Are you ready to take your WooCommerce store to the next level? If you’re diving into the world of online sales, choosing the right payment gateway is crucial. With so many options out there, it can feel overwhelming to find the perfect fit for your business needs. But don’t worry! In this article, we’ll break down everything you need to know about selecting the best payment gateway for your WooCommerce platform. We’ll explore the top contenders, weighing their features, fees, and ease of integration, so you can make an informed decision that enhances your customers’ shopping experience and boosts your bottom line. Let’s get started on the path to seamless transactions and happy shoppers!

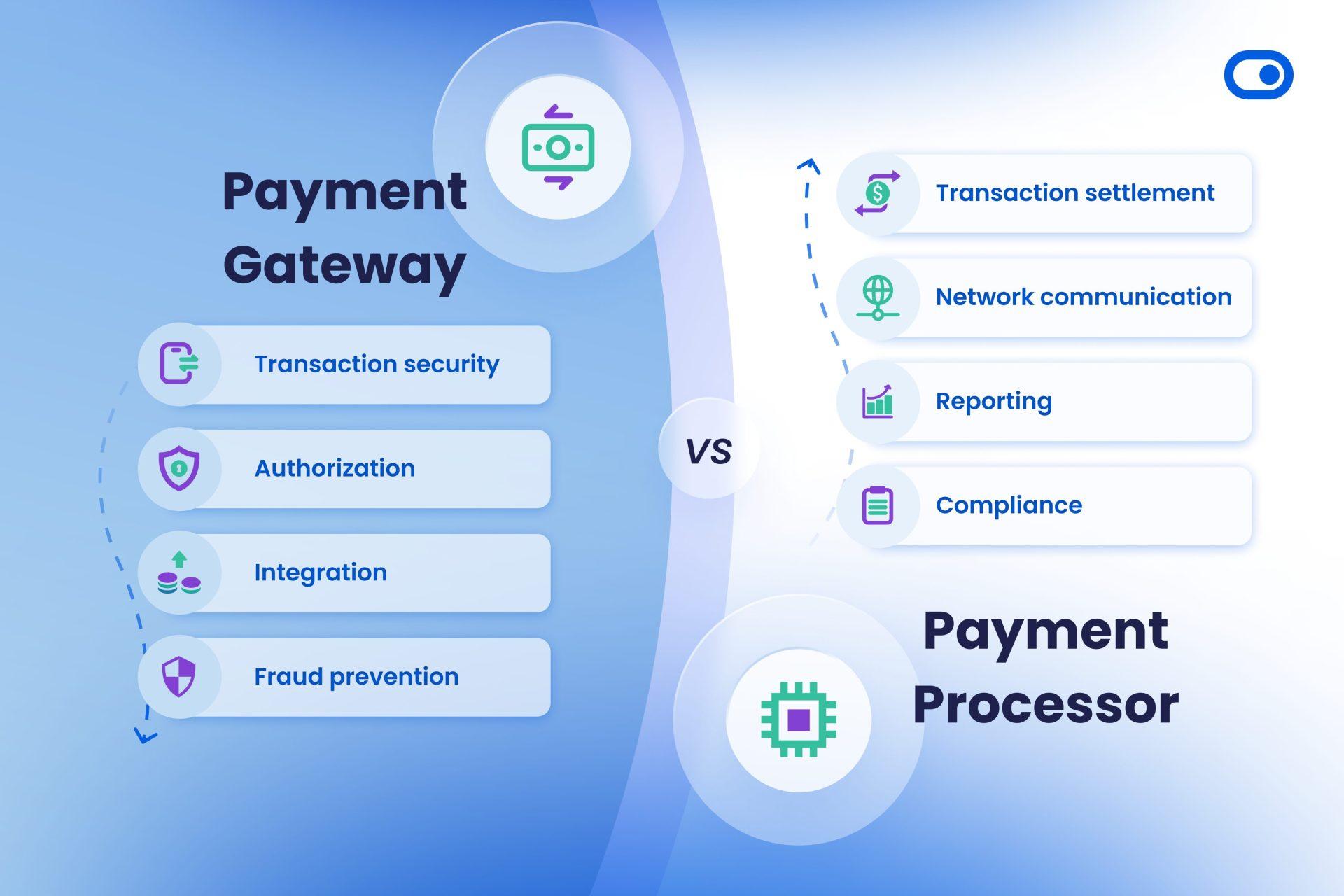

understanding Payment Gateways and Their Importance for WooCommerce

when it comes to running a successful WooCommerce store, choosing the right payment gateway is crucial. A payment gateway is the technology that connects your online store to the payment processing network,allowing customers to complete their transactions seamlessly. With a myriad of options available, understanding what a payment gateway does can help you make an informed decision that enhances both your business and customer experience.

Key Features of Payment Gateways:

- Security: Payment gateways utilize encryption and tokenization to protect sensitive facts during transactions. This ensures customer data is secure, fostering trust in your store.

- Multiple Payment Options: A good gateway allows your customers to pay using various methods, such as credit cards, debit cards, PayPal, and even cryptocurrencies, catering to a broader audience.

- Integration: The best payment gateways easily integrate with WooCommerce, allowing for a smooth setup process and ensuring your online store runs efficiently.

- Transaction Fees: Be aware of the costs associated with each gateway. Some charge flat fees, while others may take a percentage of each transaction, which can impact your profit margins.

Additionally, many payment gateways offer valuable features like recurring billing for subscription-based services, and multi-currency support, which can be a game-changer for businesses looking to expand internationally. Understanding these features can help you choose a solution that not only meets your current needs but also scales as your business grows.

Here’s a fast comparison of some popular payment gateways for WooCommerce:

| Payment Gateway | transaction Fees | Key Features |

|---|---|---|

| Stripe | 2.9% + 30¢ per transaction | Easy integration, supports multiple currencies |

| PayPal | 2.9% + 30¢ per transaction | Widely recognized, buyer protection policies |

| Square | 2.6% + 10¢ per swipe | Point of sale integration, easy setup |

| Authorize.Net | 2.9% + 30¢ + $25/month fee | Advanced fraud protection tools |

Choosing the right payment gateway can also enhance your checkout experience. A smooth checkout is vital for reducing cart abandonment rates. Look for gateways that offer customizable checkout options that fit your brand’s aesthetics while keeping the process straightforward for customers.

investing time in understanding payment gateways not only contributes to your store’s credibility but also directly impacts your bottom line. By evaluating the features, fees, and integration capabilities of various gateways, you can select the best option that aligns with your business goals and provides a seamless experience for your customers.

Key Features to Look for in a Payment Gateway

When it comes to choosing a payment gateway for your WooCommerce store, there are several critical features that can significantly impact your business’s success.It’s not just about processing payments; it’s about providing a seamless experience for your customers while ensuring their data is secure.

Security Measures are non-negotiable. Look for gateways that offer PCI compliance, end-to-end encryption, and fraud detection tools. This not only protects your customers’ sensitive information but also builds trust in your brand. A secure transaction process can set your store apart from competitors.

Another important feature is Integration Capabilities. Ensure the payment gateway can easily integrate with WooCommerce. A smooth integration process means you won’t face technical headaches down the line. Check if it supports various plugins and extensions to enhance functionality. Some of the popular gateways like PayPal, Stripe, and Authorize.Net offer seamless integration.

Payment Options are key to catering to a diverse customer base. Look for gateways that accept multiple payment methods, including credit cards, debit cards, digital wallets, and even cryptocurrencies. The more options you provide, the more likely customers will complete their purchases. Consider the following table for a quick comparison:

| Payment Gateway | Supported Methods | Transaction Fees |

|---|---|---|

| PayPal | Credit/Debit cards, PayPal Wallet | 2.9% + $0.30 |

| Stripe | Credit/Debit Cards, Apple pay, Google Pay | 2.9% + $0.30 |

| Authorize.Net | Credit/Debit Cards, eCheck | 2.9% + $0.30 + $25 monthly fee |

Customer Support is another feature that can’t be overlooked. A reliable payment gateway should offer robust customer support options, including live chat, email, and phone assistance. This ensures that any issues can be resolved swiftly, minimizing disruption to your business operations. Look for gateways that provide extensive documentation and tutorials as well.

consider the Cost Structure. Each gateway has different fee structures that can affect your bottom line. compare setup fees, monthly fees, and transaction fees across various options. A seemingly cheaper option may have hidden fees that could add up in the long run. Take the time to analyze your sales volume and transaction frequencies to choose a gateway that fits your budget.

Comparing Popular payment Gateways for WooCommerce

When it comes to optimizing your WooCommerce store, choosing the right payment gateway is crucial. Each payment gateway has its own set of features,costs,and benefits that can significantly affect your sales and customer experience. Let’s delve into some of the most popular options available.

PayPal

PayPal is one of the most widely recognized payment gateways globally. Its integration with WooCommerce is seamless, allowing for easy setup and fast transactions. Here are some reasons to consider PayPal:

- Global Reach: accepts payments in multiple currencies.

- Trust Factor: Many customers feel secure using PayPal due to its reputation.

- Mobile Optimization: Works well on all devices, enhancing the shopping experience.

Stripe

Stripe has gained popularity for its developer-friendly features and robust API. It’s an excellent choice for businesses that want more flexibility in their payment processes. Consider the following advantages:

- Customizable Checkout: tailor the checkout experience to fit your brand.

- Recurring Payments: Ideal for subscription-based services.

- No Hidden Fees: Clear pricing structure, which is easy to understand.

Square

Square is notably appealing for businesses with both online and brick-and-mortar presence. it offers a unified solution for accepting payments. Key benefits include:

- Unified Payments: Syncs online and offline sales effortlessly.

- Free Point of Sale: Comes with a free POS system, making it a budget-friendly choice.

- Transparent Fees: Simple pricing with no monthly fees.

Authorize.Net

For businesses looking for a reliable and established option, authorize.Net is a strong contender. With years in the market, it provides dependable service with features like:

- Recurring Billing: Great for subscription models.

- Fraud Detection Suite: enhanced security for your transactions.

- Customer Support: 24/7 reliable assistance whenever needed.

Comparison Table

| payment gateway | Transaction Fees | Key Features |

|---|---|---|

| PayPal | 2.9% + $0.30 | global reach, buyer protection |

| Stripe | 2.9% + $0.30 | Customizable checkout, subscriptions |

| Square | 2.6% + $0.10 | Unified payments, free POS |

| Authorize.Net | 2.9% + $0.30 + Monthly Fee | Fraud detection, recurring billing |

Choosing the best payment gateway for your WooCommerce store ultimately depends on your specific business needs and target audience. Each option brings its unique strengths to the table, so consider what matters most to your customers and your operations. By selecting the right gateway, you can enhance customer satisfaction and drive sales effectively.

Exploring the Benefits of Using PayPal for Your WooCommerce Store

When it comes to choosing a payment gateway for your WooCommerce store, many business owners find themselves drawn to PayPal for a variety of compelling reasons. One of the most significant advantages of using PayPal is its widespread recognition and trust among consumers.With millions of users globally, customers ofen feel more comfortable making purchases through a platform they already know and trust.

Another key benefit is the ease of integration. PayPal seamlessly integrates with WooCommerce, allowing you to set up your store and start accepting payments in just a few clicks.This means less time spent on technical details and more time focusing on growing your business. The straightforward setup process ensures that even those with limited technical expertise can get their store up and running smoothly.

PayPal also offers a range of secure payment options, which can significantly enhance the shopping experience for your customers. From credit and debit card payments to direct bank transfers, the flexibility of payment methods can cater to a variety of customer preferences. Security is paramount in today’s digital landscape, and PayPal’s robust fraud protection measures give both you and your customers peace of mind.

Additionally, using PayPal can lead to increased conversion rates. Many customers abandon their carts due to the inconvenience or lack of payment options at checkout. By offering PayPal, you provide a quick and familiar payment method, which can help minimize cart abandonment and increase sales. in fact, studies show that stores offering PayPal see a significant uplift in conversion rates compared to those that don’t.

Consider the potential for international sales as well. PayPal supports transactions in multiple currencies and is available in numerous countries. By incorporating PayPal into your WooCommerce store, you can easily reach a global audience and tap into new markets without the complexities of managing currency conversions and international payment processing.

| Benefit | Details |

|---|---|

| Trust and Recognition | Over 450 million active accounts worldwide. |

| Easy Integration | Simple setup process with WooCommerce. |

| Secure Transactions | Advanced fraud protection and buyer/seller protection. |

| Increased Conversions | Reduces cart abandonment with familiar payment options. |

| Global Reach | Supports multiple currencies and international payments. |

the advantages of using PayPal as a payment gateway for your WooCommerce store are not just limited to convenience; they extend to enhanced security, increased customer trust, and the potential for greater sales. These factors make PayPal an appealing option for anyone looking to optimize their online store’s payment processing capabilities.

Why Stripe Is a Top Choice for woocommerce Merchants

When it comes to choosing a payment gateway for WooCommerce, Stripe consistently stands out as a premier option for merchants. Its robust features and user-friendly interface make it a compelling choice for both new and established online businesses. Here are some reasons why many WooCommerce merchants opt for Stripe:

- Seamless Integration: Stripe integrates easily with WooCommerce, allowing merchants to set up payment processing with minimal hassle. The setup process is straightforward, enabling merchants to start accepting payments quickly.

- Global Reach: Stripe supports multiple currencies and is available in numerous countries, making it an excellent option for merchants looking to expand their reach internationally. This global accessibility ensures that you can cater to diverse customer bases without any payment barriers.

- advanced Security Features: Security is a top priority for any online merchant, and stripe excels in this area. With features such as PCI compliance, encryption, and advanced fraud detection, you can have peace of mind knowing your transactions are secure.

- Flexible Payment Options: Stripe offers a variety of payment methods, including credit cards, debit cards, and digital wallets like Apple Pay and Google Pay. This flexibility allows customers to choose their preferred payment method, enhancing their shopping experience.

- Detailed Analytics: Understanding your business performance is crucial, and Stripe provides comprehensive analytics and reporting features.With these insights, you can track sales trends, customer behavior, and payment flows, enabling data-driven decisions.

| Feature | Benefits |

|---|---|

| Integration | Easy setup with WooCommerce |

| Security | High-level security measures |

| Reporting | In-depth analytics for better insights |

Additionally, stripe’s customer support is highly regarded.With resources like documentation, community forums, and direct support options, you can get the help you need when you encounter challenges. This level of support is invaluable, especially for those new to e-commerce.

Lastly, Stripe continually innovates and updates its features, ensuring that merchants have access to the latest payment technologies.From mobile payments to subscription billing, Stripe is adept at adapting to the ever-evolving landscape of online commerce.

The Advantages of Using Square with WooCommerce

When integrating Square with woocommerce, users unlock a multitude of benefits that enhance both the merchant and customer experience. First and foremost, Square is renowned for its seamless payment processing, allowing businesses to accept payments in various forms—credit cards, debit cards, and digital wallets—without any hassle. This flexibility caters to diverse customer preferences, increasing the likelihood of conversions and improving customer satisfaction.

Another significant advantage is competitive pricing. Square offers transparent pricing models with a flat-rate fee, making it easy for merchants to understand and predict their transaction costs. This can be particularly beneficial for small businesses or startups that need to manage their budgets effectively. Additionally, there are no hidden fees, which allows for clearer accounting practices and financial planning.

Security is a paramount concern in online transactions, and Square excels in this area. The platform complies with PCI DSS standards and includes fraud prevention tools that safeguard both merchants and customers. With features like end-to-end encryption and secure payments, businesses can operate confidently, knowing that sensitive information is well-protected.

Moreover, Square provides robust analytics and reporting tools integrated directly into WooCommerce. Users can track sales trends, understand customer behavior, and scrutinize transaction data all in one place. This insight enables businesses to make informed decisions about inventory, marketing strategies, and overall operational efficiency.

Let’s not overlook the ease of integration.Setting up Square with WooCommerce is straightforward, allowing businesses to get started quickly without needing extensive technical knowledge. With just a few clicks, merchants can connect their Square account to WooCommerce and begin processing payments, minimizing downtime and maximizing productivity.

| Feature | Benefits |

|---|---|

| Payment Flexibility | Accepts multiple payment methods,improving customer experience. |

| Transparent Pricing | flat-rate fees with no hidden costs for better budgeting. |

| Security | Pci compliance and fraud prevention tools ensure safe transactions. |

| analytics | Integrated tools for tracking sales and customer behavior. |

| Easy Integration | Quick setup process with minimal technical knowledge required. |

Lastly, Square’s customer support is another hallmark of its offering. With a dedicated support team and comprehensive online resources, merchants can resolve any issues promptly and efficiently. This level of support ensures that businesses can focus on growth and customer engagement rather than troubleshooting payment processing problems.

Security Matters: How to Choose a Safe Payment Gateway

When selecting a payment gateway for your WooCommerce store, the security of your transactions should be your top priority. A secure payment gateway ensures that sensitive customer information, such as credit card details, is protected from potential cyber threats.Here are some key factors to consider:

- Encryption Standards: Look for gateways that utilize advanced encryption protocols, such as SSL (Secure Socket layer) or TLS (Transport Layer Security), to safeguard data during transmission.

- Compliance: Ensure the gateway is PCI DSS (Payment Card Industry Data Security Standard) compliant. This certification signifies that the provider meets strict security benchmarks to protect cardholder data.

- Fraud detection Tools: A good payment gateway should come with built-in fraud prevention measures, such as address verification services (AVS) and CVV checks, to minimize fraudulent transactions.

Another important consideration is the transaction monitoring and reporting features the payment gateway offers.Effective monitoring can definitely help you identify suspicious activities in real-time, enabling you to take swift action to protect your business and customers. Look for gateways that provide:

- Detailed transaction reports

- Automated alerts for perhaps fraudulent transactions

- Analytics to track payment success rates and chargebacks

| Payment Gateway | Encryption | PCI Compliance | Fraud Detection |

|---|---|---|---|

| Stripe | SSL/TLS | Yes | Yes |

| paypal | SSL/TLS | Yes | Yes |

| Authorize.Net | SSL/TLS | Yes | Yes |

Lastly, consider the customer support provided by the payment gateway. Reliable support is crucial when you encounter any issues or have questions about security features.Opt for gateways that offer:

- 24/7 customer service

- Comprehensive help documentation

- Community forums for peer support

By prioritizing these security aspects, you can choose a payment gateway that not only meets your business needs but also provides peace of mind to your customers. After all, a happy customer is a returning customer, and security plays a vital role in creating that trust.

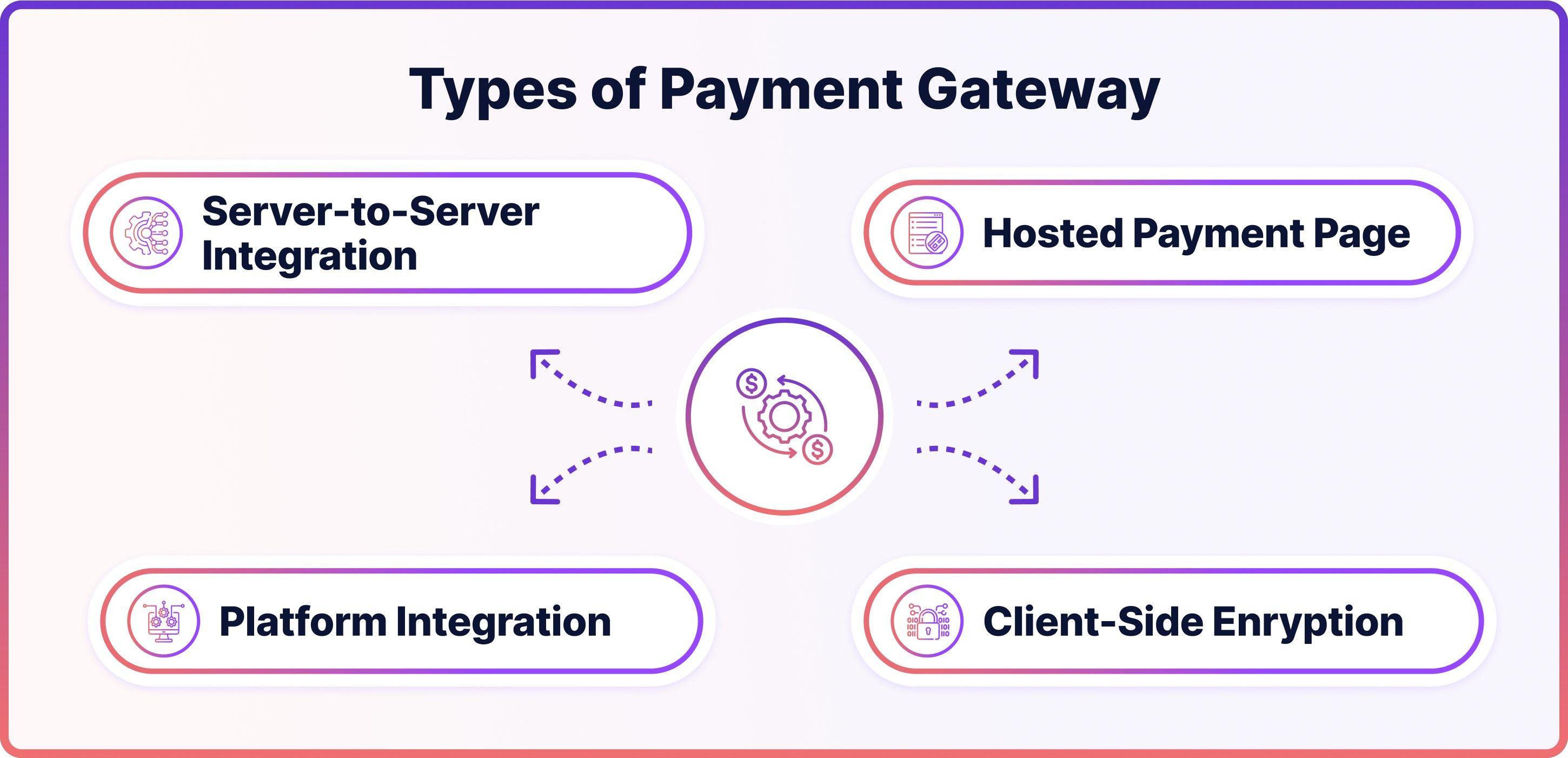

Integrating Your Payment Gateway with WooCommerce Made Easy

Integrating a payment gateway with your WooCommerce store can be a game-changer in enhancing your online business’s efficiency and customer satisfaction. While the technicalities might seem daunting at first, breaking down the steps can simplify the process significantly. Here’s how you can make this integration smooth and hassle-free.

First, choose a payment gateway that aligns with your business needs. Consider the following factors:

- Transaction Fees: Each gateway has different fee structures.Look for one that minimizes costs while maximizing usability.

- Supported payment Methods: Ensure the gateway supports a variety of payment types, including credit cards, digital wallets, and bank transfers.

- Currency Support: If you’re targeting international customers, select a gateway that can handle multiple currencies.

- Security Features: Look for gateways with robust security protocols like SSL encryption and PCI compliance to protect sensitive customer data.

Once you’ve selected your preferred payment gateway,the integration process usually follows a straightforward pattern:

- Install the payment gateway plugin from the wordpress repository.

- Activate the plugin through the WooCommerce settings.

- Configure the gateway settings according to your business requirements.

- Test the integration in a sandbox surroundings to ensure everything functions seamlessly.

To give you a clearer picture of the popular gateways available, we’ve compiled a quick comparison chart:

| Payment Gateway | Transaction Fee | Key Features |

|---|---|---|

| PayPal | 2.9% + $0.30 | Wide acceptance, buyer protection |

| Stripe | 2.9% + $0.30 | customizable API, recurring payments |

| Square | 2.6% + $0.10 | Integrated POS, fast setup |

By following these steps, you can seamlessly integrate a payment gateway into your WooCommerce platform.This will not only enhance your operational efficiency but also provide your customers with a smooth and secure checkout experience. Remember, the easier you make it for customers to pay, the more likely they are to complete their purchases!

Customer Experience: How Payment Gateways Influence Sales

In today’s digital marketplace, the experience a customer has when making a purchase can significantly influence their buying decision. One of the most critical components of this experience is the payment gateway. A seamless and efficient payment process can turn a casual browser into a loyal customer, while a elaborate or glitchy checkout can drive potential buyers away in an instant.

When choosing a payment gateway for your WooCommerce store, consider how it enhances the overall customer experience. Here are some key factors:

- Convenience: Shoppers appreciate payment options that allow them to complete transactions quickly. Integrating multiple payment methods, such as credit cards, PayPal, and digital wallets, can cater to a broader audience.

- security: Customers want to feel safe when sharing their financial information. Opt for gateways with robust security measures, such as encryption and fraud detection, which can enhance trust and reduce cart abandonment.

- Speed: A swift checkout process is essential. Payment gateways that support one-click payments or auto-fill options can significantly decrease the time it takes for customers to finalize their purchases.

Furthermore, the design and user-friendliness of the payment interface play an essential role. A well-integrated gateway within WooCommerce should match your store’s branding and be intuitive for customers to navigate. Anything that feels out of place can lead to hesitation and ultimately result in lost sales.

Consider the following table when evaluating popular payment gateways for WooCommerce:

| Payment Gateway | Transaction Fees | supported currencies | Best For |

|---|---|---|---|

| Stripe | 2.9% + 30¢ | 150+ | Online Businesses |

| PayPal | 2.9% + 30¢ | 25+ | International Sales |

| Square | 2.6% + 10¢ | USD only | Small Businesses |

| Authorize.Net | 2.9% + 30¢ | USD only | Subscription Services |

Ultimately, the right payment gateway can help you create a positive customer experience that not only boosts conversions but also fosters customer loyalty.Make informed decisions based on your target audience and their preferences to ensure that every aspect of the checkout process is as smooth as possible.

Pricing Structures: Finding the Most Cost-Effective Payment Solution

When it comes to selecting a payment gateway for your WooCommerce store, understanding the pricing structures is crucial. Each gateway comes with its own set of fees, which can impact your overall profitability. Let’s explore the primary factors to consider when evaluating cost-effective payment solutions.

Firstly, look at the transaction fees associated with each payment gateway. Some providers charge a flat rate per transaction, while others may take a percentage of the sale. It’s essential to analyze your average order value and estimate how these fees will accumulate over time.Here are a few common fee structures:

- Flat Fee: A fixed amount charged per transaction, nonetheless of the order size.

- Percentage Fee: A percentage of the transaction total,which fluctuates with order size.

- monthly Fees: some gateways may have a monthly subscription fee along with transaction costs.

Another factor to consider is the setup fee and any potential annual fees. While some payment gateways treat you to free setup, others may charge you upfront. It’s vital to factor in these costs, especially if you’re just starting and need to keep your initial expenses low.

| Gateway | Transaction Fee | Setup Fee | Monthly Fee |

|---|---|---|---|

| paypal | 2.9% + $0.30 | Free | None |

| stripe | 2.9% + $0.30 | Free | None |

| Square | 2.6% + $0.10 | Free | None |

| Authorize.Net | 2.9% + $0.30 | $49 | $25 |

also, keep in mind the currency conversion fees if you plan to sell internationally. Some gateways charge additional fees for currency conversion, which can eat into your margins. choosing a provider that offers competitive rates for foreign transactions can be a significant advantage.

Lastly, don’t overlook the customer support and integration capabilities. A payment gateway that offers robust support can save you time and money in the long run. Look for providers with excellent reviews and a reputation for responsive customer service. Additionally, ensure that the gateway integrates smoothly with woocommerce, reducing the time spent troubleshooting technical issues.

Finding a cost-effective payment solution is about balancing fees with features. Analyzing these various aspects will help you choose the right payment gateway that aligns with your business goals and budget, ensuring that you maximize your profits while providing a seamless checkout experience for your customers.

Real-Life Success Stories: Merchants Who Got It Right

Final Thoughts: Choosing the Best Payment Gateway for Your Business

When it comes to selecting the right payment gateway for your woocommerce store, there are several key factors to consider that can significantly impact your business’s success. The right choice will not only enhance your customer experience but will also streamline your operations and boost your bottom line.

First and foremost, you need to consider the transaction fees associated with each payment gateway. Some providers charge a flat fee per transaction, while others may take a percentage of each sale. It’s crucial to analyze how these fees align with your sales volume and product pricing. A seemingly low fee can quickly add up and cut into your profits if you’re processing a high volume of transactions.

Security is another vital aspect to evaluate. with the increasing prevalence of cyber threats,ensuring that your payment gateway complies with the latest security standards,such as PCI DSS,is non-negotiable. Look for gateways that offer advanced fraud detection, encryption, and robust customer support to resolve any security issues that may arise.

Additionally, consider the ease of integration with WooCommerce. Some payment gateways provide seamless integration, allowing you to get up and running quickly without extensive technical knowledge. Others might require additional plugins or coding, which can lead to complications and delays.Opt for a gateway that offers comprehensive documentation and support to facilitate a smooth setup process.

Another critical factor to reflect on is the customer experience. Your payment gateway should offer a smooth, intuitive checkout process that minimizes cart abandonment. Look for features such as one-click payments, multiple payment options, and mobile-friendly interfaces. These aspects can significantly enhance user satisfaction and encourage repeat business.

don’t overlook the importance of customer support. In the event of payment issues or technical difficulties, having access to responsive, knowledgeable support can make all the difference. Choose a gateway that offers multiple support channels—like live chat, email, and phone support—to ensure that help is readily available when you need it.

the best payment gateway for your WooCommerce store will depend on your specific business needs. By weighing factors such as transaction fees, security, ease of integration, customer experience, and support, you can make an informed decision that will set the stage for your business’s growth and success.

Frequently Asked Questions (FAQ)

Q&A: What Is the Best Payment Gateway for WooCommerce?

Q: What exactly is a payment gateway, and why do I need one for my WooCommerce store?

A: Great question! A payment gateway is a service that authorizes credit card payments and processes transactions for online stores. Think of it as the digital equivalent of a point-of-sale terminal in a physical store. For your WooCommerce store, having a reliable payment gateway is essential because it ensures secure transactions, helps prevent fraud, and provides a smooth checkout experience for your customers. Without a good payment gateway, you risk losing potential sales due to payment failures or security concerns.

Q: What should I look for in a payment gateway for my WooCommerce store?

A: When searching for the best payment gateway, consider a few key factors:

- Compatibility: Make sure it seamlessly integrates with WooCommerce.

- Fees: Check transaction fees, monthly fees, and any hidden costs.

- Security: Look for gateways that offer robust security features like encryption and fraud detection.

- Payment Methods: The more options you provide, the better. credit cards, PayPal, apple Pay, and others can cater to diverse customer preferences.

- User Experience: An easy-to-navigate interface will enhance the shopping experience for your customers.

Q: Which payment gateway do you recommend for WooCommerce?

A: While there are several great options, Stripe is often hailed as one of the best payment gateways for WooCommerce. Why? It offers a fantastic user experience, supports multiple payment methods, has transparent fees, and is trusted by businesses worldwide. Plus, it provides a seamless checkout process that keeps customers on your site, which can reduce cart abandonment.

Though, if you’re looking for an option that’s familiar to many users, PayPal is another excellent choice. It’s widely recognized and trusted,which can help boost your conversion rates.

Q: Are there any drawbacks to using popular payment gateways like Stripe or PayPal?

A: while Stripe and PayPal are fantastic options, they do have some drawbacks. such as, some users report that Stripe’s setup can be a little complex if you’re not tech-savvy. PayPal, conversely, might redirect customers to its site to complete transactions, which can disrupt the checkout flow. It’s essential to weigh these factors against the benefits and choose what aligns best with your business needs.

Q: Can I use multiple payment gateways with my WooCommerce store?

A: Absolutely! In fact, offering multiple payment gateways can enhance your customers’ experience. Different customers have different preferences, so providing options like Stripe, PayPal, and even local payment methods can help cater to a broader audience. Just ensure that managing multiple gateways doesn’t become a hassle for you.

Q: What if my business grows and I need more advanced features later on?

A: That’s a smart consideration! Many payment gateways, including Stripe and PayPal, offer scalable solutions as your business grows. They provide advanced features like subscription billing, invoicing, and analytics. Before choosing a gateway, check if it has the capacity to grow with your business, so you won’t need to switch later.

Q: How do I get started with setting up a payment gateway for WooCommerce?

A: Setting up a payment gateway with WooCommerce is generally straightforward! First, choose the gateway that best fits your needs. Then,install and activate the corresponding plugin from the WooCommerce marketplace. Follow the setup instructions, which typically involve entering your API keys and configuring your settings.test the gateway to ensure everything is working smoothly before going live!

Q: Any last tips for choosing the best payment gateway for my WooCommerce store?

A: Definitely! Take your time to research and compare different payment gateways. Read user reviews and ask fellow WooCommerce store owners about their experiences. Remember, the right payment gateway can significantly affect your sales, so choose wisely. And don’t hesitate to experiment—after all, your ultimate goal is to provide the best possible experience for your customers. Happy selling!

Insights and Conclusions

As we wrap up our journey through the world of payment gateways for woocommerce, it’s clear that the right choice can make all the difference for your online store. Whether you’re a budding entrepreneur or a seasoned business owner, selecting the best payment gateway tailored to your needs can streamline transactions, enhance customer experience, and ultimately boost your sales.

Remember, it’s not just about finding a gateway that processes payments; it’s about choosing one that aligns with your business goals and offers the features that matter most to you and your customers. Whether it’s lower transaction fees,multi-currency support,or top-notch security,the right gateway can set you up for success.

So, take a moment to assess your specific requirements and the unique preferences of your customers. With the insights shared in this article, you’re now equipped to make an informed decision. Don’t hesitate to explore your options, test out the features, and see what fits best. happy selling, and may your WooCommerce store thrive with the perfect payment gateway!