Unlocking the Secrets of Financially Prosperous Small Business Owners

Have you ever wondered what sets financially successful small business owners apart from the rest? Is it their knack for networking, a secret formula for pricing, or perhaps a sprinkle of luck? while these factors certainly play a role, there’s much more beneath the surface.In the bustling world of small business, where every decision can lead to either triumph or tribulation, understanding the key strategies that pave the way to financial success is crucial.

In this article, we’ll pull back the curtain on the habits and practices that distinguish thriving entrepreneurs from those who struggle to keep their heads above water.Whether you’re an aspiring entrepreneur eager to make your mark or a seasoned business owner looking to boost your bottom line, you’ll discover actionable insights and proven tactics that can transform your financial landscape. So grab a cup of coffee, settle in, and let’s dive into the secrets that could redefine your business journey!

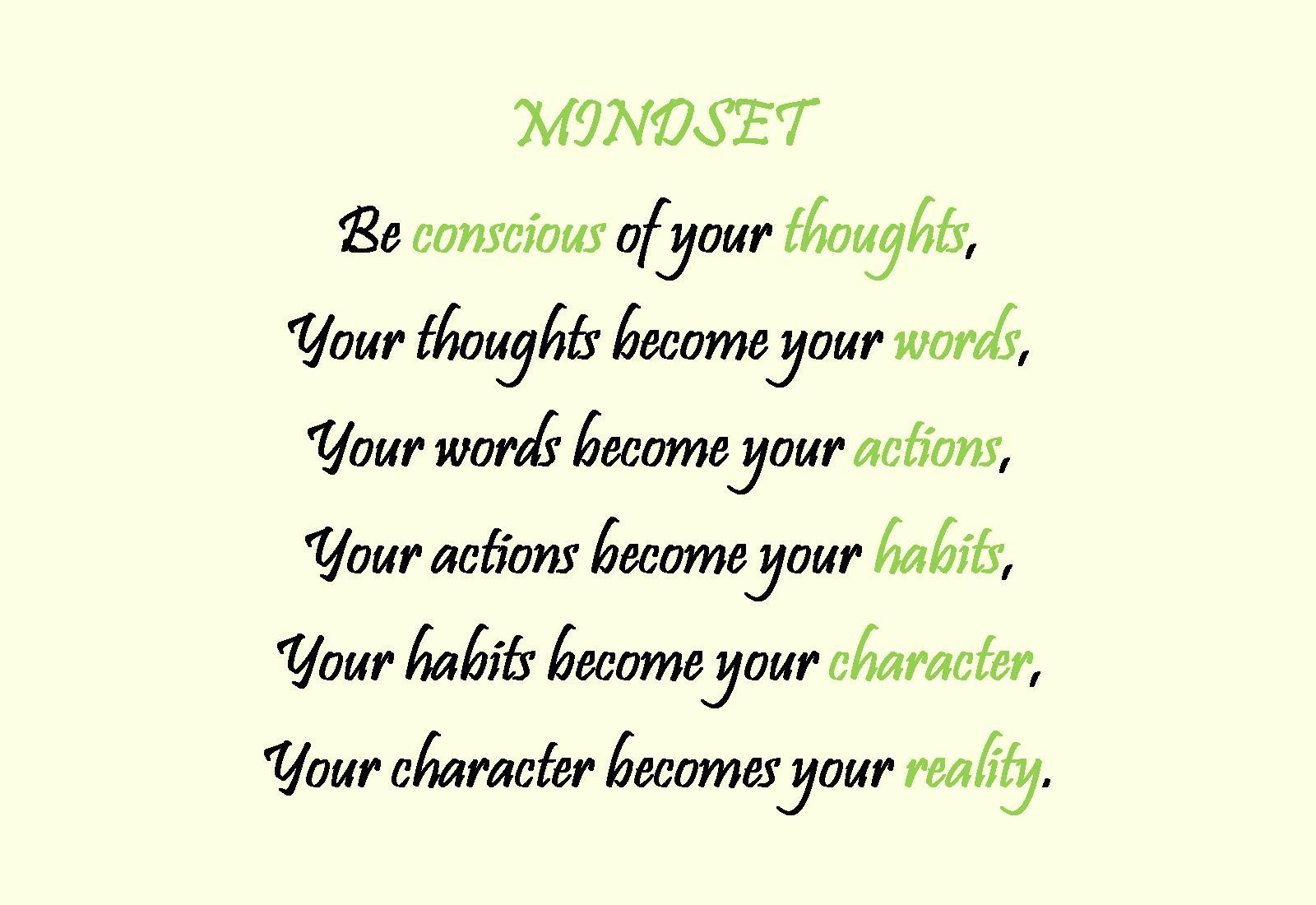

The Mindset That Sets Successful Business Owners Apart

The journey of a successful small business owner is rarely a straight line. It’s a winding path filled with challenges, opportunities, and the occasional detour. Yet, what truly sets apart those who thrive from those who merely survive is often a specific mindset. This mindset is not about having a flawless plan or unlimited resources; rather, it’s about how one approaches obstacles and opportunities along the way.

One key element of this mindset is resilience. Successful entrepreneurs understand that setbacks are part of the game.Instead of viewing failure as a dead end, they see it as a stepping stone. This resilience fosters a culture of learning within their organizations, encouraging teams to experiment and innovate. They ask themselves:

- What can I learn from this experience?

- How can I pivot my strategy to improve?

This focus on growth helps maintain momentum, even when the going gets tough. It’s about turning adversity into possibility and refusing to be discouraged by temporary setbacks.

Another crucial aspect is vision. Successful business owners have a clear picture of what they want to achieve and why it matters. This vision serves as a guiding star for their decisions and actions. They communicate this vision passionately, aligning their teams and inspiring them to contribute towards common goals. The importance of a strong vision includes:

- Creating a cohesive company culture

- Motivating employees to perform at their best

- attracting customers who resonate with their mission

In addition, adaptability is paramount. The business landscape is ever-changing,and those who cling too tightly to outdated methods can quickly find themselves left behind. Successful entrepreneurs embrace change and are open to adjusting their strategies. They actively seek feedback and stay informed about industry trends, asking questions like:

- What new opportunities can I explore?

- How can I better serve my customers’ evolving needs?

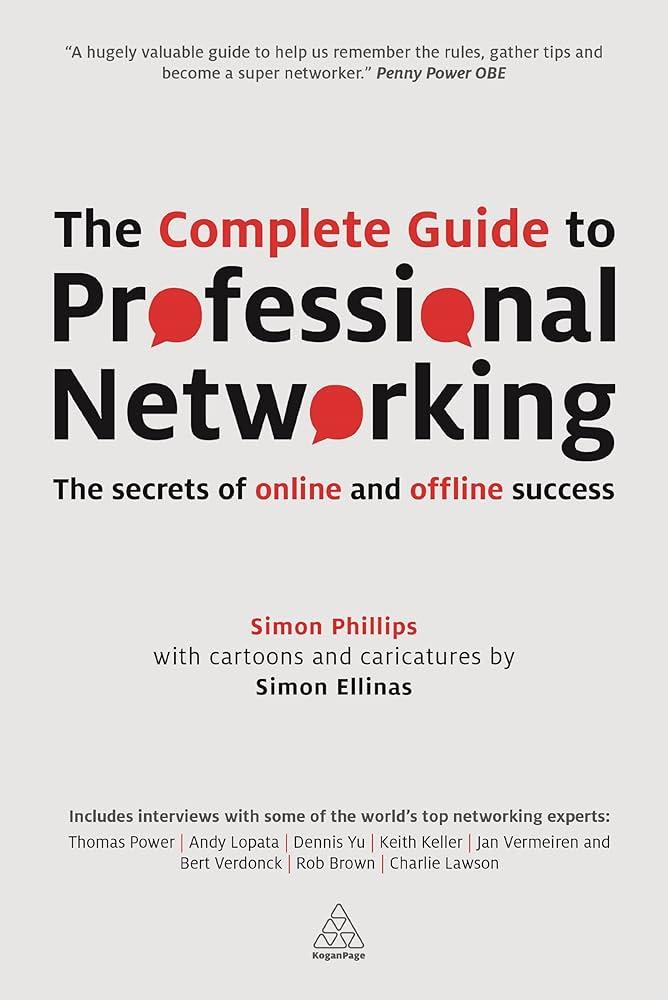

Moreover, the ability to network effectively cannot be overstated. Building relationships with other business owners, mentors, and industry leaders opens doors to resources, partnerships, and guidance that can propel a business forward. Engaging with a supportive community can provide invaluable insights and fresh perspectives,making all the difference in a competitive market.

Lastly, successful owners maintain a balance between work and life.They understand the importance of self-care, knowing that burnout can stifle creativity and productivity. by prioritizing their well-being, they ensure they remain energized and engaged, capable of steering their businesses toward success.

Mastering Cash Flow: The Lifeblood of Your Business

Understanding the dynamics of cash flow is essential for any small business owner aiming for long-term success. Cash flow is not just about the money coming in and going out; it’s about managing the timing and amount of these transactions effectively. A solid grasp of cash flow can mean the difference between thriving and merely surviving.Here are some strategies to help you gain that mastery:

- Track everything: Maintain meticulous records of all income and expenses. Utilize accounting software that fits your business size and type, making it easier to keep tabs on your cash flow.

- Forecast Cash Flow: Create a monthly cash flow forecast. this should include expected income and planned expenses, giving you a roadmap for managing your funds.

- Optimize Accounts Receivable: Implement efficient invoicing processes. Send invoices promptly and follow up on overdue payments to ensure money flows in as was to be expected.

- Negotiate Payment Terms: Establish favorable terms with suppliers and customers. Extending your own payment terms while shortening those of your clients can provide critically important breathing room.

Another critical element in managing cash flow is understanding the seasonal fluctuations that may affect your business.Many industries experience peaks and troughs in sales, so it’s wise to prepare for those lean times:

- Build a Cash Reserve: Aim to set aside a portion of your profits during peak times. This reserve can act as a buffer during slower periods.

- Diversify Revenue streams: Explore additional services or products that can generate income year-round, helping to smooth out the cash flow cycle.

embracing technology can greatly enhance your cash flow management. Consider integrating tools that automate invoicing and payments, which can save time and reduce errors. Implementing a reliable financial dashboard will give you a clear view of your cash position at any moment, enabling timely decisions.

| Key Strategy | Benefits |

|---|---|

| Regular Cash Flow Analysis | Identifies trends and potential problems early. |

| Client Payment Incentives | Encourages quicker payments and improves cash flow. |

| Expense Reduction Review | Highlights areas to cut costs without sacrificing quality. |

By mastering these aspects of cash flow management, you position your business not just to survive but to thrive in an ever-changing marketplace. Remember, cash flow is the lifeblood of your enterprise; treat it with the care it deserves, and watch your business flourish.

Building a Strong Financial Foundation: Key Strategies

Establishing a solid financial groundwork is crucial for any small business aiming for long-term success. By implementing effective strategies, you can not only safeguard your assets but also position your business for growth.Here are some key strategies to consider:

- Create a Detailed Budget: A meticulously crafted budget serves as the backbone of your financial planning. Make sure to account for all income streams and expenses, including operational costs, payroll, and marketing.Regularly review and adjust your budget to reflect changing circumstances.

- Build an Emergency Fund: Just like personal finances,having an emergency fund for your business can be a lifesaver. Aim to save at least three to six months’ worth of operating expenses. This cushion allows you to navigate unexpected downturns without jeopardizing your operations.

- Track Your Cash Flow: Understanding your cash flow is essential. Use tools and software to monitor your income and expenses. This visibility will help you identify potential shortfalls before they become problematic, allowing you to adjust your strategy accordingly.

- Invest in financial Education: Knowledge is power, especially in finance. Attend workshops, read books, or even hire a financial coach to enhance your understanding of financial management. The more informed you are, the better decisions you can make.

Additionally, setting clear financial goals can guide your decision-making process. Consider the following framework:

| Goal Type | Example |

|---|---|

| Short-term | Increase monthly sales by 15% within the next quarter |

| Medium-term | Launch a new product line within the next year |

| Long-term | Achieve $1 million in revenue within the next five years |

Lastly, don’t underestimate the power of networking. Surrounding yourself with other successful business owners can provide valuable insights and potential partnerships. attend local business events,join online forums,and engage with like-minded individuals to broaden your understanding and gather fresh ideas.

Harnessing the power of Budgeting for Growth

Budgeting might sound like a tedious chore, but it’s actually a powerful tool that can pave the way for your small business’s growth. By effectively managing your finances,you can make informed decisions that will help you reach your goals. Here are some ways to leverage budgeting for maximum impact:

- Setting Clear Goals: A well-structured budget allows you to set realistic financial goals. Whether it’s increasing sales, expanding your product line, or enhancing your marketing efforts, having a budget helps prioritize these objectives.

- Identifying Trends: Regularly reviewing your budget can reveal trends in your spending and revenue. This insight can inform your strategy,enabling you to capitalize on opportunities or cut back in areas that aren’t performing.

- Managing Cash Flow: One of the biggest challenges for small businesses is maintaining healthy cash flow. A detailed budget helps you anticipate cash flow needs, ensuring you have enough funds to manage day-to-day operations while planning for future expenses.

- Allocating Resources Wisely: With a clear financial picture, you can allocate your resources more efficiently. Whether you need to hire new staff, invest in technology, or launch a marketing campaign, a solid budget helps you decide where to best focus your efforts.

| Budgeting Benefits | impact on Growth |

|---|---|

| Informed Decision-Making | Better strategic initiatives |

| Focus on Goals | More targeted efforts |

| Resource Optimization | Reduced waste and increased efficiency |

| Improved Cash Management | stability and growth potential |

Moreover, creating a budget isn’t just about tracking expenses; it’s about creating a roadmap for success. When you establish a budget, you’re not only keeping your business on track but also setting the stage for future growth. You’ll be able to seize opportunities as they arise rather than scrambling to find the funds at the last minute.

Remember, flexibility is key. Your budget should be a living document that adapts to changes in your business habitat. Regularly revisiting and adjusting your budget allows you to respond proactively to challenges and opportunities, keeping your business agile and ready for whatever comes next.

Investing in Technology: Tools to Propel Your Success

In today’s fast-paced business environment, leveraging technology is no longer just an option; it’s a necessity for small business owners who want to stay competitive. By investing in the right tools, you can streamline operations, enhance customer engagement, and ultimately drive growth. Here are some essential tools that can transform your business landscape:

- Cloud Computing Solutions: Services like Google drive and Dropbox help you store and share files securely, making collaboration seamless for remote teams.

- project Management Software: Tools such as Trello or Asana can help you organize tasks, set deadlines, and track progress, ensuring that your team stays on the same page.

- Customer Relationship Management (CRM) Systems: Platforms like HubSpot or Salesforce allow you to manage customer interactions efficiently, helping you nurture leads and maintain relationships.

- Accounting Software: QuickBooks and FreshBooks simplify financial management, enabling you to track expenses, generate invoices, and analyse cash flow with ease.

Integrating these technologies into your operations not only boosts your efficiency but also provides valuable insights into your business performance. As an example, CRM systems can reveal patterns in customer behavior, helping you tailor your marketing strategies to meet their needs more effectively.

Moreover, investing in digital marketing tools, such as social media management platforms and email marketing software, can enhance your outreach efforts. You can automate campaigns, schedule posts, and analyze engagement metrics, allowing you to refine your marketing approach continually.

Here’s a quick comparison of popular tools that can elevate your business operations:

| Tool | Purpose | Key Feature |

|---|---|---|

| Asana | Project Management | task Assignments & deadlines |

| HubSpot | CRM | Lead Tracking & Email Automation |

| QuickBooks | Accounting | Expense Tracking & Reporting |

| Hootsuite | Social Media Management | Post Scheduling & Analytics |

Ultimately,the right technology can act as a catalyst for your business growth. By embracing digital tools and platforms, you position yourself to not just survive but thrive in an increasingly competitive market. Remember, investing in the right technology is an investment in your future success.

Networking Secrets: Building Relationships that Pay Off

Networking isn’t just about exchanging business cards or connecting on social media; it’s about forging genuine relationships that can lead to fruitful opportunities. Here are a few secrets to help you build connections that will pay off in the long run:

- Be Authentic: Peopel are drawn to those who are real. Share your story, your challenges, and your successes. Authenticity fosters trust and encourages others to engage with you.

- Listen Actively: Networking is a two-way street. Show genuine interest in what others have to say. Ask questions and listen carefully—this will not only make others feel valued but also help you understand their needs better.

- Follow Up: After meeting someone, send a quick follow-up email or message. Mention somthing specific from your conversation. This simple gesture reinforces your connection and keeps the dialog open.

- Offer Help: One of the best ways to cement a relationship is by providing value first. Whether it’s sharing information, connecting them with someone in your network, or offering your expertise, be the person who gives without expecting anything in return.

To further illustrate the importance of strategic networking, consider the following table that compares customary networking with relationship-driven networking:

| Traditional Networking | Relationship-Driven Networking |

|---|---|

| Focuses on quantity over quality | Focuses on building deep, meaningful connections |

| Short-lived interactions | Long-term relationships that evolve |

| Often transactional | Collaborative and supportive |

| Limited follow-up | Consistent dialogue and engagement |

Remember, the goal of networking is not just to advance your own interests but to create a community of mutual support. Attend industry events, join local business groups, and be active in online forums. The more you engage, the more relationships you’ll cultivate.

Lastly, embrace technology to enhance your networking efforts. Utilize social media platforms tailored for professionals, such as LinkedIn, to connect with peers and potential mentors. Share valuable content that resonates with your audience,and don’t hesitate to participate in discussions.Your online presence can significantly expand your reach and open doors to new opportunities.

Smart Marketing on a Shoestring Budget

For small business owners operating on a tight budget, effective marketing can seem like a daunting challenge. though, with a sprinkle of creativity and strategic thinking, you can turn limited resources into a powerful marketing tool. Here are some strategies that can help you make the most of every dollar:

- Leverage Social Media: Platforms like Instagram, Facebook, and Twitter offer free accounts that can reach thousands. Create engaging content, share stories, and connect with your audience through polls and live sessions.

- Content is King: Start a blog related to your business niche. Share valuable insights, tips, and stories to establish authority in your field. This not only helps in SEO but also builds trust with your audience.

- Networking: Attend local events, trade shows, or community gatherings. Building relationships can lead to referrals and partnerships that require little to no financial investment.

- Email Marketing: Build a mailing list and send regular newsletters. This keeps your audience informed and engaged, allowing you to promote products or services effectively without breaking the bank.

- Collaborate with Other Small Businesses: Partner with non-competing businesses to cross-promote each other’s products and services. This can expand your reach without additional costs.

To further maximize your marketing efforts, consider the following tips that can make a significant impact:

| Strategy | Benefit |

|---|---|

| Utilize Free Tools | Access to design and analytics tools without cost. |

| Engage with Your Community | Increased local visibility and customer loyalty. |

| Offer Free Workshops/Webinars | Establish authority and attract potential customers. |

| Referral Programs | Encourage existing customers to refer friends and family. |

By adopting these smart marketing strategies, you can create a buzz around your business without emptying your wallet. Remember, creativity frequently enough trumps budget, and with the right approach, even the smallest marketing efforts can yield significant results. Don’t hesitate to experiment and find what resonates with your audience!

Understanding Your Target Market: know Your Customers

To carve a niche in the competitive world of small business, understanding your clientele is crucial. Your customers are the lifeblood of your enterprise, and knowing their preferences, needs, and behaviors can set you apart from the competition. Start by conducting thorough research to build a comprehensive picture of your target market.

Engage with your customers directly through surveys,interviews,or focus groups. This can provide invaluable insights into their buying habits and preferences. Consider asking questions that cover:

- Demographics: Age, gender, income level, and education.

- Psychographics: Interests, values, and lifestyle choices.

- Buying behavior: How frequently enough they shop, where they prefer to shop, and what influences their purchase decisions.

Utilizing analytics tools can also be a game-changer. Platforms like Google Analytics and social media insights can reveal trends and patterns in customer behavior.Look for:

| Data Point | Insights Gained |

|---|---|

| Website traffic Sources | Understand where customers are coming from (social media,referrals,etc.). |

| User Behavior Flow | See how customers navigate your site and identify potential drop-off points. |

| Conversion Rates | Measure how well your website converts visitors into customers. |

Another effective strategy is to segment your audience. By categorizing customers based on various factors like demographics, interests, or purchasing habits, you can tailor your marketing efforts to resonate with each group. This personalized approach frequently enough leads to increased engagement and loyalty.

Don’t forget the power of social media! platforms like Instagram and Facebook allow you to interact directly with your audience and gain real-time feedback. Regularly monitor comments and messages to understand customer sentiments and address any concerns promptly.

always remember that your target market isn’t static; it evolves. Stay proactive by continuously researching and adapting your strategies. This adaptability will not only enhance customer satisfaction but also solidify your position as a trusted provider in your industry.

Leveraging Data for Better Financial Decisions

In the modern landscape of small businesses, the ability to harness data effectively can distinguish a thriving entrepreneur from one who merely survives. By leveraging data, owners can tap into insights that not only enhance operational efficiency but also pave the way for strategic financial decisions.

Consider the following approaches to make data work for you:

- track Key Performance Indicators (KPIs): Identifying and monitoring KPIs specific to your business can reveal patterns and areas for enhancement. metrics like sales growth, customer acquisition costs, and inventory turnover should be at the forefront of your analysis.

- Utilize financial Analytics Tools: There are several robust tools available that can automate the collection and analysis of financial data.These tools can provide real-time insights, helping you make informed decisions without spending hours on manual calculations.

- Conduct Customer Segmentation: Analyzing your customer data can help you segment your audience based on purchasing behavior and preferences. This segmentation allows for targeted marketing strategies that can increase revenue and customer loyalty.

Additionally, creating a culture of data-driven decision-making within your team can further enhance your financial strategies. Encourage your staff to share insights derived from data, and provide training on how to interpret financial reports and analytics.This collective knowledge can lead to innovative ideas and solutions.

To visualize the impact of data on your finances, consider the following table that illustrates the potential benefits:

| Data Utilization | Expected Outcome |

|---|---|

| Sales tracking | Increased revenue through informed inventory decisions |

| Expense analysis | Reduced costs and improved cash flow management |

| Market trend analysis | Enhanced strategic planning and forecasting |

Ultimately, employing data not only equips you with the necessary insights to make better financial decisions but also helps you stay ahead of trends and competitor moves. The more you understand your financial landscape through data, the more empowered you become to navigate challenges and seize opportunities.

The Importance of Continuous Learning and Adaptation

In the fast-paced world of small business,the ability to learn and adapt continuously is not just beneficial; it’s essential for survival. Financially successful small business owners understand that staying relevant means keeping pace with industry trends, customer preferences, and technological advancements. By embracing a mindset of lifelong learning, these entrepreneurs can navigate challenges and seize opportunities that others may overlook.

Consider the following strategies that can help foster a culture of continuous learning:

- Regular Training and Workshops: Investing in training for yourself and your team can yield significant returns. Workshops on new technologies, customer service, or financial management can sharpen skills and inspire innovative thinking.

- Networking Opportunities: Engaging with other business owners and industry experts can provide valuable insights. Attend conferences, join local business groups, and participate in online forums to share experiences and learn from others.

- Feedback Mechanisms: Establishing a system for receiving feedback from customers and employees can highlight areas for improvement. Regular surveys or suggestion boxes can help identify needs and preferences effectively.

moreover, adaptation is vital in responding to market shifts. Small business owners should keep a close eye on competitors and industry trends. this may involve:

| Area | Action |

|---|---|

| market Trends | Research and adjust product offerings based on demand. |

| Technological Advancements | Implement new tools or platforms that enhance efficiency. |

| Customer Feedback | modify services based on customer suggestions and complaints. |

Additionally, fostering a culture of curiosity within your team can lead to greater innovation. Encourage your employees to pursue their interests and share their findings with the group. This collaborative approach not only enhances team morale but also opens avenues for creative problem-solving.

Ultimately, the path to financial success for small business owners lies in a commitment to continuous learning and flexibility. The landscape of business is ever-changing, and those who invest in their own growth and the growth of their team will be best positioned to thrive in any environment. By making learning a priority, you are not just safeguarding your business; you are paving the way for lasting success.

Navigating Taxes Like a Pro: Essential Tips

Managing taxes can seem daunting, especially if you’re navigating the complexities of small business ownership.But with the right strategies, you can turn tax time into an opportunity rather than a headache. Here are some essential tips to help you master your tax obligations and maximize your financial success.

Organize Your Finances year-Round

One of the best ways to prepare for tax season is to keep your financial records organized throughout the year. This means:

- Tracking all income and expenses meticulously.

- Maintaining receipts and invoices in a structured manner.

- Using accounting software to manage your books effectively.

When it comes time to file, this organization will save you countless hours and reduce the stress that often accompanies tax planning.

Know Your Deductions

Understanding which expenses can be deducted is crucial for minimizing your taxable income. Some common deductions include:

- Home office expenses.

- Vehicle costs for business use.

- Business-related travel and meals.

Be sure to consult with a tax professional to ensure you’re taking full advantage of all available deductions. Missing out on a deduction could mean leaving money on the table.

Consider Estimated Taxes

If your small business is profitable, it’s wise to pay estimated taxes quarterly. This helps you avoid a hefty tax bill at year-end and potential penalties for underpayment. Here’s a simple breakdown of estimated tax payments:

| Payment Due Date | Coverage Period |

|---|---|

| April 15 | Jan 1 – Mar 31 |

| June 15 | Apr 1 – May 31 |

| September 15 | Jun 1 – Aug 31 |

| January 15 (next year) | Sep 1 – Dec 31 |

Seek Professional Guidance

Taxes can be intricate, and enlisting the help of a tax professional can be a game changer. They can provide insights specific to your industry and help you strategize on tax planning. Make sure to choose someone who understands small businesses and is proactive about tax-saving strategies.

Stay Informed

Tax laws are constantly evolving, and staying informed is key to navigating them successfully. Subscribe to newsletters,follow relevant blogs,and participate in industry forums to keep up with changes that may impact your business taxes.

By incorporating these tips into your financial routine, you’ll be well on your way to navigating taxes like a pro. Embrace the process, and turn tax time into a strategic advantage for your small business.

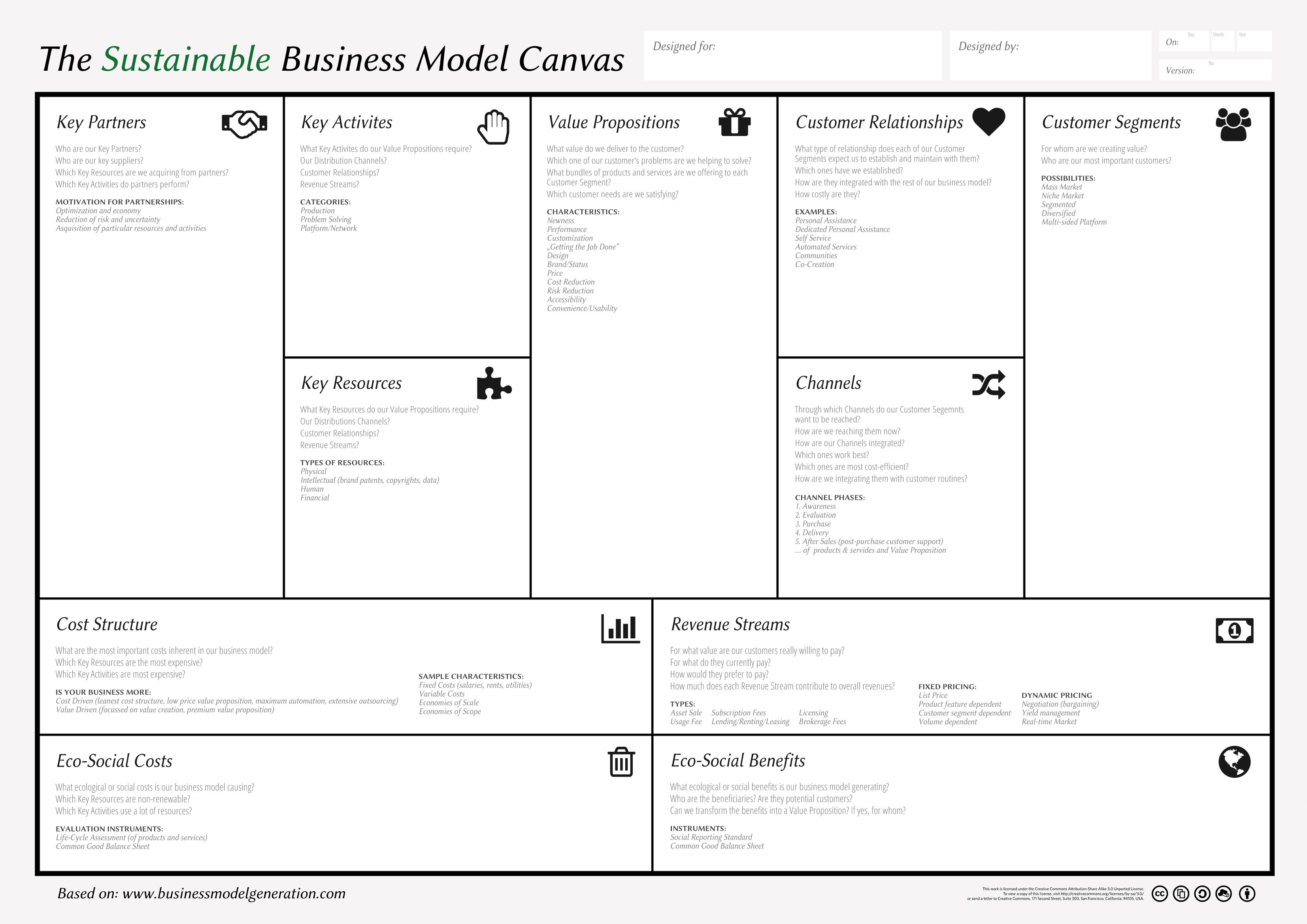

Creating a Sustainable Business Model for Long-Term Success

To thrive in today’s competitive landscape, small business owners must adopt a business model that prioritizes sustainability. This approach not only meets the needs of the present but also ensures that future generations can continue to rely on the resources and opportunities your business offers. Here are some strategies to build a sustainable business:

- Understand your Market: Conduct thorough market research to identify trends and consumer preferences. This knowledge helps you adapt your offerings and stay relevant.

- Embrace Innovation: Continuously seek ways to improve your products or services. Innovating can involve using eco-friendly materials or leveraging technology to enhance customer experiences.

- Build Strong Relationships: Cultivate partnerships with suppliers and customers. Establishing a loyal customer base can provide stability and drive repeat business.

Additionally, consider implementing sustainable practices that resonate with your values and the values of your customers:

- reduce Waste: Implement recycling programs and encourage digital transactions to minimize paper usage.

- Source Responsibly: Choose suppliers committed to sustainable practices, which can enhance your brand’s reputation and attract conscientious consumers.

- Engage in Community Initiatives: Support local events or charities, showcasing your commitment to the community and fostering goodwill.

Furthermore, adopting a sustainable business model can lead to significant financial benefits. Here’s how:

| Benefit | Description |

|---|---|

| Cost Savings | Reducing waste and energy consumption can lower operational costs. |

| Attracting Investors | More investors are looking to fund businesses that demonstrate sustainability. |

| Enhanced Brand Loyalty | Consumers are increasingly loyal to brands that prioritize sustainability. |

Ultimately, a sustainable business model is not just a trend; it’s a long-term strategy that fosters resilience. By integrating these practices into your business framework,you position yourself for lasting success while making a positive impact on the environment and your community.

Frequently Asked Questions (FAQ)

Q&A: Secrets of Financially successful Small Business Owners

Q: What’s the first secret to being a financially successful small business owner?

A: The first secret is understanding your numbers.Successful business owners know their financial statements inside and out. This means regularly reviewing your income statement, balance sheet, and cash flow statement. It’s not just about looking at the bottom line but diving into the details to see where your money is coming from and where it’s going.

Q: That sounds intricate! How can I get started with understanding my financials?

A: It can seem daunting at first, but start small.Set aside a regular time each week to review your financials. Look for trends in sales and expenses. There are many user-friendly accounting software options that can simplify this process. once you start to get a grip on the numbers, you’ll feel more empowered to make informed decisions.

Q: Networking seems important, but how can it actually help my business financially?

A: Absolutely! networking is more than just exchanging business cards. It’s about building relationships that can lead to collaborations, referrals, and even mentorship. When you connect with other business owners, you can share tips, learn from their experiences, and even find new customers. remember, your network can be one of your biggest assets!

Q: What role does marketing play in financial success?

A: Marketing is crucial! A great product or service won’t sell itself. You need to create awareness and attract customers.Invest in understanding your target audience and develop a marketing strategy that resonates with them. Whether it’s through social media, email campaigns, or community events, effective marketing can lead to increased sales and, ultimately, profitability.

Q: How important is having a budget for my small business?

A: Having a budget is essential! It acts as a financial roadmap, helping you allocate resources effectively and avoid overspending. A well-planned budget allows you to anticipate expenses and set aside funds for growth opportunities. Check your budget regularly and adjust as needed to adapt to changing circumstances.

Q: What about customer feedback? Should I really pay attention to it?

A: Definitely! Customer feedback is gold.It helps you understand what your customers love and what needs improvement. By listening to your customers, you can make informed adjustments to your products or services, enhancing customer satisfaction and loyalty—which directly impacts your bottom line.

Q: Any last tips for aspiring financially successful small business owners?

A: Don’t be afraid to innovate and adapt! The business landscape is constantly changing, and flexibility can be your greatest asset. Embrace new technologies, stay informed about industry trends, and be willing to pivot when necessary.Moreover, never stop learning—whether it’s through books, podcasts, or workshops—knowledge is key to financial success.

Q: It sounds like there’s a lot to manage. Can I succeed without help?

A: While it’s possible to do it all on your own, seeking help can significantly ease the burden. Consider hiring an accountant to manage your books or a business advisor for strategic planning. surrounding yourself with a strong team can free you up to focus on what you do best, allowing you to grow your business and achieve financial success more efficiently.

Q: Any final words of encouragement?

A: Absolutely! Remember,every successful business owner started somewhere. Stay persistent, keep learning, and don’t hesitate to reach out for support. Your financial success is within reach if you approach your business with passion, strategy, and the willingness to adapt. You’ve got this!

Closing Remarks

As we wrap up our journey into the secrets of financially successful small business owners, it’s clear that the path to success isn’t just about crunching numbers or mastering marketing strategies. It’s about cultivating a mindset that embraces learning, adaptability, and resilience.

Remember, every successful entrepreneur started where you are right now—with dreams, challenges, and a determination to thrive. By implementing the strategies we’ve discussed, you’re not just setting your business up for financial success; you’re also creating a foundation for growth and sustainability.So, take a moment to reflect on what you’ve learned. Identify the areas where you can take action today.Whether it’s refining your budget, investing in your skills, or building that all-important network, every step you take brings you closer to your goals.

In the world of small business, success doesn’t happen overnight. But with the right mindset and tools in hand,you can unlock your potential and pave your way to a prosperous future. Now, go out there and make those dreams a reality—your successful business journey awaits!