Are you looking to launch an online store without the headache of navigating complex tax regulations? If you’re diving into the world of e-commerce with WooCommerce on WordPress,you’re in for a treat! This powerful combination gives you the flexibility and tools to create a stunning store that meets your needs. However, when it comes to taxes, many budding entrepreneurs ofen feel overwhelmed. The good news? You don’t need to be a tax expert or break the bank on complicated setups. In this article, we’ll walk you through the essential steps to build a tax-compliant WooCommerce store that doesn’t add extra overhead to your business. You’ll discover practical tips and straightforward solutions to ensure your online venture thrives while staying on the right side of the law. so, let’s get started on your journey to e-commerce success, minus the tax-related anxiety!

Understanding the Importance of Tax Compliance for Your WooCommerce Store

When you run a WooCommerce store, staying compliant with tax regulations isn’t just a good practice—it’s essential for your business’s longevity. Ignoring tax compliance can led to severe penalties, lost revenue, and a tarnished reputation. Here’s why understanding tax compliance is crucial for your online store:

- Avoiding Legal Issues: Tax regulations can be complex and vary by location. Failing to comply can result in hefty fines or legal action. By being proactive,you can avoid these pitfalls.

- Building Trust with Customers: Customers prefer clear businesses. By showing that you’re compliant with tax regulations, you enhance your store’s credibility and build trust.

- Streamlined Operations: Proper tax compliance helps streamline your operations.Keeping records organized and accurate can save you time and resources, especially during tax season.

- Future-Proofing Your Business: As your business grows, tax obligations can become more complicated. Setting up a compliant system from the start makes scalability easier down the line.

To ensure tax compliance doesn’t feel like an overwhelming burden, consider leveraging tools and plugins designed specifically for WooCommerce. These tools can help automate calculations based on the customer’s location, ensuring you charge the appropriate sales tax without manual input. This not only saves time but also reduces the chance of human error.

Here’s a simple overview of key tax compliance elements to keep in mind:

| Tax Compliance Element | Description |

|---|---|

| Sales Tax Collection | Determine where you need to collect sales tax based on nexus laws. |

| Record Keeping | Maintain clear and accurate records of all transactions and tax collected. |

| Filing Requirements | Know your deadlines for filing tax returns to avoid penalties. |

| local Regulations | Stay updated on local tax laws,as they can change frequently. |

By embracing tax compliance as a core aspect of your business strategy, you pave the way for lasting growth. don’t view it as a chore; rather, see it as an opportunity to enhance your business practices and reassure your customers. Keeping tax obligations in check can lead to greater financial clarity and a more robust business model overall.

Remember, the goal is to create a seamless experience for your customers while operating within the boundaries of the law. With the right strategies in place, your WooCommerce store can thrive without the added stress of tax-related issues.

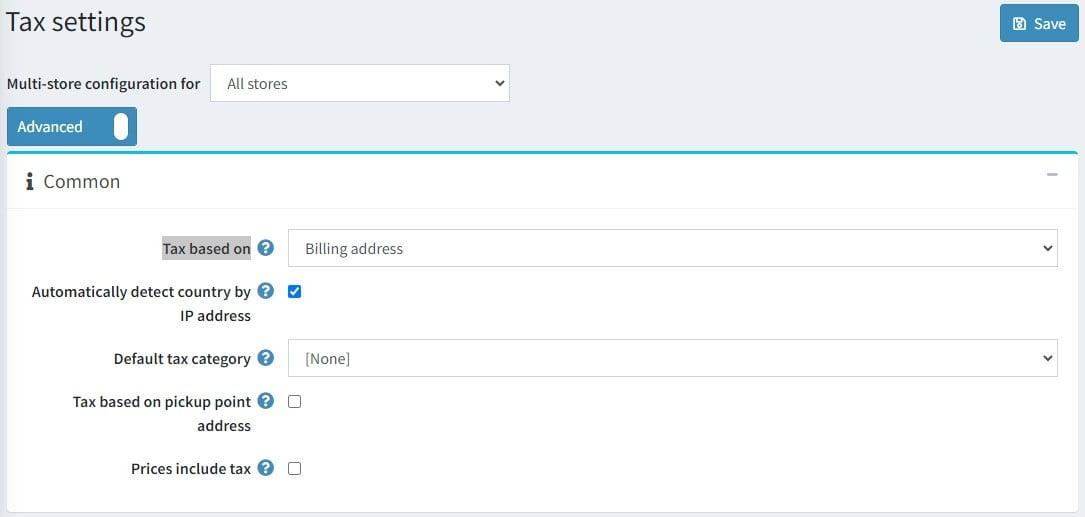

choosing the Right Tax Settings in WooCommerce Made Easy

Choosing the right tax settings in your WooCommerce store is crucial for maintaining compliance and providing a seamless shopping experience for your customers. Understanding the different tax options available can help you avoid penalties and ensure accurate reporting.here’s how to navigate those settings with ease.

To start off, you’ll want to determine your tax display options. WooCommerce allows you to set how prices are displayed on your site. Here are your key choices:

- Prices Excluding Tax: This setting is often preferred for B2B transactions, where clients expect to see prices without tax included.

- Prices Including Tax: Ideal for B2C sales, this option makes it simple for customers to see the total amount they will pay at checkout.

- show Tax Totals: Decide if you want tax totals displayed on the product pages or only at checkout.

Next, you’ll want to configure your tax classes.WooCommerce allows you to create multiple tax classes for different types of products or services. this flexibility ensures that you can cater to various tax rates depending on the context. Consider creating tax classes for:

- Standard Rate: For most goods and services.

- Reduced Rate: If you sell specific items that qualify for a lower tax rate.

- Zero Rate: For tax-exempt products or services.

| Tax Class | Applicable Rate | Use Case |

|---|---|---|

| Standard Rate | 20% | General merchandise |

| Reduced Rate | 5% | Food items |

| Zero Rate | 0% | Export goods |

Lastly, it’s essential to stay updated with local tax regulations. Tax laws can vary substantially depending on your location, so here are a few tips to stay compliant:

- Regular Updates: Make sure to regularly check for updates in tax laws relevant to your business.

- Use Tax Plugins: Consider leveraging tax calculation plugins that automatically adjust rates based on location or product type.

- Consult a Professional: When in doubt, don’t hesitate to consult with a tax professional to ensure you’re following all necessary regulations.

Leveraging Tax plugins to Simplify Your Compliance Efforts

When it comes to managing the complexities of tax compliance in your WooCommerce store, tax plugins are invaluable tools that can streamline the process and reduce administrative burdens.By integrating these plugins, you can ensure that your store remains compliant with local regulations while saving precious time and resources.

Why Tax Plugins Matter:

- They automate tax calculations based on the customer’s location.

- They keep up with changing tax laws and rates, ensuring you’re always compliant.

- They provide detailed reports, which simplifies your accounting and tax filing process.

One of the standout features of many tax plugins is their ability to automatically update tax rates. This means you don’t have to worry about manually adjusting rates when legislation changes. Instead, you can focus on what truly matters—growing your business. With the right plugin, you can:

- Set tax classes for different products or services.

- customize tax settings for various jurisdictions.

- Ensure accurate tax collection for all your sales channels.

Furthermore, these plugins often provide user-pleasant dashboards that give you insights into your tax obligations and sales data at a glance. This not only helps you stay organized but can also enhance your decision-making capabilities. Consider the following benefits:

| Feature | Benefit |

|---|---|

| Real-Time Tax calculation | Eliminates errors during checkout and enhances customer trust. |

| Customizable Settings | Tailors tax management to fit your business model perfectly. |

| Automated Reporting | Saves time and reduces stress during tax season. |

Choosing the right tax plugin depends on your specific needs, but popular options such as WooCommerce Tax or TaxJar are highly recommended. They offer robust features tailored to e-commerce and can be easily integrated within your WordPress habitat. Additionally, many of these plugins come with excellent customer support that can guide you through any challenges you might face.

Ultimately, leveraging tax plugins not only simplifies your compliance efforts but also empowers you to take control of your business’s financial aspects. With less time spent on tax-related concerns, you can focus on enhancing customer experience and boosting sales. Embrace the power of automation and watch your WooCommerce store thrive without the extra overhead.

Navigating Sales Tax Regulations for Different Regions

Understanding the various sales tax regulations across regions is crucial for any WooCommerce store owner. Each area can have its own specific rules regarding taxable goods and services,which can make compliance seem daunting. However, with the right tools and knowledge, you can ensure that your store remains compliant without excessive overhead.

To effectively navigate these regulations, consider the following key points:

- Know Your Nexus: Nexus refers to the physical or economic presence your business has in a state or region, which often dictates whether you need to collect sales tax there. This could be based on factors like having a physical location, employees, or significant sales.

- Understand Tax Categories: Different products might belong to different tax categories.Some items might be exempt or taxed at different rates, so identifying these can help reduce your tax burden.

- Utilize Tax Calculation Plugins: There are various plugins compatible with WooCommerce that automatically calculate taxes based on the customer’s location, ensuring you charge the right amount without manual calculation.

- Stay Updated: Tax laws frequently change. Subscribe to updates from relevant tax authorities or consider networks that provide insights into shifts in tax regulations specific to eCommerce.

Implementing automated tax solutions can significantly reduce the burden of compliance. For example, integrating a plugin that connects you directly to tax databases allows for real-time updates on sales tax rates and regulations relevant to your products. This not only saves time but also minimizes the risk of errors that can lead to fines or penalties.

| Region | Tax Rate | Product Category Exemptions |

|---|---|---|

| California | 7.25% | Clothing,Food |

| texas | 6.25% | Clothing |

| New York | 4% | Clothing (under $110) |

Moreover, consider leveraging cloud-based accounting software that integrates seamlessly with WooCommerce. This software can definitely help track your sales tax obligations across multiple states, offering reports that make filing easier. Many of these solutions also provide features like audit support, helping you remain prepared in case of inquiries from tax authorities.

don’t hesitate to seek professional advice. Consulting with a tax professional who understands eCommerce can provide tailored insights into your specific situation, ensuring that you remain compliant while optimizing your tax strategy.

Creating a Transparent Tax Policy to Build Customer Trust

When it comes to e-commerce, clarity in tax policy is essential to cultivating trust among your customers. No one enjoys unexpected charges at checkout, and clear communication about tax obligations can set your WooCommerce store apart. Here are some practical steps to ensure your tax practices are transparent and customer-friendly:

- Clear Tax Breakdown: Always provide a detailed breakdown of taxes during the checkout process. This helps customers understand where their money is going and reassures them that there are no hidden fees.

- Regular Updates: Tax laws can change frequently. Ensure that your WooCommerce store is updated regularly to reflect the latest tax rates relevant to your customers’ locations.

- Educational Content: Create blog posts or FAQs about your tax policies. Educating your customers can demystify the process and enhance their trust in your brand.

Moreover, integrating a reliable tax calculation plugin can simplify the process for both you and your customers.Here are some popular options:

| Plugin Name | Features | Cost |

|---|---|---|

| WooCommerce Tax | Automatic tax calculations based on location | Free |

| taxjar | Real-time sales tax calculations, reports | Starts at $19/month |

| avalara | Streamlined compliance for complex sales tax | Contact for pricing |

Additionally, being upfront about your return and refund policies related to tax can enhance customer confidence.If taxes are included in the price, make that clear. If not, provide data on how taxes will be handled in the case of a return.

consider utilizing customer feedback to refine your tax communication strategy. Simple surveys can yield insights into whether customers feel informed and confident about their purchases. Remember, a transparent approach not only fosters customer trust but also positions your WooCommerce store as a credible and responsible business.

Utilizing Automated Tax Calculations to Reduce Manual Errors

In today’s digital landscape, where efficiency is key, leveraging automated tax calculations is a game changer for anyone running a WooCommerce store. Manual calculations can lead to a plethora of issues,from simple miscalculations to more severe compliance violations. By integrating automated systems, you not only streamline the process but also significantly minimize the risk of errors that could cost you both time and money.

Imagine this: you’re at the peak of your sales season, and orders are rolling in faster than you can keep up. Relying on manual tax calculations in such a hectic environment is a recipe for disaster.Automated tax solutions eliminate the guesswork by:

- Ensuring Accuracy: Automated systems calculate the correct tax rates based on the latest regulations,which means you can trust that your figures are always up to date.

- saving Time: With calculations happening in real-time during checkout, you can focus your energy on growing your business rather than crunching numbers.

- Reducing Compliance Risks: Automatic updates to tax rules and rates help you stay compliant with local, state, and federal regulations, reducing the risk of audits or penalties.

Additionally, using an automated tax calculation tool can provide extensive reporting features, allowing you to gain insights into your sales and tax obligations. This means that you can easily generate detailed reports that display:

| Report Type | Details |

|---|---|

| Sales Tax Summary | A complete overview of all sales tax collected over a specific period. |

| Transaction Reports | Dive into individual transactions to review tax calculations per sale. |

| State-wise Tax Breakdown | View tax collected by state, which can be essential for compliance and planning. |

By harnessing these tools,you create a seamless checkout experience for your customers. Shoppers appreciate transparency and efficiency; when they see their total calculated accurately and instantly, it builds trust in your brand. Furthermore, automated systems can handle varying tax rates effortlessly, which is particularly advantageous if you ship products across different states or jurisdictions.

integrating automated tax calculations into your WooCommerce store isn’t just a smart move; it’s a necessity in a fast-paced, ever-evolving eCommerce environment. With precision, compliance, and enhanced customer satisfaction on your side, you can confidently run your store while focusing on what truly matters—growing your business.

Monitoring Tax Changes and Staying Updated Without Stress

Staying on top of tax changes can feel overwhelming, but with the right tools and strategies, it doesn’t have to be. By leveraging technology and critical resources, you can ensure your WooCommerce store remains compliant without the stress of constant monitoring. Here are some effective methods to keep your tax obligations in check:

- Subscribe to Tax Newsletters: Sign up for updates from reputable tax advisory firms or government websites. Regular newsletters can provide insights into tax law changes that impact your business.

- Use Automated Tax Solutions: Implement plugins like WooCommerce Tax or TaxJar. These tools automatically calculate taxes based on current regulations, minimizing manual checks and reducing errors.

- Join Online Communities: Engage with fellow WooCommerce store owners in forums or social media groups. Sharing experiences and resources can help you stay informed about tax changes in your industry.

- Follow Relevant Blogs and Podcasts: Keep an ear out for experts discussing tax updates and compliance tips. These platforms often provide practical advice in an easily digestible format.

To make compliance even simpler, consider creating a tax calendar. This can be a physical calendar or a digital one integrated into your project management tools. Include important tax deadlines, updates from your subscription sources, and reminders to review your tax configurations periodically. Here’s a simple table to give you a head start:

| Month | Important Task |

|---|---|

| January | Review previous year’s tax changes |

| April | Quarterly tax submission |

| July | Check for mid-year tax updates |

| October | Prepare for year-end tax reporting |

Lastly, don’t hesitate to consult with a tax professional if you feel overwhelmed. A qualified accountant can provide personalized advice tailored to your store’s unique situation. This investment can save you time and ensure you’re compliant with changing regulations, ultimately providing peace of mind.

Keeping Accurate Records for Easy Tax Reporting

When running a WooCommerce store, keeping accurate records is essential for seamless tax reporting. Not only does it ensure compliance with tax regulations, but it also saves you time and stress during tax season. Here are some strategies to help you maintain organized records:

- Utilize Accounting Plugins: Leverage plugins like WooCommerce QuickBooks Connector or Xero to automate your financial records. These tools can synchronize your sales data, making it easy to track income and expenses without manual entry.

- Organize Financial Statements: Regularly update and categorize your financial statements.Create a simple folder structure in your cloud storage or local drive to segregate documents by year, quarter, or month, making it easier to find critically important files.

- track Transactions: Keep a detailed log of all transactions, including sales, refunds, and chargebacks. Use a spreadsheet or a dedicated accounting software to summarize daily sales and track patterns over time.

Implementing a standardized method for record-keeping can significantly streamline your workflow. consider the following tips to enhance your record-keeping practices:

- Schedule Regular reviews: Set a specific time each week or month to review your financial records. This will help you catch any discrepancies early and stay on top of your finances.

- Backup Your Data: always have a backup plan in place. Regularly export your data and save it securely. Cloud storage options like Google Drive or Dropbox are great for ensuring you don’t lose critical information.

- Use a Consistent Naming Convention: Adopt a clear naming convention for files and folders, making it easier to locate documents quickly. For example, use “YYYY-MM-DD_InvoiceNumber” for invoices.

To visualize your financial performance over time, consider creating a simple table to summarize key metrics.this can definitely help you track your revenue growth and expenses at a glance:

| Month | Revenue | Expenses | Net Profit |

|---|---|---|---|

| January | $2,000 | $1,200 | $800 |

| February | $2,500 | $1,000 | $1,500 |

| March | $3,000 | $1,500 | $1,500 |

By establishing a routine for accurate record-keeping and automating where possible, you can ensure that your WooCommerce store is not only compliant but also positioned for financial success. Remember, the more organized your records are, the easier it will be to manage your taxes and make informed business decisions!

Tips for Streamlining Your Store Operations Without Extra Costs

Running an efficient online store doesn’t have to come with hefty price tags. Actually, there are several strategies you can implement to streamline your operations while keeping costs low. Let’s dive into some actionable tips that can elevate your WooCommerce store’s efficiency.

Leverage Automation Tools to reduce manual tasks. Automating processes such as inventory management, order fulfillment, and customer communication can save you significant time and effort. Tools like Zapier can connect your WooCommerce store with other applications,allowing seamless data transfer and reducing the risk of human error.

Consider setting up recurring billing for subscription-based products. By offering subscription options, you not only provide convenience to your customers but also create a predictable revenue stream. This can help in planning your cash flow better and reducing marketing costs over time.

Optimize your product descriptions and images to improve SEO without spending extra on ads. High-quality images and detailed,engaging descriptions can enhance user experience and boost organic traffic. Take time to analyze what keywords your audience is searching for and integrate them naturally into your content.

Utilize the power of customer feedback. encourage your customers to leave reviews and suggestions. This not only helps to build trust but also provides insights into areas where you can improve. Integrating a feedback loop can lead to better products and services,ultimately enhancing customer satisfaction.

Conducting regular audits of your store’s performance can uncover inefficiencies. Use plugins that provide analytics and reports on sales trends, conversion rates, and customer behavior. Identifying underperforming products or services can help you pivot strategies without incurring additional costs.

Lastly,consider fostering a community around your brand. Encourage user-generated content, such as social media posts featuring your products. This not only enhances brand loyalty but can also serve as free advertising, reducing your need for costly marketing campaigns.

How to Educate Your Customers About Tax Charges seamlessly

When managing a WooCommerce store, it’s essential to keep your customers informed about tax charges. An effortless way to do this is by integrating clear communication into your shopping experience. This not only ensures transparency but also builds trust with your clientele.

Utilize Tooltips and Pop-Ups: One effective method is to use tooltips or pop-up messages that provide additional information about tax charges. As an example, when a customer hovers over the total price, you can display a brief explanation of how taxes are calculated. This can be easily implemented with the help of plugins or custom code in your WooCommerce settings.

Clear Checkout Messaging: Make sure your checkout page has explicit messaging regarding tax charges. This should include:

- What the tax charge covers

- How it’s calculated (e.g., state rates, product categories)

- Any exemptions that may apply

| Tax Type | Description | Example Rate |

|---|---|---|

| Sales Tax | Tax on the sale of goods and services | 7% (varies by state) |

| Value Added Tax (VAT) | Tax on the value added at each production stage | 20% (UK standard) |

| Service Tax | Tax on services provided | 15% (India) |

FAQs Section: Consider creating a dedicated FAQ section on your site that addresses common queries about taxes. This can preemptively answer questions your customers may have and eliminate confusion. Some example questions you might include are:

- “Why am I being charged tax?”

- “How do I know if I’m tax-exempt?”

- “Will tax charges vary by location?”

Post-Purchase Communication: After a purchase, send a follow-up email that summarizes the transaction details, including tax charges. This reinforces transparency and provides customers with a reference point for their records, making them feel appreciated and informed.

The Benefits of Seeking Professional Advice for Your Tax Compliance

When running a WooCommerce store on WordPress, managing tax compliance can often feel overwhelming. Many store owners may think they can handle it all, but seeking professional advice can provide significant advantages. Here’s why enlisting an expert can make a world of difference for your business.

1. Expertise in complex Tax Laws: Tax regulations are constantly changing, and they vary by region. A tax professional stays updated on the latest laws, ensuring that your store complies with all applicable tax regulations. This not only helps avoid penalties but also helps you take advantage of any available deductions or credits.

2. tailored Solutions for Your Business: Every WooCommerce store is unique, and cookie-cutter solutions often fall short. A professional can analyze your specific business model and tailor a tax compliance strategy that fits your needs. This personalized approach maximizes your efficiency and minimizes the risk of errors.

3. Time and Resource Savings: Managing taxes can be incredibly time-consuming. By outsourcing this responsibility, you can focus on growing your business instead of drowning in paperwork. This allows you to allocate your time and resources toward what really matters—enhancing your products and improving customer service.

4. Peace of Mind: Knowing that a qualified professional is handling your tax compliance allows you to sleep easier at night. You can trust that you’re meeting your obligations and that your business is on solid ground. This peace of mind is invaluable as you navigate the complexities of running an online store.

5. Avoiding Costly Mistakes: Mistakes in tax compliance can lead to hefty fines and audits, which can be detrimental to a growing business. Professionals have the experience and knowledge to identify potential pitfalls before they become issues, saving you from financial headaches down the road.

6. Continuous Support: A good tax advisor doesn’t just help you during tax season; they can provide ongoing support throughout the year. This includes reviewing your financials regularly,advising on record-keeping,and suggesting strategies to optimize tax outcomes as your business evolves.

Incorporating professional advice into your tax compliance strategy is not just an investment; it’s a crucial step towards building a successful and sustainable WooCommerce store. Your time is valuable, and the right expertise can definitely help ensure that your business not only complies with tax laws but thrives in the competitive online marketplace.

future-Proofing Your WooCommerce Store Against Tax Challenges

As you look ahead to the evolving landscape of e-commerce taxation, it’s crucial to establish a solid foundation for your WooCommerce store that can withstand future regulatory changes. Here are some strategies to consider for ensuring your store remains compliant without overwhelming your operational load.

- Leverage Tax Automation Plugins: Investing in a quality tax automation plugin can handle the complexities of tax calculation effortlessly. Tools like WooCommerce Taxamo or Quaderno automatically adapt to tax laws and rates based on your customers’ locations.

- Stay Informed: Tax regulations are constantly changing.Regularly check resources such as IRS.gov or the Department of Revenue websites for updates related to sales tax in your operating regions.

- Utilize Geolocation: Implement geolocation services to automatically detect where your customers are and apply the correct tax rates. This reduces human error and ensures compliance.

Another essential aspect of future-proofing your store is to maintain clear and accurate records. Consider setting up a structured approach to tracking sales and tax collected. This not only simplifies your reporting responsibilities but also mitigates risks during audits.

| Feature | Benefit |

|---|---|

| Automated Tax Calculation | Reduces manual errors and saves time. |

| Real-Time Reporting | Helps in making informed business decisions. |

| Multi-Currency Support | Enhances global sales potential. |

In addition, you should consider consulting with a tax professional who specializes in e-commerce.They can provide personalized insights tailored to your specific business model and location, ensuring you’re not just compliant today, but also set up for future success. A small investment in tax advisory can save you from potential pitfalls down the line.

don’t underestimate the power of community knowledge. Engaging with other WooCommerce store owners through forums, social media groups, or local meetups can provide valuable insights into best practices and emerging trends in tax compliance. Remember, staying connected can open doors to solutions you might not have considered.

Frequently Asked Questions (FAQ)

Q&A: How to Build a Tax-Compliant WooCommerce Store on WordPress Without Extra Overhead

Q: Why is it critically important to have a tax-compliant WooCommerce store?

A: Great question! compliance with tax regulations is crucial for any online business. Not only does it help you avoid legal troubles and penalties, but it also builds trust with your customers. A tax-compliant store ensures that you’re following local laws, which can enhance your brand reputation and encourage more sales.

Q: What are the basic steps to ensure tax compliance in my WooCommerce store?

A: To start, you’ll want to configure your WooCommerce settings to reflect your local tax rates. You can do this by going to WooCommerce settings and navigating to the ‘Tax’ tab. Next, consider using a reliable tax plugin, which can automate calculations based on customer location. keep abreast of changing tax laws in your region to ensure continuous compliance.

Q: Do I need to hire an accountant or tax expert?

A: While it’s always good to consult an expert, especially when starting, you can build a tax-compliant store without hiring a full-time accountant. Many plugins and tools are designed to simplify the process. If you’re uncomfortable doing it alone, consider a one-time consultation to set things up right.

Q: What tax plugins do you recommend for WooCommerce?

A: Some popular options include taxjar, Avalara, and WooCommerce’s built-in tax functionality.Each of these can help automate tax calculations and ensure you’re collecting the right amount based on current rates. Look for one that fits your specific business needs and budget!

Q: What about international sales? How do I manage taxes for customers outside my country?

A: when selling internationally,be aware that different countries have different tax regulations. Many tax plugins can automatically adjust rates based on the customer’s location, so you can manage international sales without much overhead. Just make sure to stay informed about VAT and GST regulations in the countries you plan to sell to.

Q: How can I avoid extra overhead while staying compliant?

A: The key is to leverage technology! Use plugins that automate tax calculations and reporting, which will save you time and reduce the need for manual tracking.Also, consider using tools that integrate directly with your accounting software for seamless data management.

Q: What if my business grows and my tax needs become more complex?

A: As your business expands, you may need more sophisticated solutions, but you can still keep overhead low. Look into scalable tax automation tools and consider periodic consultations with a tax professional to ensure compliance without the need for a full-time hire.

Q: Can I still be successful with a tax-compliant store even if I’m a small business?

A: Absolutely! In fact, being tax-compliant can give you a competitive edge. Customers are more likely to shop with businesses they trust. A well-managed store that adheres to tax laws can enhance your credibility and lead to long-term success—small business or not!

Q: Any final tips for someone just starting?

A: Start with a solid foundation by setting up your WooCommerce store with tax compliance in mind from the get-go. Take advantage of available resources, like online tutorials and forums, to learn as you go. And remember, keeping things organized from the start will save you time and headaches down the road. Your dream store is closer than you think—just take it step by step!

In Conclusion

As we wrap up our journey into building a tax-compliant WooCommerce store on WordPress, it’s clear that managing taxes doesn’t have to be a daunting task. By implementing the strategies we’ve discussed, you can streamline your processes and focus on what really matters: growing your business and delighting your customers.

Remember, staying compliant not only protects your business from potential penalties but also builds trust with your customers. When they see that you take tax compliance seriously, it enhances your credibility and can even encourage repeat business.

So, take the leap! Start applying these tips today, and watch your WooCommerce store flourish without the needless overhead. If you have any questions or need further guidance, don’t hesitate to reach out. We’re in this together, and we’re here to help you succeed. Happy selling!