In today’s fast-paced financial landscape, managing wealth has become a complex endeavor, especially for high-net-worth families.Gone are teh days when wealth management meant simply keeping track of investments and balancing a checkbook. Now, wiht the ever-evolving market dynamics, diverse investment opportunities, and intricate tax regulations, the need for a more sophisticated approach is clearer than ever. Enter family office software—a game-changer in the realm of wealth management.

imagine having a tool that not only simplifies your financial oversight but also enhances collaboration across your family’s financial advisers, ensures transparency, and provides real-time insights into your investments.Family office software is redefining how affluent families approach asset management, offering a seamless blend of technology and personalized service. In this article, we’ll explore how these innovative platforms are revolutionizing wealth management, the key features to look for, and why investing in the right software can empower your family’s financial future like never before. Whether you’re a seasoned investor or just starting to navigate the world of wealth management, understanding the benefits of family office software is essential for securing and growing your family legacy. Let’s dive in!

Understanding Family Offices and Their Unique Needs

In the intricate world of wealth management,family offices stand out as specialized entities dedicated to managing the unique needs of high-net-worth families. These organizations not only oversee investments but also navigate the complexities of legacy planning, philanthropy, and even tax strategies.Understanding their distinctive requirements is vital for tailoring software solutions that truly meet their needs.

Family offices frequently enough juggle multiple responsibilities, which include:

- Investment Management: Strategically investing in diverse asset classes to grow wealth.

- Tax Planning: Implementing strategies to minimize tax liabilities while ensuring compliance.

- Estate Planning: Structuring the transfer of assets to future generations.

- Philanthropic Initiatives: Managing charitable contributions and social impact investments.

- Family governance: Creating frameworks for decision-making and conflict resolution.

Each of these responsibilities presents a unique challenge that requires powerful, integrated software solutions. A good family office software platform offers:

- Centralized Data Management: Collecting and organizing financial data from various sources in one place.

- Real-Time Reporting: Providing insights into portfolio performance with up-to-date financial reports.

- Collaboration Tools: Facilitating communication among family members and advisors.

- Customizable Dashboards: Allowing users to visualize their wealth in a manner that fits their specific needs.

When it comes to selecting the right software, family offices should consider features that allow for scalability and flexibility. As families grow and their needs evolve, their wealth management solutions must adapt seamlessly. Hear’s a simple comparison of key features to look for in family office software:

| Feature | Importance |

|---|---|

| Data Security | Crucial for protecting sensitive financial information. |

| Integration Capabilities | Essential for consolidating various financial platforms. |

| User-Kind Interface | Vital for ensuring that all family members can easily navigate the system. |

| Client Support | Valuable for addressing any technical issues or questions promptly. |

Ultimately, the right family office software can revolutionize the way high-net-worth families manage their wealth. By understanding their unique needs, software providers can create tailored solutions that not only streamline financial management but also foster family unity and ensure the longevity of wealth across generations.

How Family Office Software Simplifies Wealth Management

In the intricate world of wealth management, high-net-worth families often find themselves juggling a myriad of financial responsibilities. This is where family office software steps in, acting as a game-changer by streamlining processes and enhancing decision-making. By centralizing financial information, this software enables families to gain a clearer viewpoint on their assets, investments, and overall financial health.

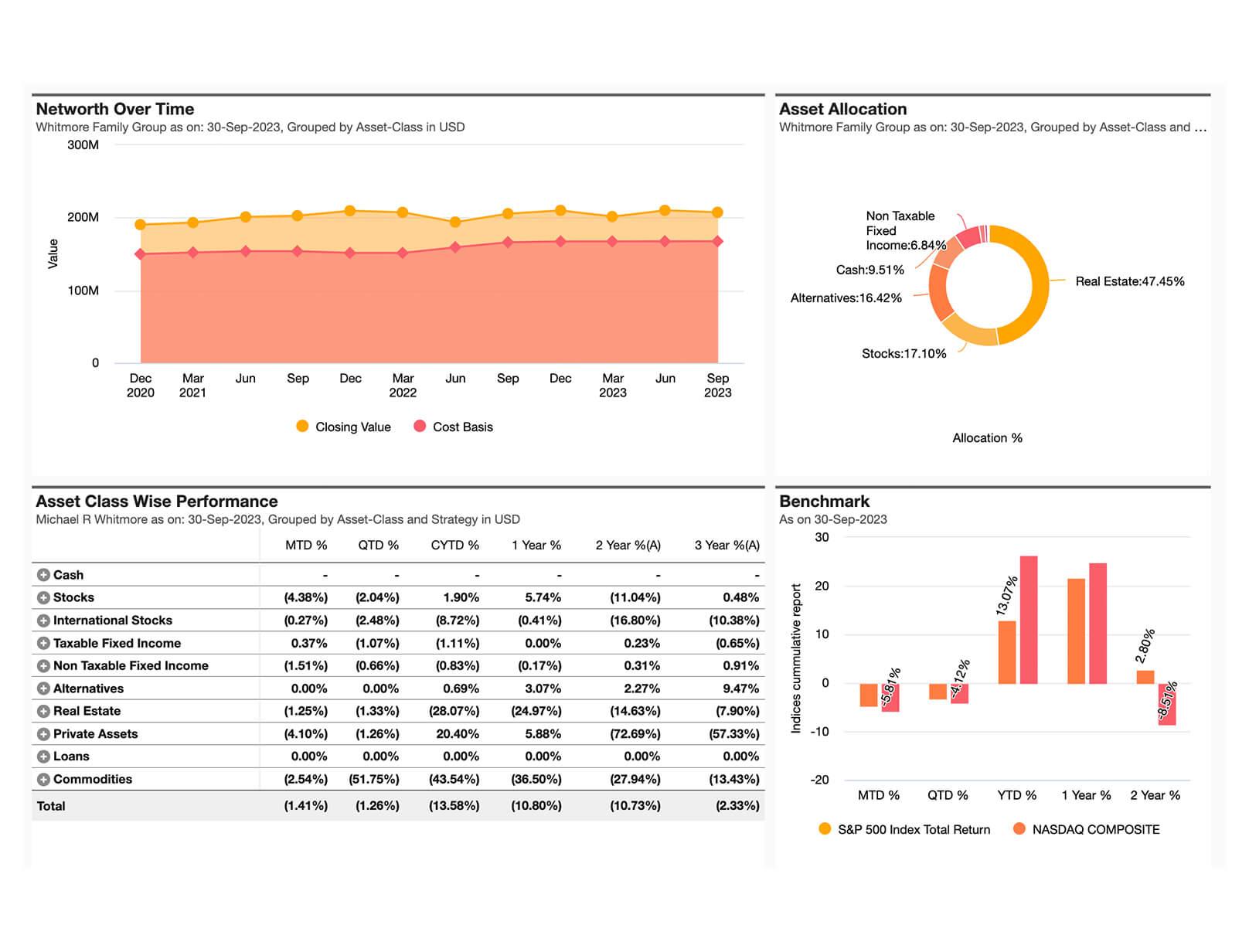

One of the standout features of family office software is its ability to consolidate data from multiple sources. Rather of sifting through countless spreadsheets and documents,families can access real-time insights within a single platform. This not only saves time but also reduces the risk of errors that can arise from manual data entry. With just a few clicks, families can pull comprehensive reports that illustrate their financial standing, allowing for informed decision-making and strategic planning.

Moreover, the software substantially enhances communication and collaboration among family members and advisors. Many platforms come equipped with secure messaging systems and document-sharing capabilities, fostering a transparent dialog about financial matters. This is crucial for families that may have members living in different locations or those who prefer to be more involved in their financial planning. With all stakeholders on the same page, families can work collectively towards common financial goals.

Another compelling advantage is the built-in risk management tools that many family office software solutions offer. These tools help families identify potential risks and assess the impact on their wealth in real-time.By analyzing various scenarios, families can strategize better and safeguard their assets against market fluctuations or unforeseen events.With a proactive approach to risk management, families can not only protect their wealth but also position themselves for growth.

Here’s a quick overview of how family office software can enhance wealth management:

| Feature | Benefit |

|---|---|

| Data Consolidation | Access to a unified financial overview |

| Real-Time Reporting | Informed decision-making at your fingertips |

| Secure Communication | Improved collaboration among family members |

| Risk Management Tools | Proactive strategies for asset protection |

family office software is not just a luxury for wealthy families; it is indeed an essential tool that revolutionizes how they manage and grow their wealth.By embracing these innovative solutions, families can enhance their financial literacy, streamline operations, and ultimately, secure a prosperous legacy for future generations.

Key Features to Look for in Family Office Software

When selecting family office software, it’s essential to prioritize features that cater to the unique needs of high-net-worth families. The right software can streamline processes, enhance decision-making, and ultimately safeguard your family’s wealth. Here are some key features to consider:

- Comprehensive Financial Reporting: Look for software that offers customizable financial reports. This feature allows you to easily track investments, cash flow, and overall portfolio performance, giving you a holistic view of your family’s financial health.

- Tax Management Tools: effective tax management is crucial for preserving wealth. Choose software that includes tools for tax calculations, planning, and compliance, ensuring you can optimize your tax strategy year-round.

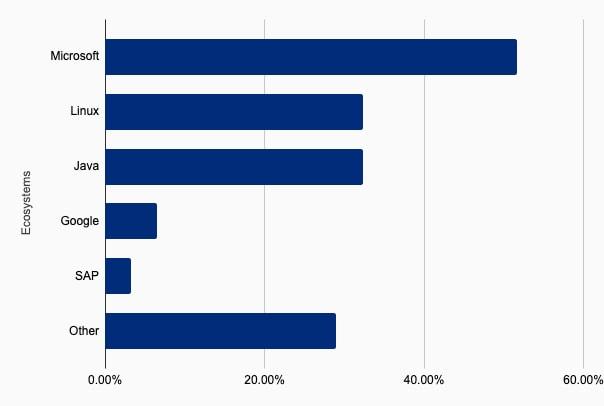

- Investment Tracking: A robust investment tracking feature will enable you to monitor various assets and evaluate performance against benchmarks. This insight is crucial for making informed decisions about future investments.

- Compliance and Regulatory Support: With the ever-evolving landscape of financial regulations,software that helps manage compliance is invaluable. Look for features that offer automated alerts and documentation support to keep your family office in line with legal requirements.

- Collaboration tools: Family offices often involve several stakeholders. Software that facilitates collaboration through secure document sharing,messaging,and task management can enhance communication and streamline decision-making processes.

Additionally, consider the following aspects:

| Feature | benefits |

|---|---|

| User-Friendly interface | Promotes ease of use and minimizes the learning curve for family members and staff. |

| Mobile Access | Enables on-the-go management and oversight of assets and investments. |

| Data Security | Protects sensitive financial information with advanced encryption and access controls. |

it’s wise to consider integrations with other financial tools and platforms. Seamless integration can provide a more comprehensive view of your family’s finances by consolidating data from various sources, enhancing the effectiveness of your wealth management strategy.

Streamlining Investment Tracking for Greater Transparency

Investing can frequently enough feel like navigating a labyrinth, especially for high-net-worth families with diverse portfolios. The complexity of managing various assets—from real estate to stocks and private equity—can be daunting. However, with the right family office software, investment tracking becomes not only simpler but also more transparent.

Imagine having all your investment data at your fingertips, updated in real time. This level of accessibility is crucial for making informed decisions. Family office software allows for:

- Centralized Data Management: All investment information is stored in one secure location, reducing the risk of information silos.

- Enhanced Reporting: Generate tailored reports to analyze performance across different asset classes effortlessly.

- Data Visualization: Utilize intuitive dashboards to get an instant overview of your portfolio’s health and performance.

Transparency is key to understanding where your wealth is allocated and how it is indeed performing. With advanced analytics tools embedded in family office software, families can easily track investment outcomes and assess risk. This not only fosters accountability but also helps in aligning investments with family values and long-term goals.

Moreover, streamlined investment tracking mitigates the complexities frequently enough associated with tax implications and compliance. By keeping meticulous records of gains, losses, and transactions, families can navigate tax obligations with ease. The software helps you maintain organized documentation that can be easily retrieved during audits or reviews.

Consider the following table that outlines the comparative advantages of utilizing family office software:

| Feature | traditional Method | Family Office Software |

|---|---|---|

| Data Accessibility | limited, often requires manual updates | Real-time access, centralized information |

| Reporting Efficiency | Time-consuming, prone to errors | Quick, customizable reports |

| Risk Management | Difficult to quantify | Automated analysis and alerts |

In this fast-paced financial landscape, families need tools that enhance clarity and agility. By implementing advanced family office software, high-net-worth families can not only streamline their investment tracking but also gain greater confidence in their financial decisions.The benefits are clear: enhanced transparency, improved performance monitoring, and peace of mind knowing that your wealth is being managed intelligently and effectively.

Enhancing collaboration Among Family Members with Technology

In today’s fast-paced world, technology plays a pivotal role in bringing families closer, despite geographical distances and busy schedules.Family office software serves as a bridge, enhancing collaboration among family members by streamlining communication and decision-making processes. By providing a centralized hub for managing family assets and communications, these tools ensure everyone stays informed and engaged.

One of the most notable advantages of utilizing family office software is its ability to facilitate real-time collaboration. family members can easily share documents, discuss investment strategies, and track financial performance, all within a secure platform. this fosters a culture of transparency, encouraging open dialogue about the family’s wealth and financial planning.

- Improved Communication: Instant messaging and notification features keep everyone in the loop.

- Document Sharing: Securely upload and access vital documents anytime, anywhere.

- Task Management: Assign responsibilities and deadlines to ensure accountability.

- Investment Tracking: Monitor portfolios collectively, aligning everyone’s interests.

This collaborative approach not only strengthens family bonds but also enhances financial literacy among members. By involving everyone in discussions about wealth management, families can make informed decisions that reflect their collective values and goals. Moreover, younger generations can learn from their elders, gaining valuable insights into investment strategies and wealth preservation techniques.

Furthermore, many family office software solutions come equipped with tools that support educational initiatives.From webinars to resource libraries, families can cultivate a culture of learning that empowers every member to contribute to financial discussions. This knowledge-sharing can be crucial for ensuring the sustainability of family wealth across generations.

| Feature | Benefit |

|---|---|

| Real-Time Updates | Stay informed on family investments and changes. |

| Centralized Information | Access all financial data in one place. |

| Secure Communication | Discuss sensitive matters privately. |

| Custom Reporting | Generate reports tailored to specific needs and interests. |

Ultimately, family office software transforms the way high-net-worth families manage their wealth and collaborate. By leveraging technology, families can nurture lasting relationships, empower each other through education, and ensure that their financial legacy is preserved for future generations. A proactive approach to wealth management through collaborative technology not only makes financial sense but also enriches family dynamics.

The Role of data Security in Family Office Software Solutions

In today’s digital landscape, the importance of safeguarding sensitive information cannot be overstated, especially for family offices managing significant wealth. these entities require robust software solutions to ensure that their financial data is not only organized but also secure from potential breaches. Data security acts as the backbone of these sophisticated systems, providing peace of mind while enabling families to manage their assets effectively.

Family office software solutions are designed with advanced security features to protect against a myriad of threats. here are some critical aspects that highlight the significance of data security:

- Encryption: Data is encrypted both in transit and at rest, making it nearly impossible for unauthorized users to access sensitive information.

- Access Controls: Role-based access ensures that only authorized personnel can view or manipulate specific data, reducing the risk of internal threats.

- Two-Factor Authentication: Adding an extra layer of security, this feature requires users to verify their identity through multiple channels before gaining access.

- Regular Audits: Continuous monitoring and regular audits help identify any vulnerabilities, allowing for swift remediation before breaches occur.

Investing in family office software with a strong emphasis on data security means families can focus on growing their wealth without the constant worry of cyber threats. Moreover, having secure systems can enhance the family’s reputation, fostering trust among partners and stakeholders. When families are confident that their assets are protected, they can make more informed and strategic investment decisions.

The consequences of inadequate data security can be dire. In addition to financial losses, families may experience reputation damage and legal ramifications if sensitive information is compromised. This is why a detailed and strategic approach to data security within family office software is essential. Consider the following table that summarizes potential risks versus the benefits of robust data security:

| Potential Risks | Benefits of Robust Data Security |

|---|---|

| Data Breaches | Enhanced Trust |

| Financial Losses | Informed Decision-Making |

| Legal Issues | Compliance with Regulations |

| Reputation Damage | Stronger Relationships |

Families should prioritize solutions that not only address their wealth management needs but also incorporate strong data security measures. In a world where information is power, ensuring the integrity and confidentiality of that information is paramount. By choosing the right family office software with data security at its core, families can navigate their financial landscape with confidence, knowing they are protected against the evolving threats in today’s digital age.

Integrating Tax Planning and Compliance for Maximum Efficiency

In today’s complex financial landscape, high-net-worth families face the dual challenge of effective tax planning and stringent compliance requirements. Integrating these two crucial aspects using family office software can lead to unparalleled efficiency, allowing families to maintain their wealth while navigating the intricacies of tax obligations.

Streamlined Processes: Family office software serves as a central hub, consolidating financial data and facilitating seamless communication between tax professionals and family members. This integration ensures that all parties have real-time access to relevant information, reducing the risk of errors and enabling proactive decision-making. By automating routine tasks, families can focus on strategic planning rather than administrative burdens.

Holistic Tax Strategies: With a comprehensive view of a family’s financial picture, family office software enables the growth of tailored tax strategies that align with overall wealth management goals. This holistic approach helps identify opportunities for tax efficiency, such as:

- Utilizing tax-advantaged accounts

- Implementing charitable giving strategies

- Maximizing deductions and credits

Compliance Simplified: Compliance can often feel like navigating a labyrinth. Family office software simplifies this by offering built-in compliance tools that keep track of deadlines, regulations, and reporting requirements. Families can avoid costly penalties and ensure they remain in good standing with tax authorities.

Data-Driven Insights: The power of data analytics within family office software allows families to gain insights into their financial health. By analyzing past tax returns, investment performance, and expenditure patterns, families can make informed decisions about future planning. This level of insight drives efficiencies and maximizes tax-saving opportunities.

Collaboration and Transparency: Effective tax planning is a team effort.The collaborative features of family office software foster transparency among family members and advisors. Secure document sharing and communication tools ensure that everyone is on the same page, leading to unified strategies and minimizing misunderstandings.

| Benefit | Description |

|---|---|

| Efficiency | automates tax-related tasks reducing time and effort. |

| Accuracy | Minimizes errors through real-time data updates. |

| Strategic Planning | Facilitates long-term wealth preservation strategies. |

By embracing the integration of tax planning and compliance through specialized family office software, high-net-worth families can achieve a level of efficiency that not only safeguards their wealth but also empowers them to thrive in a dynamic financial habitat. This revolutionary approach transforms traditional wealth management into a streamlined, proactive process that addresses the unique needs of affluent families.

Unlocking the Benefits of Customization in Wealth Management tools

The landscape of wealth management is evolving rapidly, and customization is at the forefront of this transformation. High-net-worth families are no longer satisfied with one-size-fits-all solutions. they demand tailored approaches that reflect their unique financial goals,values,and preferences. This need for personalization is where family office software steps in, offering a suite of tools designed to meet the specific demands of affluent families.

One of the primary advantages of customization in wealth management tools is the ability to create a comprehensive financial strategy that aligns with an individual’s or family’s vision. Rather than adhering to generic investment portfolios,family office software enables families to:

- Integrate Multiple Asset Classes: Seamlessly manage diverse investments,from real estate and private equity to traditional stocks and bonds.

- Personalize reporting: Generate reports that highlight metrics critically important to the family, such as social impact, legacy planning, or wealth preservation.

- Set Specific goals: Define and track financial objectives, be it funding a family foundation, planning for future generations, or philanthropic endeavors.

Moreover, customization enhances client engagement and satisfaction. By providing tailored insights and solutions,family office software fosters a deeper connection between wealth managers and their clients. This relationship is essential for understanding the nuanced financial needs and aspirations of families. For example, being able to analyze a family’s values can lead to more informed decisions regarding sustainable investments or social impact initiatives.

Additionally, customization aids in risk management. Wealth management tools that adapt to individual risk appetites allow families to stay ahead of market fluctuations. Through advanced analytics and predictive modeling, families can identify potential risks and adjust their strategies accordingly. This proactive approach not only protects wealth but also optimizes growth opportunities.

To illustrate the importance of customization, consider the following table which highlights different customization features and their benefits:

| Customization Feature | Benefit |

|---|---|

| Dynamic Reporting | Real-time updates on financial performance. |

| Goal Tracking | Monitor progress towards personal and family objectives. |

| Investment Strategy Customization | Align investments with personal values and risk tolerance. |

| Estate Planning Tools | Facilitate seamless wealth transfer across generations. |

Ultimately, the power of customization in family office software lies in its ability to empower high-net-worth families. By providing tailored wealth management solutions,families can navigate complexities,sieze opportunities,and ensure their financial legacy for generations to come. The time has come for affluent families to embrace these innovative tools and experience the transformational benefits of a personalized wealth management strategy.

Real-Time Reporting: Keeping Families Informed and Engaged

In today’s fast-paced world, keeping families informed and engaged about their wealth management is more crucial than ever. Real-time reporting features of family office software serve as a game-changer for high-net-worth families, allowing them to have immediate access to their financial data. This accessibility fosters transparency and builds trust among family members who may have varying levels of involvement in financial decision-making.

Imagine being able to view your investment portfolio’s performance, cash flow status, and tax obligations at the touch of a button. with real-time reporting, family members can:

- Stay Updated: Receive instantaneous updates on market changes and investment performance.

- Make Informed Decisions: Access current financial data to guide strategic planning and investment choices.

- Enhance Communication: Facilitate discussions among family members based on shared data, minimizing misunderstandings.

Moreover, real-time reporting can be customized to meet the unique needs of each family member. Whether it’s a detailed breakdown of expenses for a younger generation or a comprehensive overview for the family’s matriarch, tailored reports ensure everyone is on the same page.This level of personalization encourages participation from all family members,making wealth management a collaborative effort rather than a solitary pursuit.

One standout aspect of real-time reporting is its ability to break down complex financial data into understandable visuals. Families can benefit from:

- Interactive Dashboards: Visual representations of financial health that make it easy to grasp essential information at a glance.

- Alerts and Notifications: Customizable alerts that inform family members of important changes or milestones in real time.

- performance Benchmarks: Comparisons of investment performance against key market indices, helping families assess their strategies effectively.

| Feature | Benefit |

|---|---|

| Real-Time Data Access | Instant insight into financial performance |

| Customizable Reports | Tailored information for different family members |

| Visual dashboards | Clear understanding of wealth management |

Ultimately, the integration of real-time reporting within family office software not only enhances transparency but also empowers families to take control of their financial destinies. By fostering a culture of informed engagement, these tools help to create a legacy of wealth management that is both collaborative and resilient.

choosing the Right Software: A Guide for High-Net-Worth Families

When it comes to managing wealth, high-net-worth families have unique needs that require specialized tools. Choosing the right software can become a game-changer in the realm of family office management.With a plethora of options available, it’s essential to focus on features that align with your family’s specific requirements.

Customization is key. Look for software that allows you to tailor dashboards and reports to reflect the unique aspects of your family’s wealth portfolio. You want a system that can evolve alongside your family’s needs, offering flexibility in asset management, investment tracking, and financial reporting.

Consider the user experience. A user-friendly interface can make a significant difference in how effectively your family members engage with the software. Intuitive design minimizes the learning curve, ensuring everyone—from seasoned investors to younger generations—can navigate with ease.

Another critical factor is security.The protection of sensitive financial information is paramount. Look for software that offers advanced encryption, secure access controls, and regular updates. It’s vital to ensure that your family’s data remains confidential and protected from potential cyber threats.

Don’t overlook the importance of integrations. The right software should seamlessly integrate with other tools and platforms your family already uses. Whether it’s accounting software, investment platforms, or communication tools, smooth integration can streamline operations and enhance overall efficiency.

| Feature | Importance |

|---|---|

| Customization | Tailors to unique family needs |

| User Experience | Encourages engagement from all members |

| Security | Protects sensitive financial data |

| Integrations | Streamlines operations with existing tools |

Lastly, consider the support offered by the software provider. Having access to reliable customer service can make all the difference,especially when you encounter issues or need assistance with implementation. Look for platforms that provide comprehensive resources, including tutorials, live support, and community forums.

The Future of Family offices: Embracing Innovation and Technology

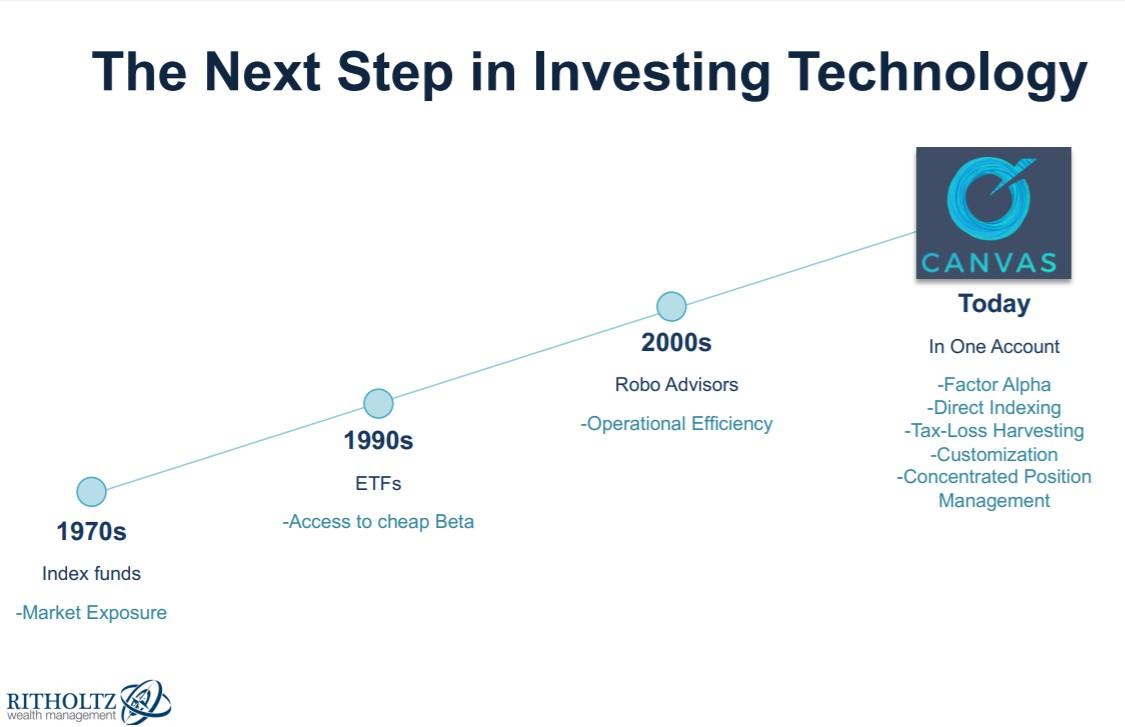

as the landscape of wealth management evolves, family offices are discovering the transformative potential of technology. The integration of family office software is not merely a trend; it’s a necessary evolution in how high-net-worth families manage their wealth, investments, and legacies. By embracing these innovative tools, family offices can enhance efficiency, improve decision-making, and ensure that their wealth is managed with precision.

One of the most significant advantages of adopting specialized software is the ability to centralize data. Family offices often juggle multiple assets, investments, and accounts across various financial institutions. With advanced software solutions, families can:

- Consolidate Financial Information: Keep all financial data in one place, making it easier to track performance and make informed decisions.

- Enhance Reporting: Generate real-time reports and analytics to assess the health of investments at a glance.

- Improve Communication: Facilitate better communication among family members and advisors, ensuring everyone is on the same page.

Moreover, the use of technology fosters a more proactive approach to investment management. Predictive analytics and AI-driven insights can help family offices identify emerging market trends and opportunities, allowing them to act swiftly and strategically. As a notable example, by leveraging data analysis tools, families can:

- Identify Investment Opportunities: Pinpoint undervalued assets or sectors poised for growth.

- Mitigate Risks: Analyze potential risks associated with various investments and adjust portfolios accordingly.

security is another area where technology excels. High-net-worth families often face unique challenges concerning data protection and confidentiality. Advanced software solutions come equipped with state-of-the-art security features, including:

- Multi-Factor Authentication: Ensure that only authorized individuals can access sensitive information.

- encryption: Safeguard data during transmission and storage to prevent unauthorized access.

To illustrate the impact of technology on family offices, consider the following table that outlines traditional methods versus software-enabled management:

| Traditional Methods | Software-Enabled Management |

|---|---|

| Manual data entry and tracking | Automated data consolidation |

| Infrequent reporting | Real-time analytics and reporting |

| Limited communication tools | Integrated communication platforms |

as family offices look toward the future, the necessity of innovation becomes increasingly evident. By harnessing the power of family office software,these institutions not only enhance their operational efficiency but also position themselves to navigate the complexities of modern wealth management. The question is no longer whether to adopt these technologies, but rather how quickly families can adapt to stay ahead in a rapidly changing financial landscape.

Success Stories: How Family Office Software Transformed Wealth Management

Frequently Asked Questions (FAQ)

Q&A: family office Software – Revolutionizing Wealth Management for High-Net-Worth Families

Q: What exactly is family office software?

A: Great question! Family office software is a specialized platform designed to help high-net-worth families manage their wealth more effectively. It integrates various financial activities such as investment tracking, financial reporting, tax planning, and even estate management, all in one user-friendly interface. Think of it as a digital command center for your family’s financial life!

Q: Why should high-net-worth families consider using this software?

A: If you’re a high-net-worth family, managing your wealth can become quite complex.Family office software streamlines all those moving parts, offering you a comprehensive view of your assets and investments. It saves time, reduces errors, and provides valuable insights, allowing families to make informed decisions faster. In short, it takes the stress out of wealth management!

Q: I’ve heard that some families still prefer traditional methods.What are the benefits of switching to software?

A: While traditional methods may work for some, they frequently enough lack the efficiency and real-time data that software provides. Family office software can automate routine tasks, offer advanced analytics, and ensure that everyone involved is on the same page. plus, with robust security features, you can rest assured that your sensitive information is well-protected. Transitioning to software means embracing innovation while enhancing your ability to manage and grow your wealth effectively.

Q: How does family office software ensure data security?

A: Security is a top priority for any reputable family office software provider. Many use advanced encryption, multi-factor authentication, and regular security audits to safeguard your data. Additionally,cloud-based solutions frequently enough offer automatic updates and backups,which further protect your information from breaches and loss. Your family’s financial privacy is paramount, and the right software gives you peace of mind.

Q: Can family office software help with investment management?

A: Absolutely! One of the standout features of family office software is its investment management capabilities. you can track portfolio performance, analyze asset allocation, and even simulate various financial scenarios. The software provides insights that can help you make better investment decisions, optimize your portfolio, and adjust your strategies as market conditions change. It’s like having a personal financial advisor at your fingertips!

Q: What about tax planning? Is that somthing this software can assist with?

A: Yes, indeed! Family office software frequently enough includes tools for tax planning and compliance. You can keep track of tax liabilities, deadlines, and deductions all in one place.Some platforms even offer projections based on your financial activities,helping you strategize for tax efficiency. This means you can maximize your wealth while minimizing your tax burdens—who wouldn’t want that?

Q: Is family office software user-friendly for all family members?

A: Definitely! The best family office software is designed with user experience in mind. Most platforms feature intuitive interfaces and easy navigation, making it accessible for family members of all ages and tech-savviness. Plus, many providers offer training and support to help you get the most out of the software. It’s about empowering your entire family to be informed and involved in wealth management.

Q: how do I choose the right family office software for my family?

A: Choosing the right software depends on your specific needs and goals. Start by assessing what features are most important to you—whether it’s investment tracking, tax planning, or estate management. Look for platforms that offer customization options and good customer support. Don’t hesitate to take advantage of free trials or demos to see what feels right for your family. Ultimately, the best software will align with your family’s unique financial landscape and aspirations.

Q: Any final thoughts on family office software?

A: Investing in family office software is an investment in your family’s future. It not only simplifies wealth management but also fosters greater financial literacy and involvement among family members. In an ever-evolving financial landscape, having the right tools can make all the difference.So why not take the leap toward a more organized,secure,and empowered approach to your family’s wealth? Your future self will thank you!

in Retrospect

As we wrap up our exploration of family office software,it’s clear that this innovative technology is more than just a tool—it’s a game changer for high-net-worth families navigating the complexities of wealth management. By streamlining processes,enhancing transparency,and providing comprehensive insights,family office software empowers families to take control of their financial legacies.

Imagine a future where managing your family’s wealth is not just easier, but also more strategic and informed. With the right software in place, you can focus on what truly matters: preserving your family’s values, nurturing your philanthropic passions, and passing down a legacy of financial wisdom to future generations.

so, if you haven’t already, it might be time to consider how these solutions can transform your approach to wealth management. After all, in a world where financial landscapes are constantly shifting, having the right tools and insights can make all the difference. Embrace the revolution in wealth management—your family’s future could very well depend on it!