Are you ready to dive into the dynamic world of ecommerce? Whether you’re a seasoned online seller or just starting your digital storefront,one question looms large: how can you ensure smooth,secure,and efficient transactions for your customers? Enter the realm of ecommerce payment processing! It’s not just about accepting payments; it’s about creating a seamless shopping experience that keeps your customers coming back for more. In this guide, we’ll explore the top seven payment processing services that can elevate your business, simplify your operations, and enhance customer satisfaction. From user-friendly interfaces to robust security measures, we’ll cover everything you need to know to choose the right service for your unique needs. So, grab a cup of coffee and get ready to unlock the secrets to successful online transactions—your ecommerce journey starts here!

Understanding the Fundamentals of Ecommerce Payment Processing

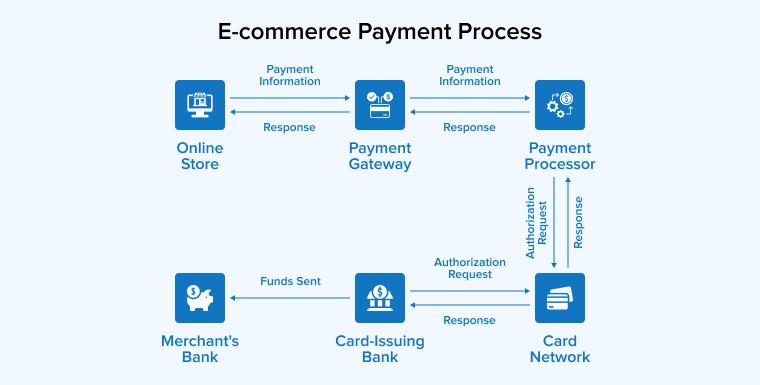

When venturing into the world of ecommerce, understanding payment processing is essential for seamless transactions and customer satisfaction. At it’s core, ecommerce payment processing refers to the technology and systems that facilitate online payments. This includes everything from the moment a customer clicks “buy” to the final confirmation of their order.

Payment processing involves several key components:

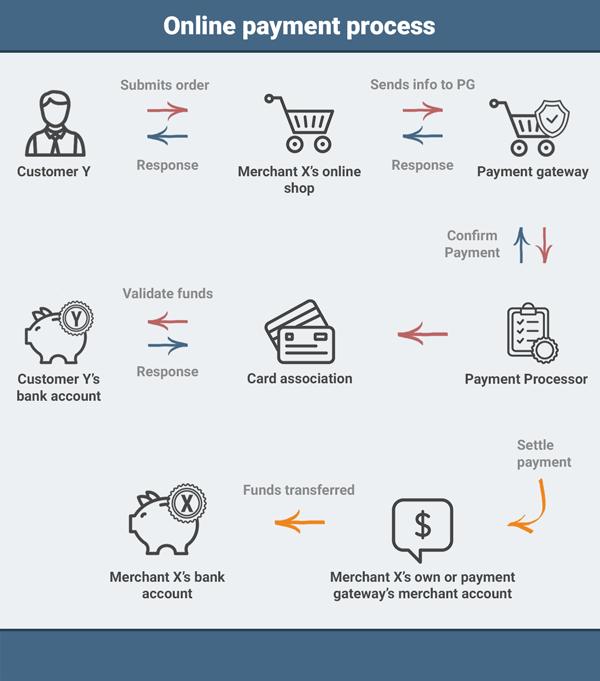

- Payment Gateways: These are the digital equivalent of a physical point-of-sale terminal. They securely capture and transmit transaction data from the customer to the merchant’s bank.

- Merchant Accounts: A merchant account acts as a bank account that allows businesses to accept payments, typically through credit or debit cards.

- Payment Processors: These entities handle the transaction by routing the funds from the customer’s bank to the merchant’s bank. They ensure the funds are securely transferred and that all parties are properly notified.

To ensure a smooth checkout experience,it’s important to choose the right payment processing service. Here are some critical factors to consider:

- Transaction Fees: Most services charge fees per transaction. Compare these to understand the cost implications for your business.

- Security features: With the rise in online fraud, ensure that your payment processor offers robust security measures, such as encryption and fraud detection capabilities.

- User Experience: The payment process should be seamless and intuitive. A complex checkout can lead to cart abandonment.

Moreover, it’s crucial to be aware of the various payment methods that customers prefer. A versatile payment processing solution can accommodate:

- Credit and debit cards

- Digital wallets, such as PayPal or Apple Pay

- Buy Now, Pay Later options

Understanding the different payment options and their implications can empower you to make informed choices for your business. Below is a simple table summarizing popular payment processing services and their standout features:

| Service | Key Features | Best For |

|---|---|---|

| PayPal | Widely accepted,buyer protection,easy setup | Small to medium businesses |

| Stripe | Customizable,extensive API,recurring billing | Developers and tech-savvy businesses |

| Square | Integrated POS,clear pricing,user-friendly | Retail and service-oriented businesses |

By grasping these fundamentals,you can streamline your payment processing,enhance customer satisfaction,and ultimately drive sales. The right payment processor will not only support your current needs but will also scale with your growth, making it a critical component of your ecommerce strategy.

Why Choosing the Right Payment Gateway is Crucial for Your Business

Choosing the right payment gateway is a pivotal decision that can shape the financial health and customer experience of your business. With a plethora of options available,it’s essential to find one that aligns with your specific needs,enhances security,and fosters customer trust. A seamless payment experience not only encourages repeat purchases but also plays a notable role in reducing cart abandonment rates.

One of the key factors to consider is transaction fees. These fees can vary widely among providers, impacting your bottom line. It’s vital to analyze how each payment gateway structures its fees—some may charge a flat rate, while others might have variable fees based on transaction volume. Understanding these costs can definitely help you select a gateway that minimizes expenses and maximizes profit margins.

Another essential aspect is integration capabilities. The payment gateway you choose should easily integrate with your existing ecommerce platform and other tools. This ensures a smooth workflow and saves you valuable time in the long run. Popular ecommerce platforms often have recommended gateways that are optimized for their systems, making integration even more straightforward.

Security features are non-negotiable when it comes to processing payments. Customers want assurance that their sensitive information is safeguarded. Look for gateways that offer advanced security measures such as PCI compliance, tokenization, and fraud detection tools. This not only protects your customers but also enhances your brand’s credibility.

Moreover,consider the customer experience during the checkout process. A complicated payment procedure can lead to frustration and lost sales. Select a gateway that provides a user-friendly interface and a variety of payment options, such as credit cards, digital wallets, and bank transfers. The easier it is for customers to complete their purchases, the higher your conversion rates will be.

The availability of customer support is another crucial consideration. In the fast-paced world of ecommerce, issues can arise at any time. A payment gateway that offers 24/7 support can help you resolve problems quickly, ensuring minimal disruption to your operations. Having reliable support can also help you navigate any technical challenges that may occur during integration or routine transactions.

think about the growth potential of your business. As you scale, your payment processing needs may evolve. Choose a gateway that can grow with you,offering features such as multi-currency support and advanced reporting tools. This adaptability will empower you to expand your business without the headache of switching gateways down the line.

Exploring the Top 7 Payment Processing Services on the Market

When it comes to running an ecommerce business, choosing the right payment processing service can make or break your success. A seamless payment experience not only boosts customer satisfaction but also helps to improve conversion rates. Below,we delve into seven of the best payment processing services currently available,each with unique features tailored for different business needs.

- PayPal: With its widespread recognition and ease of use, PayPal is a favorite among both merchants and shoppers. It offers a robust set of tools including invoicing, payment buttons, and subscription management. Its buyer protection policy also instills trust, making it a go-to choice for many.

- Square: Ideal for small to medium-sized businesses, Square provides an all-in-one solution that includes payment processing, point of sale (POS) systems, and inventory management. Its transparent pricing model means no hidden fees, which is a significant advantage for budget-conscious entrepreneurs.

- Stripe: Known for its developer-friendly API, Stripe is perfect for tech-savvy businesses looking to customize their payment experiences. With features like subscription billing, fraud prevention, and a suite of tools for mobile payments, Stripe is an excellent choice for growing businesses.

- Authorize.Net: A pioneer in the payment processing industry, Authorize.Net is reliable and secure. It supports various payment methods, including eChecks and digital wallets, making it a versatile option for businesses of all sizes.

- Adyen: This service is perfect for global brands looking to streamline their payment processes across multiple countries. Adyen supports various currencies and payment methods, all while providing detailed analytics to help businesses optimize their financial strategies.

- 2Checkout (now Verifone): As a global payment processing service, 2Checkout offers comprehensive support for both physical and digital goods. It provides a user-friendly interface and a wide range of integrations,making it easy to get started.

- WorldPay: Recognized for its extensive range of payment solutions, WorldPay caters to businesses of all sizes.It offers competitive rates and supports a variety of payment methods, including cards and choice payment options, ensuring a seamless experience for customers.

Each of these services has its strengths, and the right choice depends on your specific business needs. Consider factors such as transaction fees, ease of integration, customer support quality, and the geographic areas you serve. A well-informed decision can lead to improved customer experiences and greater profitability.

| Service | Best For | Key Features |

|---|---|---|

| PayPal | Everyone | Invoicing, Buyer Protection |

| Square | Small Businesses | POS, Transparent Pricing |

| Stripe | Developers | Custom API, Subscription Billing |

| Authorize.Net | Reliability | eChecks, Security |

| Adyen | Global Brands | Multi-Currency Support |

| 2Checkout | Digital Goods | User-Friendly Interface |

| WorldPay | All Sizes | Various Payment Methods |

Ultimately, the right payment processor should align with your business model and customer expectations. By evaluating these top services, you can find a solution that not only enhances your operations but also builds trust and loyalty among your customers.

Breaking Down Fees: What to Expect from payment Processors

When it comes to choosing a payment processor for your eCommerce business, understanding the associated fees is crucial. These fees can significantly impact your bottom line, so it’s essential to break them down and know what to expect.Let’s dive into the different types of fees you might encounter.

Transaction Fees: Most payment processors charge a fee per transaction. This is usually a percentage of the sale plus a fixed amount. for example, you might see rates such as:

| Processor | Percentage Fee | Fixed Fee |

|---|---|---|

| Processor A | 2.9% | $0.30 |

| Processor B | 2.7% | $0.25 |

| Processor C | 3.1% | $0.20 |

Monthly Fees: Some processors charge a monthly fee for their services. This fee can cover account maintenance, customer support, and software updates. Be sure to consider this in your overall cost analysis, as it can add up over time.

Chargeback Fees: If a customer disputes a charge, you may incur a chargeback fee. This fee is typically around $15-$30, depending on the processor. to prevent chargebacks, ensure your product descriptions are clear and your customer service is top-notch.

Setup and Integration Fees: Some payment processors require a one-time setup fee or integration fee. this can vary widely from one provider to another. Look for processors that offer free integration or have low setup costs to keep your initial expenses down.

Currency Conversion Fees: If you plan to sell internationally, be aware of potential currency conversion fees. These fees can range from 1% to 3% depending on the payment processor and the currencies involved. Make sure to factor this into your pricing strategy if you’re targeting customers outside your home country.

Understanding these fees is essential in selecting the right payment processor for your eCommerce business. By keeping a close eye on these costs, you can optimize your payment processing and ultimately enhance your profit margins.

Seamless Integration: How to Choose a Payment Service That Fits Your Platform

Choosing the right payment service is crucial for the success of your ecommerce platform. With the myriad of options available, it can feel overwhelming.However, understanding your specific needs is the first step in making a decision that not only streamlines your payment processing but also enhances the overall customer experience.

Here are some factors to consider when evaluating payment services:

- Compatibility: Ensure that the payment service integrates seamlessly with your existing platform, whether it’s a custom-built site or a popular ecommerce solution like WooCommerce, Shopify, or Magento.

- Transaction Fees: Look closely at the fee structure. Some services charge a flat rate, while others may have variable fees based on transaction volume. Calculate how these fees will impact your bottom line.

- security Features: Security should be your top priority. choose a payment processor that offers robust fraud protection, PCI compliance, and encryption to protect your customers’ sensitive information.

- User Experience: The checkout process should be user-friendly. Opt for services that support one-click payments, saved payment methods, and mobile optimization to reduce cart abandonment rates.

- Customer Support: Reliable customer support can save you time and headaches. Ensure that the payment service provides 24/7 support through multiple channels,such as live chat,email,and phone.

Another significant aspect to think about is the variety of payment options offered.Customers today expect versatility, so choosing a service that supports multiple payment methods, from credit and debit cards to digital wallets and even cryptocurrencies, can be a game-changer.

| Payment Service | Key Features | Average Transaction Fee |

|---|---|---|

| PayPal | Widely recognized, mobile-friendly | 2.9% + $0.30 |

| Stripe | Customizable, supports subscriptions | 2.9% + $0.30 |

| Square | Integrated with POS,simple setup | 2.6% + $0.10 |

| Authorize.Net | Advanced fraud detection, recurring billing | 2.9% + $0.30 + monthly fee |

don’t forget to look at the scalability of the payment service. As your business grows, your payment processing needs may change. A service that can scale with you is invaluable for avoiding the hassle of switching providers later on.

Enhancing Security: protecting Your Business and Customers During Transactions

in today’s digital marketplace, ensuring the security of your ecommerce transactions is paramount. Customers need to trust that their sensitive information is safe, and businesses must comply with regulations and industry standards. By prioritizing security during payment processing, you not only protect your business from potential breaches but also foster customer loyalty.

Implementing Strong Encryption

One of the first lines of defense in protecting transaction data is implementing robust encryption technologies. Look for payment processors that utilize SSL (Secure Socket Layer) certificates, which encrypt data during transmission. This means that sensitive information such as credit card numbers and personal details are scrambled,making it nearly impossible for hackers to intercept and misuse them.

Multi-Factor Authentication

Adding layers of security through multi-factor authentication (MFA) can significantly reduce the risk of fraud. With MFA, users must provide multiple forms of verification before they can complete a transaction. This coudl include somthing they know, such as a password, combined with something they have, like a smartphone app that generates a unique code. This extra step ensures that even if passwords are compromised, unauthorized users cannot easily access accounts.

Regular Security Audits

Conducting routine security audits is essential for identifying vulnerabilities within your payment processing system. Partner with reputable security firms to assess your infrastructure and practices. Regular audits can help pinpoint weaknesses that could be exploited and provide recommendations for enhancing security measures. Investing in these assessments not only protects your business but also reassures customers that you take their safety seriously.

Choosing the Right Payment Processor

When selecting a payment processor, consider those that are compliant with industry standards such as PCI DSS (Payment Card Industry Data Security Standard). Compliance with these standards is crucial as it requires businesses to adhere to strict security measures regarding customer data. Here’s a quick comparison of some popular payment processors based on their security features:

| Payment Processor | SSL Encryption | MFA Support | PCI DSS Compliance |

|---|---|---|---|

| paypal | yes | Yes | yes |

| Stripe | Yes | Yes | Yes |

| Square | Yes | Yes | Yes |

| Authorize.Net | Yes | No | Yes |

Educating Your Customers

don’t underestimate the power of customer education.Create informative content that guides your customers on how to protect their information while shopping online. Offer tips such as recognizing phishing scams, using strong passwords, and monitoring their financial statements. When customers feel informed and empowered,they are more likely to trust your business with their transactions.

Mobile Payments: Staying Ahead in the Era of Smartphone Shopping

In today’s fast-paced world,mobile payments have revolutionized the way consumers shop. With the advent of elegant technology and an increasing reliance on smartphones, businesses must adapt quickly to stay relevant. By embracing mobile payment solutions,ecommerce retailers not only enhance the customer experience but also improve their operational efficiency.

One of the significant benefits of mobile payments is their ability to facilitate speedy transactions.Customers can complete their purchases with just a few taps,reducing cart abandonment rates. This shift towards convenience is crucial, as studies indicate that up to 70% of consumers prefer the ease of mobile payments over traditional methods.

Moreover, incorporating mobile payment options can cater to a broader audience. Many younger consumers, notably Millennials and Gen Z, prioritize flexible payment methods. By offering services that align with their preferences, you can tap into a lucrative market segment. Consider these popular mobile payment options:

- Apple Pay

- Google Pay

- Samsung Pay

- PayPal

Security is a top concern for both consumers and retailers. Implementing secure mobile payment systems can mitigate the risks of fraud and data breaches. Features such as tokenization and biometric authentication can instill confidence in your customers, encouraging them to complete transactions without hesitation. In fact, a secure payment process can lead to a significant increase in customer trust and loyalty.

| Mobile Payment Service | Security Features | Transaction Fees |

|---|---|---|

| Apple pay | Tokenization, Face ID | Varies by retailer |

| Google Pay | Tokenization, Fingerprint | Varies by retailer |

| PayPal | encryption, Two-factor Authentication | 2.9% + $0.30 per transaction |

As you refine your ecommerce strategy, consider integrating mobile payment analytics. Understanding consumer behavior through data can provide insights that shape your marketing efforts. As an example, tracking your customers’ preferred payment methods can help you tailor promotions that drive engagement and sales.

staying ahead in mobile payments means continuously updating your systems and embracing innovation. Regularly evaluate new technologies and trends in mobile commerce, such as QR code payments and cryptocurrency acceptance. By remaining proactive, you’ll not only meet consumer expectations but also position your brand as a leader in the ecommerce landscape.

The Importance of Customer Experience in Payment processing

In the fast-paced world of ecommerce, the customer experience is paramount, especially when it comes to payment processing. A seamless and efficient payment process can significantly impact customer satisfaction and retention. When shoppers feel confident in the payment mechanism, they are more likely to complete their purchases and return for future transactions.

Here are some key reasons why prioritizing customer experience in payment processing is essential:

- Trust and Security: Customers want to feel safe while making online transactions. Implementing secure payment gateways and transparent processes builds trust, ensuring customers that their sensitive information is protected.

- Simplicity and Speed: A complicated payment process can lead to cart abandonment.Streamlining checkout with minimal clicks and clear instructions can enhance user experience and boost conversion rates.

- Multiple Payment Options: Different customers have different preferences. Offering a variety of payment methods, such as credit cards, digital wallets, and buy-now-pay-later services, caters to a wider audience.

- Mobile Optimization: With the increasing use of mobile devices for online shopping,a mobile-optimized payment process is crucial. Ensuring that the payment interface is user-friendly on smartphones and tablets can greatly enhance customer experience.

Moreover, customer experience extends beyond the transaction itself. Providing excellent support during the payment process can alleviate concerns and enhance satisfaction. Consider incorporating live chat support or comprehensive FAQs that address common payment-related queries. This proactive approach can turn a possibly frustrating experience into a positive one.

| Payment Method | Customer Preference | Advantages |

|---|---|---|

| Credit/Debit Cards | High | Familiar and widely accepted |

| Digital Wallets | Growing | Fast and convenient |

| Bank Transfers | Moderate | Secure and direct |

| Buy Now, Pay later | Increasing | Flexible payment options |

by investing in customer experience during the payment process, businesses not only enhance satisfaction but also foster loyalty and increase overall sales. It’s this commitment to customer-centric practices that sets successful ecommerce platforms apart in an increasingly competitive landscape.

Adapting to Global Markets: Choosing Services for International Transactions

In an increasingly interconnected world, adapting your ecommerce business to cater to global markets is essential for success. Selecting the right payment processing services for international transactions can significantly impact your ability to reach a broader audience while ensuring smooth and secure transactions. Here are some key considerations to keep in mind:

- Currency Support: Choose a service that supports multiple currencies to cater to international customers. This not only enhances user experience but also builds trust with buyers who prefer to transact in their local currency.

- Payment Methods: Different regions have varying preferences when it comes to payment methods. Ensure that the service you choose can process credit cards, digital wallets, and alternative payment options popular in specific locales.

- transaction Fees: Be mindful of the fees associated with processing international transactions. Look for transparent pricing models that don’t have hidden charges, as high fees can eat into your profit margins.

Security is another critical factor when handling international transactions. Customers need to feel confident that their payment information is protected. Choose services that offer robust fraud protection measures and comply with global security standards,such as PCI DSS.

Additionally, consider the user interface of the payment service. A seamless checkout experience,available in multiple languages and optimized for various devices,can lead to higher conversion rates. Customers are more likely to complete their purchases if the process is intuitive and streamlined.

Another aspect to think about is the integration capabilities of the payment processor. It should easily integrate with your existing ecommerce platform and any other tools you use for inventory management, accounting, or customer relationship management. This integration will help automate processes and reduce manual work.

| Service | Key Features | Best For |

|---|---|---|

| PayPal | Multi-currency support, buyer protection | Small to medium businesses |

| Stripe | Developer-friendly, extensive API | Tech-savvy startups |

| Adyen | Global reach, advanced analytics | Large enterprises |

| Square | Point of sale solutions, easy setup | Retail and online sales |

Ultimately, the right payment processing service for international transactions will depend on your specific business needs and target market. By carefully considering these factors, you can make a more informed decision that not only improves customer satisfaction but also drives your ecommerce growth on a global scale.

Tips for Optimizing Your Payment Processing for Increased Sales

optimize Your Payment Processing for Increased Sales

To boost your ecommerce sales, the optimization of your payment processing system is crucial. Start by offering multiple payment options.Customers have different preferences, and by accommodating them, you reduce cart abandonment rates. Consider integrating options like:

- Credit and Debit Cards

- digital Wallets (such as PayPal, Apple Pay, Google Pay)

- Buy Now, Pay Later services

Next, ensure that your checkout process is as streamlined as possible. A lengthy or complicated checkout can frustrate potential buyers. Simplifying your process can include:

- Minimizing the number of steps to complete a purchase

- Utilizing guest checkout options to avoid mandatory account creation

- Providing clear progress indicators during checkout

Security is another critical factor. Customers want to feel safe when they enter their payment information. Invest in SSL certificates and make sure your payment processor is PCI DSS compliant.displaying security badges can also enhance customer trust at checkout.

consider implementing abandoned cart recovery strategies. Use email reminders or retargeting ads to bring back customers who left without completing their purchase. Here’s a simple table outlining effective strategies:

| Strategy | Description |

|---|---|

| Email Follow-ups | Send personalized emails reminding customers of their abandoned items. |

| Discount Offers | Provide incentives or discounts to encourage completion of the purchase. |

| Retargeting Ads | Use social media and display ads to remind them of what they left behind. |

By focusing on these key areas, you can significantly enhance your payment processing system, leading to higher sales and better customer satisfaction. Every small change can make a big difference in your customer’s purchasing journey.

Future trends in Ecommerce Payment Solutions You Should Know

the landscape of ecommerce payment solutions is evolving rapidly, driven by technological advancements and changing consumer expectations.As we look ahead, several trends are emerging that retailers need to be aware of to stay competitive and meet customer needs effectively.

Adoption of cryptocurrency

Cryptocurrency is gradually making its way into mainstream ecommerce.With the rise of decentralized finance (defi) and the increasing acceptance of Bitcoin, Ethereum, and other digital currencies, online retailers may soon find it essential to offer these payment options. The benefits of accepting cryptocurrency include:

- Lower transaction fees: Many cryptocurrencies have lower fees compared to traditional payment methods.

- Global reach: Cryptocurrencies are not tied to any specific country or currency, making them ideal for international transactions.

- Enhanced privacy: Consumers are increasingly concerned about data security, and crypto transactions offer more anonymity.

Integration of Artificial Intelligence

Artificial Intelligence (AI) is set to play a crucial role in shaping ecommerce payment solutions. AI can help streamline payment processes, enhance security, and improve user experience through:

- Fraud detection: AI algorithms can analyze transaction patterns in real-time, significantly reducing the risk of fraud.

- Personalized offers: AI can tailor payment options based on consumer behavior, increasing conversion rates.

- Chatbot support: AI-driven chatbots can assist customers with payment issues, improving the overall shopping experience.

Mobile Wallets and Contactless Payments

As smartphone usage continues to rise, mobile wallets and contactless payment methods are becoming increasingly popular. Retailers who embrace these technologies can benefit from:

- Convenience: Customers appreciate the ease of tapping their phones for quick payments.

- Faster checkout: Reducing the time spent at checkout can lead to higher customer satisfaction.

- increased loyalty: offering preferred payment methods can encourage repeat business.

Seamless Omnichannel Experiences

Today’s consumers expect a seamless shopping experience across multiple channels, whether they are shopping online, in-store, or via mobile apps. Payment solutions that support this omnichannel approach include:

| Channel | payment Solution | Benefit |

|---|---|---|

| Online | PayPal, Stripe | Widely trusted and secure |

| In-store | Square, Clover | Integrated inventory management |

| Mobile | Apple Pay, Google Wallet | Fast and convenient |

Subscription and Recurring Payments

Subscription models are gaining traction across various sectors, from food delivery to streaming services. Ecommerce businesses can capitalize on this trend by implementing payment solutions that support:

- Automated billing: Reduces manual workload for businesses.

- Customer retention: Recurring payments create predictable revenue streams and foster loyalty.

- Flexible options: Offering different subscription tiers can cater to varying customer preferences.

Final Recommendations: Making the Best Choice for Your Ecommerce Business

When it comes to selecting a payment processing service for your ecommerce business, making an informed decision can significantly impact your operations and customer satisfaction. Here are some key factors to consider that will lead you to the best choice:

- Transaction Fees: Keep an eye on the fees charged for transactions. A lower fee per transaction can save you money in the long run.

- Payment Options: Ensure the service supports a variety of payment methods, including credit cards, e-wallets, and even cryptocurrencies. This flexibility can enhance customer experience.

- Integration Capabilities: Check how easily the payment processor integrates with your existing ecommerce platform. A seamless integration can save you time and technical headaches.

- Security Features: Make sure the provider complies with the highest security standards, such as PCI DSS. Security is crucial for gaining customer trust.

- Customer Support: Look for a service that offers responsive customer support. Quick assistance can resolve issues swiftly, keeping your operations smooth.

Moreover,consider your business’s specific needs. as an example,if you expect high transaction volumes,a service that offers bulk processing might be beneficial. Additionally,if you’re selling internationally,ensure that the payment processor can handle multiple currencies and languages.

To help you visualize your options, here’s a quick comparison table of some top services:

| Payment Processor | Transaction Fee | Supported Currencies | Customer Support |

|---|---|---|---|

| Stripe | 2.9% + 30¢ | 135+ | 24/7 Support |

| PayPal | 2.9% + 30¢ | 25+ | Phone & Chat |

| Square | 2.6% + 10¢ | 1 | Email Support |

| Authorize.Net | 2.9% + 30¢ | 1 | 24/7 Support |

By weighing these factors and comparing various services,you’ll be well-equipped to make a decision that not only fits your current capabilities but also supports your future growth. A well-chosen payment processor can elevate your customer’s experience, streamline your operations, and ultimately drive your ecommerce success.

Frequently Asked Questions (FAQ)

Q&A: Ecommerce Payment Processing Guide: Top 7 Services and More

Q1: Why is choosing the right payment processing service so critically important for my ecommerce business?

A1: Great question! The right payment processor can significantly impact your sales. A seamless checkout experience can reduce cart abandonment and increase customer satisfaction. Plus, the fees, security features, and payment options offered can directly affect your bottom line. By choosing wisely, you ensure your customers enjoy their shopping experience while you keep your costs manageable.Q2: What should I look for in a payment processing service?

A2: Look for key features like transaction fees, ease of integration, security measures (like PCI compliance), customer support, and the variety of payment options available (like credit cards, digital wallets, and even cryptocurrency). Additionally, consider whether the service supports international transactions if you plan to sell globally.

Q3: Can you give me a brief overview of the top 7 payment processing services?

A3: Absolutely! Here’s a quick rundown:

- paypal – Widely recognized and trusted,offering easy integration and buyer protection.

- stripe – developer-friendly with customizable options, perfect for tech-savvy businesses.

- Square – Ideal for small to medium-sized businesses, providing an all-in-one solution with a user-friendly interface.

- Authorize.Net - A reliable option, especially for established businesses that want robust features.

- Braintree - Owned by PayPal, it offers great flexibility and mobile payment solutions.

- Shopify Payments – Best for Shopify store owners, as it integrates seamlessly with their platform.

- Adyen – A more comprehensive option for larger enterprises, supporting a wide range of currencies and payment methods.

Q4: What are some common pitfalls to avoid when choosing a payment processor?

A4: One major pitfall is not fully understanding the fee structure. Some processors charge hidden fees that can sneak up on you. Another is overlooking security features; your customers’ trust depends on how secure their payment information is. Lastly, don’t forget to consider customer support; having a responsive team can be crucial, especially during peak sales periods.

Q5: How does payment processing affect my website’s user experience?

A5: Payment processing plays a crucial role in the overall user experience. A complicated or slow payment process can frustrate customers and lead to abandoned carts. Opt for a processor that offers a smooth, quick checkout process, multiple payment options, and a responsive design for mobile users. This not only enhances user satisfaction but also boosts your conversion rates!

Q6: Are there any emerging trends in payment processing that I should be aware of?

A6: Absolutely! Some hot trends include the rise of contactless payments, increased use of mobile wallets like Apple Pay and Google Pay, and the growing popularity of buy now, pay later services. Additionally, as ecommerce continues to expand, we’re seeing more interest in cryptocurrency payments. Staying ahead of these trends can give your business a competitive edge!

Q7: How can I get started with integrating a payment processing service into my ecommerce site?

A7: Start by researching which service aligns best with your business needs. once you’ve chosen a provider, most offer detailed guides to help you integrate their payment system into your website, whether you’re using a platform like Shopify or wordpress. Don’t hesitate to reach out to their customer support if you hit any snags; they’re usually more than happy to assist!

Q8: Is there anything else I should know before diving into ecommerce payment processing?

A8: Yes! Keep in mind that your payment processor is a long-term partner in your ecommerce journey. Regularly review your options to ensure you’re getting the best rates and services as your business grows. Also, stay informed about any updates or changes in terms of service, fees, or technology to keep your business running smoothly and profitably.

By understanding the ins and outs of payment processing, you can set your ecommerce business up for success. Happy selling!

Concluding Remarks

As we wrap up our deep dive into the world of ecommerce payment processing, it’s clear that choosing the right service can make all the difference in your online business success. The top seven services we explored are not just names on a list; they represent powerful tools that can streamline your transactions, enhance customer trust, and ultimately boost your bottom line.

remember, the right payment processor is more than just a facilitator of transactions; it’s a partner in your business journey.Whether you prioritize low fees,security,or user experience,there’s a solution out there perfectly tailored to your needs.

So, take a moment to reflect on what matters most for your ecommerce venture. Don’t be afraid to test a few options and see which one resonates best with you and your customers. After all, a seamless checkout experience can be the difference between a first-time visitor and a loyal customer.

We hope this guide has illuminated the path to making informed decisions about ecommerce payment processing. With the right tools at your disposal, you can focus on what you do best: growing your business and delighting your customers. Now, let’s get to work and make your ecommerce dreams a reality! Happy selling!