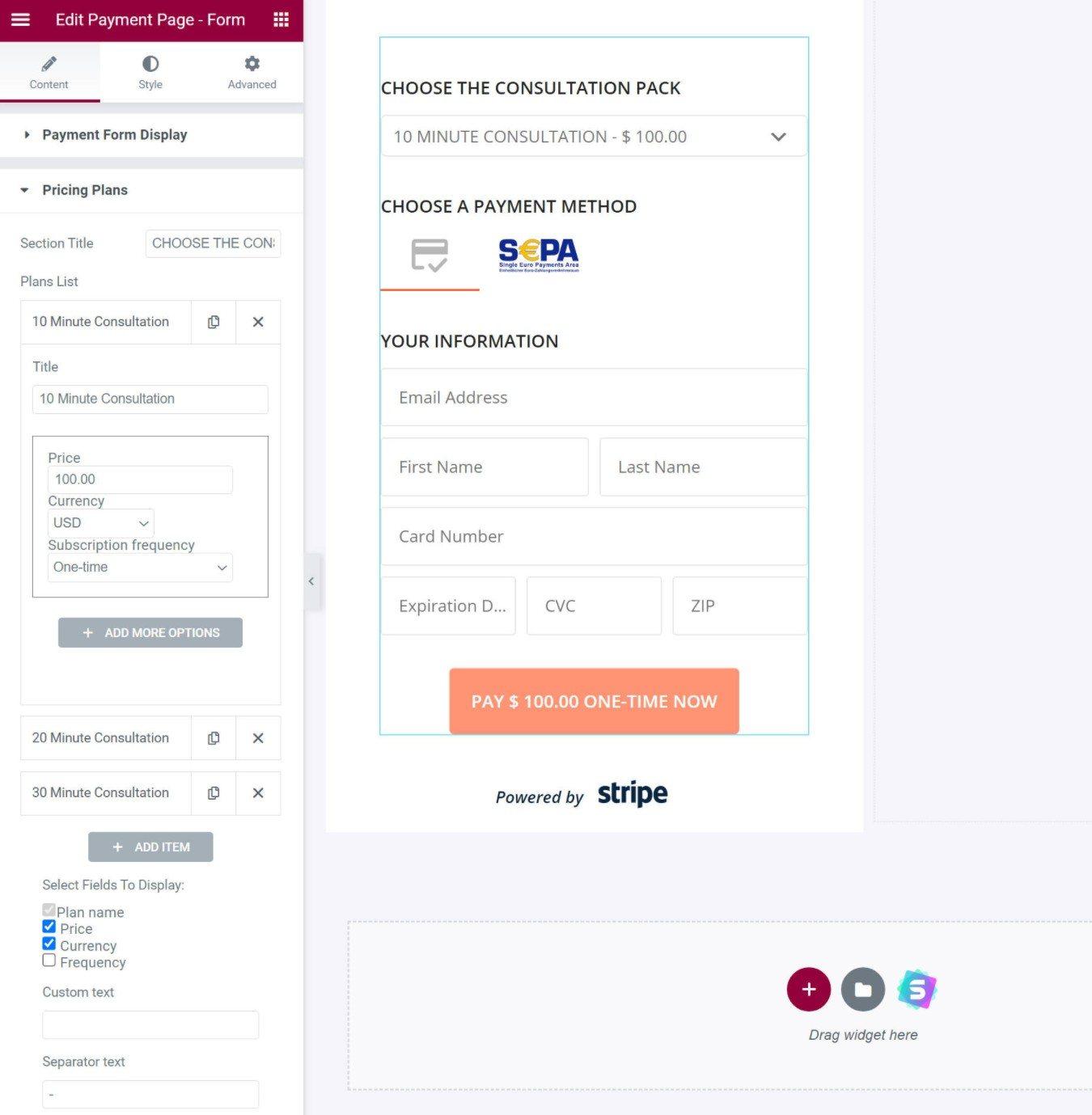

Step-by-Step guide to Setting Up Your Chosen Plugin

Setting up your chosen plugin for accepting recurring payments in WordPress can seem daunting, but with this straightforward guide, you’ll be up and running in no time. Whether you’re looking to offer subscription services, memberships, or regular donations, following these steps will streamline the process.

First things first, you need to install and activate the plugin of your choice. Here’s how:

- Navigate to your WordPress dashboard.

- Go to Plugins > Add New.

- Search for your plugin by name in the search bar.

- Click on Install Now and then Activate once installation is complete.

Once activated, you’ll find a new menu item in your dashboard. Click on this menu to start configuring your plugin settings. Here, you’ll typically need to:

- Select your payment gateways (e.g., PayPal, stripe).

- Input your account details for the selected gateways.

- Customize your payment options, including currency and default payment settings.

Next,you’ll want to set up your products or services for recurring payments. Depending on the plugin, this might involve:

- creating a new product or service entry.

- Defining the pricing structure (one-time fee, monthly, yearly).

- Adding a brief description and images if necessary.

After configuring your products, it’s crucial to set up email notifications for your customers. This can typically be done in the plugin settings. consider adding:

- confirmation emails upon subscription.

- Reminders for upcoming payment renewals.

- Thank you emails after prosperous transactions.

always test your setup before going live. Create a fake subscription to ensure everything—from payment processing to email notifications—works flawlessly. Keep an eye on:

- Payment gateway functionality.

- Email delivery to ensure customers receive all necessary details.

- Access to the products or services for subscribers.

With your plugin set up and tested, you’re ready to start accepting recurring payments and growing your business. Simplifying the payment process can lead to better customer retention and increased revenue—so why wait?

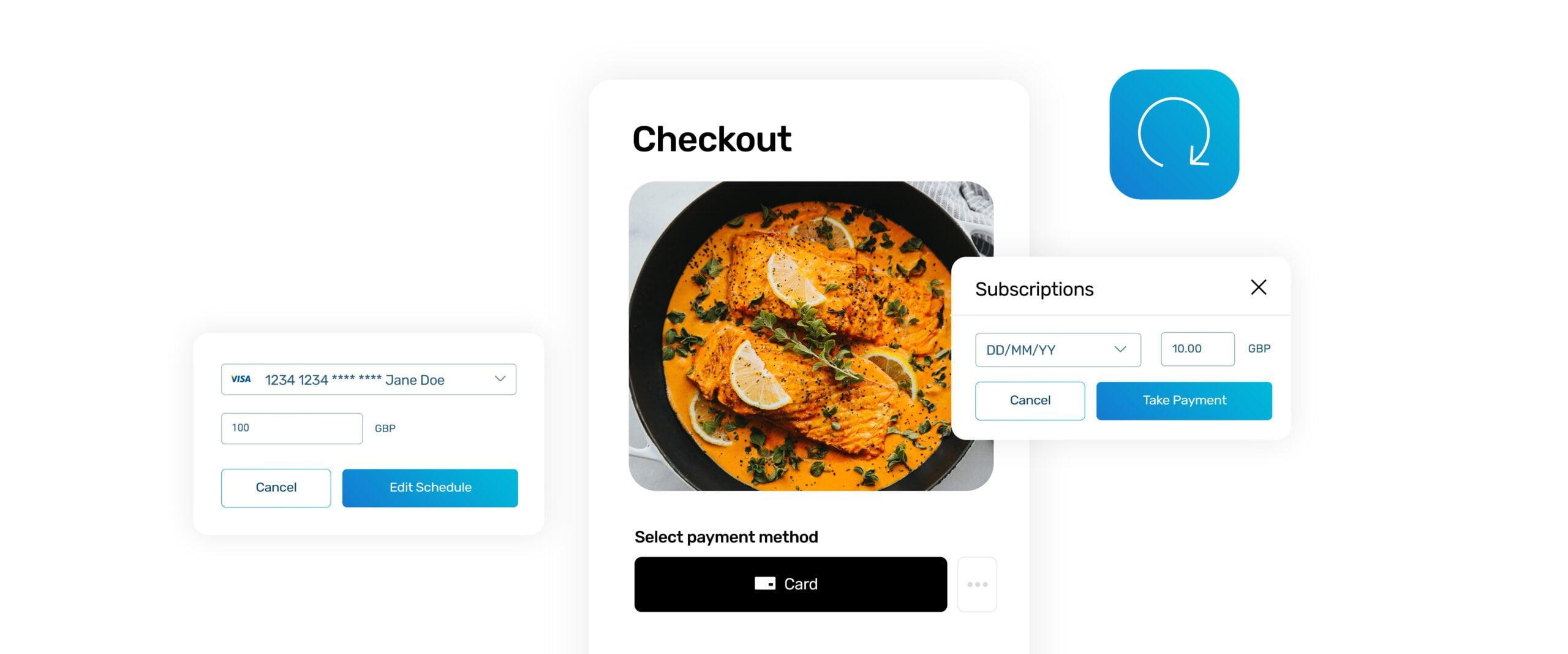

Customizing Payment Plans for Your Customers

When it comes to offering payment plans, flexibility is key.Your customers have unique needs and financial situations, so providing options can significantly enhance their overall experience and increase your sales. With the right tools, you can customize payment plans that cater to diffrent preferences, ensuring that your offerings are accessible to a wider audience.

One of the most effective ways to customize payment plans is by allowing customers to choose their payment frequencies. Consider offering options such as:

- Weekly

- Bi-weekly

- Monthly

- Quarterly

This kind of flexibility not only accommodates varying cash flows but also helps customers manage their budgets more effectively, which can lead to increased customer loyalty.

Along with choosing frequency,you can also allow customers to select their payment amounts. This can be particularly effective for larger purchases. As an example, you could provide a simple slider tool that lets customers adjust their payments based on their preferences. Imagine a setup like this:

| Payment Amount | payment Frequency | Total Duration |

|---|---|---|

| $50 | Monthly | 6 Months |

| $25 | Bi-weekly | 3 Months |

| $100 | Monthly | 1 Year |

Moreover,consider incorporating a discount for customers who opt for longer payment terms. This not only incentivizes larger purchases but also communicates that you value their commitment. A simple 10% discount for opting into a 12-month plan can make a significant difference in conversion rates.

don’t forget to make the sign-up process as smooth as possible. Use simple, clear forms that guide the user without overwhelming them with information. Ensure that your customers know exactly what they’re signing up for, including any associated fees, interest, or terms. Transparency builds trust and can help reduce cart abandonment.

regularly review the effectiveness of your payment plans. Use analytics tools to monitor which plans are most popular and which might need adjustments. by staying attuned to customer behavior, you can continually refine your offerings to better meet their needs, driving further growth for your business.

Ensuring Secure Transactions for Peace of Mind

When it comes to handling recurring payments, security should be your top priority. Customers want to feel confident that their sensitive information is protected, especially when entering their payment details repeatedly. with the right tools and practices, you can ensure that every transaction is safe, paving the way for a smoother, worry-free experience for both you and your clients.

One of the simplest ways to ensure secure transactions is by utilizing reputable payment gateways. These gateways not only help in processing payments but also provide robust fraud detection and prevention measures. Here are a few key features to look for:

- Encryption: Always choose a solution that encrypts data during transmission.

- PCI Compliance: Ensure that the payment gateway complies with Payment Card Industry standards.

- Tokenization: This replaces sensitive card information with a unique identifier, reducing risk.

Additionally, integrating SSL (Secure Socket Layer) certificates into your WordPress site is crucial. An SSL certificate encrypts the data between the user’s browser and your server,ensuring that any information shared is secure. In fact, browsers now display security warnings for sites without SSL, which could deter potential customers from making a purchase.

It’s also vital to choose a plugin that offers built-in security features.Many WordPress plugins designed for recurring payments come equipped with security functionalities, such as:

- Automatic updates: Keeping your plugin updated ensures that the latest security patches are applied.

- Two-factor authentication: Adding an extra layer of security during login can protect your admin panel.

To further enhance security,consider implementing a robust user verification process.This could involve email confirmations or even SMS verification for significant transactions. These steps can reassure customers that their payments are being handled securely and that their information is safeguarded.

Ultimately, maintaining transparency with your customers about your security measures can build trust. Clearly outline your payment processes and the steps you take to protect their information on your website. This proactive approach not only enhances customer confidence but can also help in reducing chargebacks and disputes.

ensuring secure transactions is not just a technical requirement; it’s a vital component of customer satisfaction. by selecting the right tools, implementing strong security practices, and maintaining clear dialog, you can create a safe habitat for accepting recurring payments on your WordPress site.

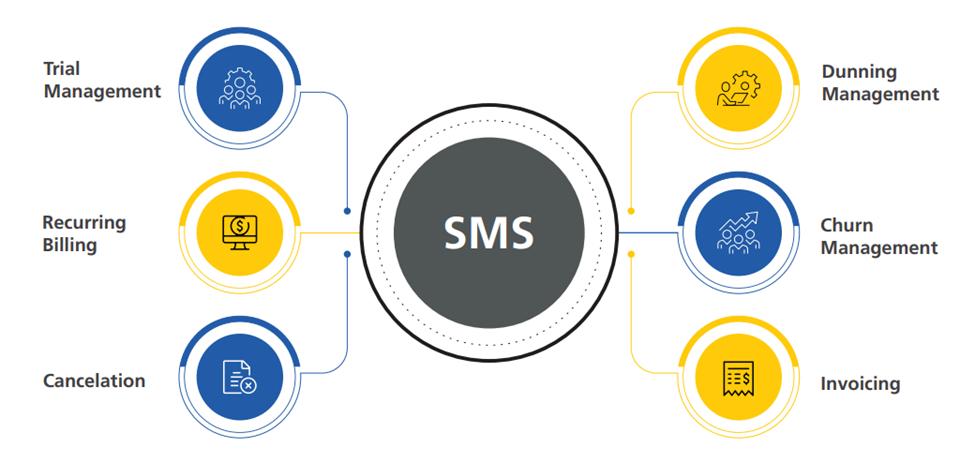

Integrating Subscription Management into Your Workflow

Integrating subscription management into your existing workflow can streamline operations and enhance customer satisfaction. One of the most effective ways to implement this is through seamless integration with your WordPress site. By utilizing plugins that offer subscription capabilities, you can automate recurring payments and maintain control over your billing processes.

Here are some key points to consider when integrating subscription management:

- Choose the right plugin: Not all plugins are created equal. Look for one that best fits your business needs, whether it’s WooCommerce subscriptions or a lightweight option like WP Simple Pay.

- Set Clear Payment Intervals: Define how often you want to bill customers—monthly, quarterly, or annually.Clarity in billing cycles helps manage customer expectations.

- Offer free Trials or Discounts: Attract new subscribers by providing introductory offers. This can be an effective way to entice them into signing up for a paid plan.

Once you’ve selected a plugin, the next step is to focus on user experience. Customers should feel confident in the subscription process from start to finish.Consider these strategies:

- simplify the Checkout Process: Reduce the number of fields required during checkout. A simple, user-amiable interface can significantly decrease abandonment rates.

- Provide Clear Information: Ensure your pricing structure and subscription terms are easily accessible. Transparency builds trust and encourages sign-ups.

- Regular communication: Send updates and reminders about subscription renewals. This keeps your customers informed and engaged.

Additionally, it’s crucial to keep track of your subscriptions and manage them efficiently. Using a dashboard provided by your chosen plugin can give you insights into:

| Metric | Importance |

|---|---|

| Active Subscribers | Understanding your customer base |

| Churn Rate | Identifying retention issues |

| Revenue Growth | Measuring business health |

By actively managing these metrics, you’ll be well-equipped to adapt your marketing strategies and ensure your subscriptions are thriving. Incorporating subscription management into your workflow not only simplifies financial transactions but also builds a recurring revenue model that can lead to sustained growth. Embrace this transition, and watch how it transforms your business dynamics!

Tips for Promoting Your Recurring Payment Options

When it comes to promoting your recurring payment options, the key is to make them as attractive and accessible as possible. Highlight the convenience these options offer, both for you and your customers. To start, you can:

- Feature on Your Homepage: Place a prominent banner or section on your homepage that showcases your recurring payment plans. Use eye-catching graphics and clear calls-to-action (CTAs) that encourage visitors to learn more.

- Utilize Email Marketing: Send out newsletters or dedicated emails to your subscribers highlighting the benefits of your subscription services. Personalize your messages to resonate with their interests.

- Create Engaging Content: Write blog posts,guides,or FAQs that explain how recurring payments work. Use real-life examples or testimonials to demonstrate their value.

Another effective strategy is to leverage social media. Share posts that explain the advantages of your recurring payment options, using visuals to capture attention. Create short, informative videos that walk your audience through the subscription process, making it more approachable.

Don’t forget about offering incentives! Consider providing special discounts for customers who choose recurring payments. You could run a limited-time promotion, such as “Sign up now and get 20% off your first three months!” This not only encourages sign-ups but also creates a sense of urgency.

utilize user-generated content as well. Encourage your current subscribers to share their experiences on social media, tagging your brand and using a specific hashtag. This builds trust and can influence potential customers by showing real satisfaction from real people.

consider using clear, straightforward pricing tables to display your payment options. Here’s a simple example:

| Plan | Price | Benefits |

|---|---|---|

| basic Plan | $9.99/month | Access to basic features |

| Pro Plan | $19.99/month | Access to premium features + priority support |

| ultimate Plan | $29.99/month | All features + exclusive content |

By implementing these strategies,you can effectively promote your recurring payment options and encourage more customers to take advantage of them. Make your offers clear, compelling, and easy to access, and watch your subscription numbers grow!

Troubleshooting Common Issues with recurring Payments

Accepting recurring payments can streamline your business operations, but it’s not uncommon to encounter a few bumps along the way. Here are some common issues and how to address them effectively, ensuring a seamless experience for you and your customers.

- Encourage customers to check their payment details for accuracy.

- Implement a reminder system to notify customers when their card is about to expire.

- Provide alternatives for them to update their payment info easily through your site.

- Double-check the setup of your payment intervals in the plugin settings.

- Send automated notifications to customers before their next payment is due.

- Consult your plugin’s documentation for guidance on adjusting settings.

- make sure your email configuration is set up correctly in WordPress.

- Use a reliable SMTP service to manage email delivery.

- Encourage customers to whitelist your sending email address to reduce chances of misplacement in spam folders.

| Issue | Solution |

|---|---|

| Payment Declined | Verify details, update card info, and notify users |

| Payment Schedule Issues | Re-check settings and send reminders |

| Failed Notifications | Check email settings and use SMTP services |

- Set up automated receipt generation after each successful payment.

- Provide a user-friendly dashboard where customers can view their payment history.

- Encourage feedback on the receipt process to identify further improvements.

Addressing these common issues with recurring payments can significantly enhance customer satisfaction and reduce churn. By proactively managing these potential problems, you’ll not only maintain a healthy revenue stream but also foster trust and loyalty among your clientele.

Analyzing Your Recurring Revenue and Making Adjustments

Understanding your recurring revenue is crucial for the long-term success of your business. It’s not just about tracking the income; it’s about deriving insights that can drive growth. Start by diving into the metrics that matter. Look at your average revenue per user (ARPU) and churn rate to gauge how effectively you’re retaining customers. this data will help you identify trends and adjust your strategies accordingly.

to enhance your analysis, consider segmenting your customer base. This allows you to see which segments are performing well and which might need a bit more attention. You can categorize your customers based on:

- Demographics

- Subscription plans

- Engagement levels

By understanding these segments, you can tailor your offerings or communication strategies to meet their specific needs. As an example, if you find a segment with a high churn rate, you may need to investigate why customers are leaving and devise targeted retention strategies.

Once you have a firm grasp on your metrics, it’s time to make adjustments. This could mean tweaking your pricing model, enhancing customer support, or even refining your product or service offerings. Here’s a quick table summarizing potential adjustments based on common revenue analysis findings:

| Finding | Adjustment |

|---|---|

| High churn rate | Implement loyalty programs |

| Low engagement | Personalize content and offers |

| Price sensitivity | Introduce flexible payment options |

Moreover, don’t hesitate to gather feedback from your customers. Conduct surveys or interviews to understand their experiences and expectations. This direct input can reveal issues you might not see in the numbers and empower you to make informed adjustments that resonate with your audience.

it’s essential to regularly revisit your recurring revenue analysis. The market and customer preferences are constantly evolving, and staying ahead means being proactive. Set a schedule for reviewing your metrics, whether quarterly or bi-annually, to ensure your strategies remain aligned with your business goals. Adjusting your approach based on data not only strengthens your revenue streams but also builds lasting customer relationships.

Engaging Customers to Boost Retention Rates

Engaging customers is crucial for enhancing retention rates, especially when you’re implementing a recurring payment system in WordPress. By creating an inviting and user-friendly experience, you can foster loyalty and encourage your customers to stick around longer. Here are effective strategies to enhance customer engagement:

- Personalize Communication: Tailor your emails and notifications to reflect your customers’ interests and preferences. Using their names and purchase history can create a more intimate connection.

- Offer Exclusive Benefits: Implement loyalty programs or exclusive discounts for recurring customers. This can give them a sense of belonging and appreciation.

- Seek Feedback Actively: Regularly ask for customer feedback through surveys or quick polls.When customers feel their opinions matter, they’re more likely to stay committed.

- Provide exceptional Customer Service: Quick responses and effective solutions to customer inquiries can significantly enhance their overall experience, making them more inclined to continue their subscriptions.

Additionally, consider incorporating engaging content into your strategy. Content such as tutorials, tips, and behind-the-scenes looks can keep customers interested and connected. as a notable example, if you’re offering a subscription service for a digital product, share helpful blog posts or video content that adds value to their purchase.

Another effective method is to create a community around your brand. Utilize social media platforms and forums to foster discussions among your customers. This not only builds a sense of belonging but also encourages users to share their experiences, making your service more appealing to potential subscribers.

Implementing these strategies can definitely help create a cycle of engagement that stimulates retention. Keep in mind that a positive customer experience paired with a seamless recurring payment system can transform casual buyers into loyal advocates for your brand.

| Strategy | Benefit |

|---|---|

| Personalized Communication | Enhances connection and loyalty |

| Exclusive Benefits | Encourages continued subscriptions |

| Active Feedback | Improves products and services |

| Exceptional customer Service | Increases customer satisfaction |

Real-Life Success Stories of Recurring Payments in Action

Recurring payments have transformed the way businesses manage their finances, enabling a steady stream of income while enhancing customer satisfaction. let’s take a look at some real-life success stories that illustrate the power of this payment model in action.

A Fitness Studio’s Journey to Stability

A local fitness studio implemented recurring payments for their monthly memberships.Initially struggling with inconsistent cash flow, they decided to switch to a subscription model. By offering tiered membership options that included personalized training sessions and access to exclusive classes,they saw a significant uptick in membership retention.

- Increased membership retention by 40%

- Daily attendance improved by 30%

- 95% satisfaction rate from members

A Digital Content Creator’s New Revenue Stream

Consider a digital content creator who focused on providing high-quality video tutorials. By introducing a monthly subscription service, they could now offer premium content to subscribers. This strategy not only diversified their income but also built a loyal community.

- Monthly subscriber growth of 200%

- Subscribers engage with 75% of new content

- Skyrocketed ad revenue thanks to increased traffic

An E-commerce Business’s Boost in Sales

An e-commerce store specializing in gourmet snacks opted for a subscription box model. Customers received curated boxes of products each month, which not only ensured repeat purchases but also simplified inventory management for the business. The result was a stable revenue stream that allowed for better financial planning.

| Metric | Before Subscription | After Subscription |

|---|---|---|

| Average Monthly Sales | $5,000 | $15,000 |

| Customer Retention Rate | 20% | 60% |

A Non-Profit’s Sustainable Funding Model

For non-profit organizations, recurring donations can be a game changer. One local charity implemented a monthly giving program, allowing supporters to contribute regularly. This not only streamlined their donation process but also helped them plan future programs with predictable funding.

- Doubled their donor base within a year

- Increased total donations by 150%

- Enhanced engagement through exclusive donor events

The success stories of these businesses highlight the effectiveness of recurring payments in fostering growth, increasing customer loyalty, and providing a stable revenue stream. By adopting this model in WordPress, businesses can unlock similar potential and create lasting relationships with their customers.

Future-Proofing Your Business with Recurring Revenue Models

Adopting recurring revenue models can significantly enhance your business’s stability and growth potential. By integrating subscriptions or membership options, you create a predictable cash flow, enabling better budget planning and strategic investments.This approach not only boosts your revenue but also cultivates customer loyalty, making clients feel valued and engaged.

One of the most attractive aspects of WordPress is its flexibility, especially when it comes to managing payments. With various plugins available, you can effortlessly set up a system to accept recurring payments. Here are some essential features to look for in a payment solution:

- Ease of Use: The interface should be intuitive for both you and your customers.

- Multiple Payment Options: support for credit cards, PayPal, and other payment gateways is crucial.

- customizable Plans: Ability to create different subscription tiers or payment schedules.

- Automated Billing: System should handle renewals and reminders without manual intervention.

consider using free plugins like WooCommerce Subscriptions or Paid Memberships Pro. These tools provide robust functionality without the upfront costs often associated with premium solutions. You can easily get started with minimal technical knowledge, making it accessible for business owners at any level.

| Plugin Name | Key Features | Pricing Model |

|---|---|---|

| WooCommerce Subscriptions | Recurring payments, flexible billing periods | Free trial, then $199/year |

| Paid Memberships Pro | Membership levels, discount codes | Free, with premium add-ons available |

| Stripe Payments | Accepts multiple currencies, simple setup | Free to install, transaction fees apply |

By leveraging these free solutions, you not only save money but also position your business for long-term success. The beauty of recurring revenue is that it transforms your customers into subscribers, leading to higher lifetime value. Additionally, this model allows you to experiment with different offerings, promoting a culture of innovation.

implementing a recurring payment system through WordPress is a strategic move that can future-proof your business. Not only does it streamline your cash flow, but it also provides a competitive edge in an ever-evolving marketplace. Embrace the potential of recurring revenue, and watch your business thrive.

Frequently Asked Questions (FAQ)

Q: What are recurring payments, and why are they important for my business?

A: Great question! Recurring payments allow you to charge customers regularly for services or products, like monthly subscriptions or annual access fees. This model creates a steady income stream, helps with cash flow, and enhances customer loyalty as they’re committed to your service for the long haul.

Q: I’m new to WordPress.Can I really set up recurring payments without a lot of technical knowledge?

A: Absolutely! That’s the beauty of it. There are user-friendly plugins designed specifically for wordpress that make setting up recurring payments a breeze, even for beginners. You don’t need to be a tech wizard to get started!

Q: What’s the free solution you mentioned?

A: The free solution I’m talking about is the “WooCommerce Subscriptions” plugin. While WooCommerce is primarily known for e-commerce, its subscriptions extension allows you to set up recurring payments effortlessly. There are also other free plugins, like “Paid Memberships Pro” and “WP Simple Pay,” which are fantastic for handling subscriptions.

Q: Are there any limitations to using a free plugin?

A: Some free plugins may have limitations in terms of features or the number of subscriptions you can manage. But don’t let that discourage you! Many free options are more than sufficient for small to medium-sized businesses. Plus, you can always upgrade later if your needs grow!

Q: How do I set up these recurring payments in WordPress?

A: Setting up recurring payments is easier than you think! After installing your chosen plugin, you’ll typically follow these steps:

- Configure your payment gateway (like PayPal or Stripe).

- Create your subscription product or service.

- Set the billing cycle (weekly, monthly, yearly, etc.).

- Publish it, and voilà! Your customers can start signing up for their subscriptions right away!

Q: What payment gateways can I use with these plugins?

A: Most popular plugins support major payment gateways like PayPal, Stripe, and Authorize.Net. These gateways are trusted and provide a secure way for your customers to make payments, ensuring both you and your customers feel safe during transactions.

Q: Will I be able to manage my subscribers easily?

A: Definitely! Most plugins come with user-friendly dashboards that let you manage your subscribers, view payment history, and handle cancellations or upgrades. that way, you can focus on growing your business rather than getting bogged down in admin tasks.

Q: What if I run into issues?

A: No worries! The WordPress community is incredibly supportive. You can find tutorials, forums, and even direct support from the plugin developers. Plus, you can always reach out to other WordPress users for tips and tricks.

Q: Should I consider upgrading to a premium plugin later on?

A: It could be a good idea! Premium plugins often come with advanced features like automated invoicing, detailed analytics, and enhanced customer support. If your business grows and you need more robust capabilities,a premium option might be worth the investment.

Q: Is it really worth my time to set up recurring payments?

A: Absolutely! Investing time in setting up recurring payments can pay off significantly. It stabilizes your income, builds stronger relationships with customers, and saves you time on billing. Plus, who wouldn’t want a reliable income stream?

Q: Any final tips for someone just starting with recurring payments in WordPress?

A: Start small! Choose a plugin that suits your needs, test it, and get cozy. Always keep your customers in mind by providing clear communication about billing and updates.And don’t forget to celebrate every new subscriber – they’re the heartbeat of your business!

Future Outlook

And there you have it—accepting recurring payments in WordPress doesn’t have to be a elaborate or costly venture. With the right tools and a little guidance, you can set up a seamless payment solution that keeps your revenue flowing and your customers happy.

Choosing a free option doesn’t mean sacrificing quality or functionality; many plugins offer robust features that can meet the needs of your growing business. Remember, the goal is to create a smooth and trustworthy experience for your subscribers, and with the tips we’ve shared, you’re well on your way to achieving that.

So why wait? Dive in, explore the options, and take that next step towards automating your payments. Your future self will thank you for making this smart move today. If you have any questions or need assistance while setting everything up, don’t hesitate to reach out. Happy selling!